Copper Hits Nine-Week High

February 13, 2017

Another Groundhog Day has passed. Once again meteorologists across the country put aside science and put their trust in a big rodent named Phil to predict the forecast for the next six weeks.

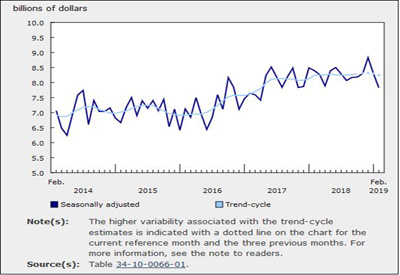

Copper forecasters are not as lucky. They can’t predict today, much less six weeks from now. That being said, copper continued to climb last week, hitting a nine-week high.

Contributing factors to the continued upward climb were a weaker U.S. dollar, solid oil prices, a strike at a copper mine in Chile and, despite being out to celebrate the New Year, manufacturing news out of China.

While the U.S. dollar index is recovering a little ground after being sharply lower last week, as you may already know, when the dollar dips, the corresponding values of hard assets — copper being one, along with gold and silver — typically rise. The price of oil also tends to flow the same as copper. The latest report sticks to that theory, as oil prices are solidly higher.

A hike in red metal prices was also supported by news of a pending workers strike at Chile’s Escondida Copper Mine, the world’s largest. Last week union workers at Escondida went out on strike. This could have a domino effect as 15 other copper mines in Chile are up for contracts renewals as well. Early last week news of the pending strike sent prices on the London Metal Exchange over $6,000 a metric ton.

An ongoing strike — or strikes — could put a big dent in copper supply, and drive the price even higher.

Investment company Angel Commodities predicted copper will likely “trade sideways” as Chinese manufacturing activity continued to be in expansion mode in January at 51.3, indicating economic stabilization. So, China is still a factor, despite the country having taken a week off to celebrate the New Year.

We will continue reporting on the price of copper and see if we can keep you ahead of the curve — shadow or not!

Jim Williams is a columnist for tED Magazine, where this article first appeared, www.tedmag.com.