Q2 Financial Statistics for Enterprises

Aug 25, 2021

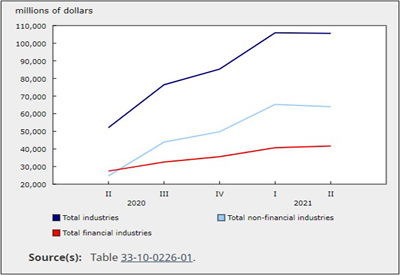

The third wave of the COVID-19 pandemic was experienced in Canada early during the second quarter of 2021. In April, the number of positive COVID-19 cases grew to its highest levels since January 2021. Consequently, provinces enacted public health measures in several regions across the country, which directly affected the performance of businesses in Canada.

Input costs for Canadian businesses grew 6.1% on average over the second quarter, higher than the 5.7% increase seen in the first quarter. While an increase in the price of lumber drove the rise, input costs rose across most product lines, which drove up the costs of goods sold for Canadian producers. Consequently, net income before taxes in the non-financial sector declined by 2.0% in the quarter.

During the quarter, a worldwide shortage of semiconductor chips strongly contributed to the 1.0% decrease in net income before tax in the motor vehicles and trailer manufacturing industry. The shortage also caused a decline in exports of motor vehicles and parts due to partial shutdowns during the period.

Property and casualty insurers in Canada report an increase in claims over the quarter

The property and casualty insurance industry reported an increase in the number of claims compared with the previous period. Later in June, a number of weather-related events damaged crops. Moreover, dry conditions prompted wildfires which may negatively impact the earnings of property and casualty insurance carriers in the next quarter.

Life, health and medical insurers in Canada saw an increase of 15.0% in net income before tax, supported by favourable foreign exchange rates during the period. Over the second quarter, the Canadian dollar appreciated 181 basis points against the US dollar reaching its highest level since 2014. Life insurance reported a slight decrease in claims, further buoying results.

The net income before taxes for wood and paper manufacturing edged up over the quarter

In the wood product and paper industry, lumber prices continued to climb for the first half of the quarter. In May 2021, lumber prices were 123.3% higher year over year. However, prices for forestry products began to fall in the following month. Nonetheless, the industry saw an increase in net income before taxes by 1.5% over the quarter.

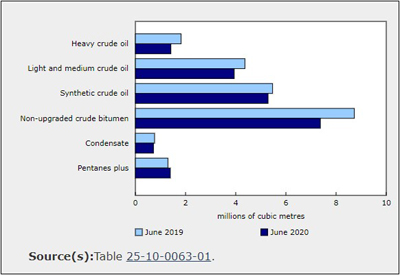

A dispute over the Line 5 pipeline prompted worries over crude supply

Over the quarter, oil and gas extraction and support services reported a net income before taxes of $1.4 billion, driven by an increase in the price of crude oil.

Simultaneously, a dispute between the State of Michigan and Enbridge prompted fears over a major interruption in crude supply through the Line 5 pipeline, leading to a decline in oil prices, before quickly recovering. A shutdown of the pipeline would mean that crude oil would be transported via rail to eastern Canada or stored in available terminals. Furthermore, interrupted operation of Line 5 would mean that active crude refineries in eastern Canada would face supply shortages. The effects of these events may be reflected in future quarters as the dispute is resolved in the courts.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210824/dq210824a-eng.htm?CMP=mstatcan