Energy Production Declines Year Over Year

Sept 9, 2020

Over the past few months, there has been a downward trend in energy production, driven by ongoing closures and low economic activity due to COVID-19. While the reopening of the economy was accompanied by a slight uptick in demand in June, overall energy production was down year over year.

Production of crude oil and equivalent products fell year over year for the third consecutive month in June. Motor gasoline, coal and natural gas production also remained below June 2019 levels, while electricity generation (including hydro, wind and solar) rose.

Crude oil production falls year over year despite growing demand

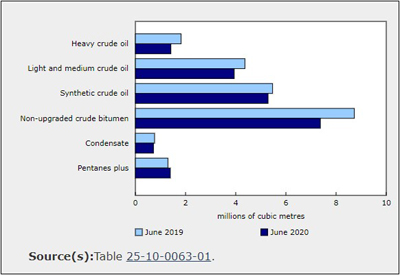

Production of crude oil and equivalent products fell 10.3% year over year to 20.1 million cubic metres (126.6 million barrels) in June, following declines in April (-10.7%) and May (-12.9%). Despite a modest recovery in demand for crude oil attributable to the pick-up in economic activity, production was still limited by the recent voluntary cuts imposed by most producers in the wake of lower oil prices.

Daily production of crude oil (excluding equivalent products) rose 6.7% from May to 600.5 thousand cubic metres in June. Daily production had fallen to a low of 562.7 thousand cubic metres in May, primarily as a result of a sharp decline in Western Canada.

In June, crude bitumen production was the main contributor to the overall decrease, down 15.5% to 7.4 million cubic metres. Outputs from both in-situ (-11.5%) and mining (-11.2%) were lower, while crude bitumen sent for further processing fell 5.5%. Extraction of heavy (-22.3%) and light and medium crude oils (-9.7%) was also down year over year, mostly because of declines in Alberta and Saskatchewan.

Maintenance work at an upgrader in northern Alberta contributed to the 3.3% drop in the production of synthetic crude oil, the first decline since March.

Nevertheless, increased economic activity due to the easing of shutdowns around the world boosted the demand for crude oil in June. According to the US Energy Information Administration, global petroleum demand exceeded global supply in June for the first time since December 2019. The price of crude oil rose by one-quarter (+26.5%) in June, following an 81.8% increase in May, according to the Raw Materials Price Index.

Exports of crude oil and equivalent products fell another 14.6% to 15.9 million cubic metres in June—the lowest level since February 2018. This followed year-over-year decreases in April (-6.7%) and May (-10.5%). Demand for Canadian crude oil remained low in the United States, where some refineries continued to operate at reduced capacity in June.

Exports by pipeline were down 9.1% in June. Meanwhile, exports to the United States by other means (rail, truck and marine) fell by more than two-thirds (-69.3%), as there was less need for other transport capacity to supplement pipelines. In contrast, exports of crude oil and equivalent products to other countries increased—mostly because of higher volumes originating from Newfoundland and Labrador.

Following a 40.7% drop in May, imports of crude oil and equivalent products fell 4.8% year over year to 2.9 million cubic metres in June, mainly as a result of imports by entities other than refineries (pipeline), down 15.7%.

Imports of crude oil by Canadian refineries rose 1.6%, as some refineries started to boost production. Capacity utilization in the petroleum and coal products industry, which includes refineries, rose 5.8% month over month to 76.2% in June, according to the Monthly Survey of Manufacturing. This followed the recent low of 53.8% in April. Despite this increase, the capacity utilization in June was down 8.5% compared with June 2019.

Refineries continue to produce less fuel year over year

Although overall refining activity increased from May to June, some Canadian refineries continued to operate at reduced capacity.

Net production of motor gasoline (including blending components and ethanol fuel) decreased 16.0% year over year to 3.2 million cubic metres in June. Diesel fuel oil production decreased 12.5% and kerosene-type jet fuel production was down by over two-thirds (-69.5%).

The demand for transportation fuels remained low in June. Domestic consumption of motor gasoline fell 14.5% year over year, and diesel fuel oil was down 9.6%.

Following large year-over-year declines in April (-84.4%) and May (-78.9%), domestic consumption of jet fuel fell 79.8% in June and remained at historically low levels. Nevertheless, a slow recovery in air travel activity continued in June. Statistics Canada data on weekly aircraft movements show that by the end of June, domestic aircraft movements had increased 122.2% since mid-April.

Prices for petroleum products were also up in June, driven by increased demand and higher prices for crude oil. According to the Industrial Product Price Index, motor gasoline (+17.7%) prices increased for the second consecutive month, while the price of diesel fuel (+20.8%) and jet fuel (+28.5%) rose following five months of decline.

Natural gas production remains down

Canadian marketable natural gas production decreased for the fourth consecutive month, down 0.7% year over year to 544.7 million gigajoules in June. The decrease was attributable to lower production in Alberta (-3.7%). Production in British Columbia increased 8.0% year over year.

The demand for natural gas continued to decline in June. Total deliveries of natural gas to Canadian consumers fell 5.0% year over year to 280.6 million gigajoules—the lowest level for the month of June since 2017. As economic activity remained slow, deliveries of natural gas to industrial (-5.3%) and commercial and institutional (-8.4%) consumers were down in June. In the meantime, deliveries to the residential sector increased 2.8% on higher consumer demand in Saskatchewan, British Columbia and Quebec.

Deliveries of natural gas in Alberta continued their downward trend in June (-10.8% to 176.0 million gigajoules), the second consecutive monthly year-over-year decline and the largest decrease since October 2019 (-10.9%). The decline was mainly due to lower demand from the industrial sector (-11.0%), which accounted for 58.5% of all natural gas delivered in Canada in June, down from 62.4% in June 2019.

As demand for natural gas remained at historically low levels in the United States, exports of natural gas by pipeline to the United States fell 10.4% to 202.5 million gigajoules in June. In the first six months of 2020, the average monthly exports of natural gas were down 10.2% compared with the same period in 2019.

Imports of natural gas from the United States by pipeline were down 1.3% to 82.5 million gigajoules, the fifth consecutive monthly year-over-year decline. The decrease in June was mainly due to lower demand for imported natural gas in Ontario.

Electricity generation and consumption up on increased demand

Electricity generation in Canada increased 2.7% to 47.4 million megawatt-hours (MWh) in June, the first year-over-year increase in 2020 and the largest since February 2019. The increase was led by electricity generated from hydro (+6.5%), wind (+24.5%) and solar (+6.3%).

Partially offsetting the overall increase, electricity generated from combustible fuels was down 3.4% to 8.4 million MWh and nuclear generation decreased 7.7% year over year to 8.0 million MWh.

Electricity consumption increased 0.5% in June, following five consecutive monthly year-over-year declines. Ontario (+3.4%) and Quebec (+0.8%) led the gain in demand for electricity. Electricity consumption in Alberta (-5.6%) and Saskatchewan (-2.3%) fell year over year as lockdown measures continued to affect industrial and commercial activity.

June also saw higher electricity prices. In Ontario, prices rose 17.2% from May to June, the largest monthly increase since May 2003, according to the Consumer Price index. On June 1, the provincial government introduced higher electricity prices, after significantly lowering prices in March in response to the pandemic.

Coal production falls by over one-quarter

Coal production declined 26.6% year over year to 3.0 million tonnes in June, as some mines that suspended production in April because of COVID-19 remained closed. Coke production decreased 11.9% to 180.7 thousand tonnes.

Energy sector rocked by COVID-19 in the second quarter

Production of crude oil and equivalent products fell by 11.3% year over year to 59.9 million cubic metres in the second quarter—the lowest level since the second quarter of 2017. The decline was attributable to lower demand following COVID-19 lockdowns imposed by governments around the world and sharply lower crude oil prices.

Production of refined petroleum products was also affected as lockdowns and travel restrictions reduced the need for transportation fuels. Consumption of motor gasoline (-30.1%), diesel fuel (-13.7%) and jet fuel (-81.1%) was down in the second quarter.

Natural gas production was less affected by the pandemic. Canadian marketable production was down 1.6% year over year to 1.7 billion gigajoules in the second quarter. Deliveries to industrial consumers declined 3.5% as economic activity slowed. In contrast, deliveries of natural gas to residential consumers were up, with more people staying home as the pandemic unfolded.

Electricity generation was unchanged at 143.0 million MWh in the second quarter compared with the same quarter in 2019, while electricity consumption declined 3.7% on lower demand from industrial and commercial sectors.

Coal production was down 25.8% year over year to 9.3 million cubic metres in the second quarter—the lowest production level on record. The decrease was largely attributable to the steady decline in the demand for coal, combined with mines closures due to COVID-19.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200904/dq200904d-eng.htm?CMP=mstatcan