Wholesale Trade, August 2023

October 16, 2023

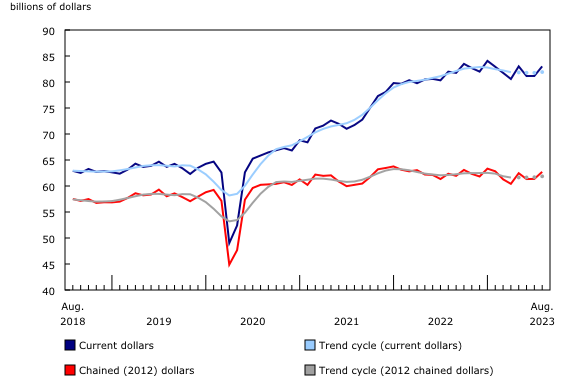

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) increased 2.3% to $83.0 billion in August. Sales increased in five of the seven subsectors, led by the machinery, equipment and supplies subsector and the miscellaneous subsector. On an annual basis, wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) were higher (+1.1%).

Petroleum products as well as oilseed and grain data continue to be available in data tables but will be excluded from monthly analysis until historical data are available for monthly and annual analysis.

Based on respondent feedback, the strike at the ports in British Columbia affected the business activities of approximately 1.4% of Canadian wholesalers in August, which is lower than the reported impact in July (3.7%). In August, a supply shortage or material delays and transportation disruptions impacted the wholesale businesses the most. On an unadjusted basis, the largest estimated impacts on sales in dollar terms were in the machinery, equipment and supplies subsector.

In volume terms, wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) grew 2.2% in August.

Chart 1

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) increase in August

Higher sales in the machinery, equipment and supplies subsector lead wholesale sales growth in August

Sales in the machinery, equipment and supplies subsector grew by 5.2% to $18.6 billion in August, recording their first increase in three months. The increase was widespread across all four industry groups in August, led by higher sales in the farm, lawn and garden machinery and equipment industry group (+17.6% to $2.6 billion). The increase in the subsector sales aligns with the higher imports of industrial machinery and equipment (+7.5%) reported in August.

The miscellaneous subsector (+6.9% to $10.3 billion) also contributed to the sector growth in August. A majority of the industry groups reported a decline in sales. However, the agricultural supplies industry group (+22.0% to $3.5 billion) and the recyclable material industry group (+21.3% to $1.3 billion) recorded significant growth that offset the declines and led the subsector to report an increase. Higher sales in the agricultural supplies industry group were due to shipments of completed orders and higher prices of related products , such as agricultural chemical products.

The third subsector to report a gain in August was the building material and supplies subsector, up 1.0% to $12.0 billion. Of the subsector’s three industry groups, two reported a monthly increase, led by the electrical, plumbing, heating and air-conditioning equipment and supplies industry group (+2.9% to $3.9 billion).

Sales in Ontario lead provincial gains

A majority of the provinces reported growth in wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain), led by Ontario and followed by Saskatchewan and British Columbia.

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) in Ontario increased by 2.1% to $43.6 billion in August. Growth in Ontario was reported in six of the seven subsectors, with the largest growth coming from the machinery, equipment and supplies subsector (+6.4% to $9.3 billion), followed by the miscellaneous subsector (+6.2% to $4.9 billion).

The second-largest provincial growth was in Saskatchewan, up 12.4% to $3.4 billion in August. Higher sales were recorded in the miscellaneous subsector (+15.1% to $1.4 billion) and the machinery, equipment and supplies subsector (+19.8% to $1.1 billion).

Sales in British Columbia rose 4.6% to $7.9 billion. Growth was reported in all of the subsectors, with the largest increase coming from the miscellaneous subsector (+15.5% to $937.1 million), followed by the food, beverage and tobacco subsector (+4.5% to $1.6 billion) and the building material and supplies subsector (+3.4% to $2.1 billion).

Inventories continue to grow in August

Wholesale inventories (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) rose 0.5% to $128.5 billion in August.

Increased inventories were reported in four of the seven subsectors, led by the building material and supplies subsector (+2.8% to $23.7 billion), followed by the machinery, equipment and supplies subsector (+1.1% to $38.2 billion).

The inventory-to-sales ratio fell from 1.58 in July to 1.55 in August. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.