Building Permits, December 2025

February 18, 2026

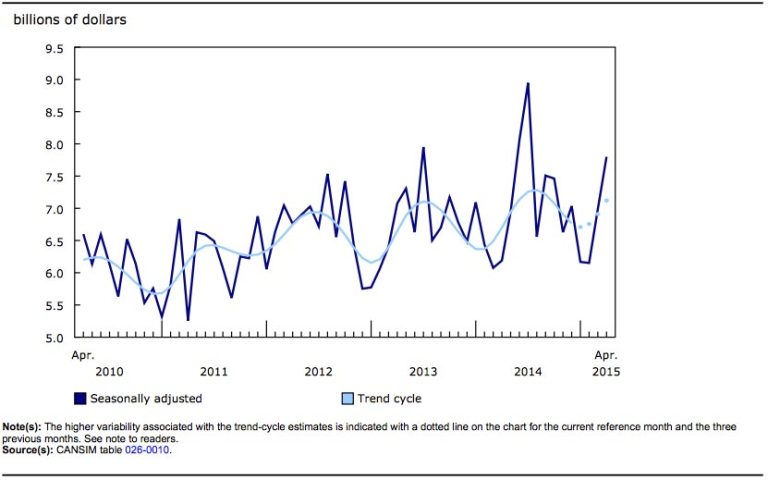

In December, the total value of building permits issued in Canada increased $821.3 million (+6.8%) to $12.8 billion. The increase was led by the residential sector (+$533.5 million) and supported by the non-residential sector (+$287.8 million).

On a constant dollar basis (2023=100), the total value of building permits issued in December grew 6.6% from the previous month and was down 6.3% on a year-over-year basis.

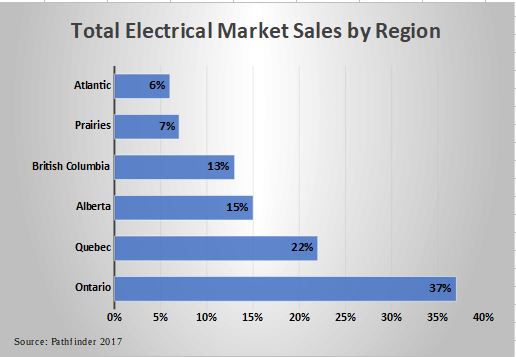

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, December 2025

Multi-unit permits drive residential sector growth

In December, residential construction intentions increased $533.5 million, bringing the total value to $8.0 billion. Gains recorded in the multi-unit component (+$653.2 million to $5.5 billion) were tempered by a decline in the single-family component (-$119.7 million to $2.5 billion).

In December, the multi-unit component gains were largely attributed to Ontario (+$548.8 million), Manitoba (+$236.9 million) and Quebec (+$130.7 million), with a total of six provinces and two territories contributing to the increase.

Meanwhile, the decline in the single-family component was driven by Ontario (-$75.4 million) and Saskatchewan (-$32.6 million). Overall, six provinces and one territory contributed to the decline in this component.

Chart 2

Number of units authorized for the residential sector and for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

Chart 4

Value of building permits for the single-family and multi-family components

Chart 5

Value of building permits for the industrial, commercial and institutional components

Institutional component leads growth in non-residential sector, despite industrial and commercial declines

In December, the value of non-residential building permits increased $287.8 million to $4.8 billion. The institutional component (+$412.6 million) drove the growth, while both the commercial (-$71.1 million) and industrial (-$53.8 million) components moderated it.

The growth in the institutional sector was led by Ontario (+$317.0 million) in December, followed by Quebec (+$103.1 million) and Alberta (+$82.5 million). Meanwhile, declines in British Columbia (-$73.5 million), the Northwest Territories (-$32.5 million) and New Brunswick (-$26.5 million) tempered the overall increase.

In December, losses in the commercial component were driven by Alberta (-$146.4 million) and Quebec (-$69.3 million), with a total of seven provinces and one territory contributing to the overall decline. Gains in Ontario (+$110.5 million), along with two other provinces and two territories, tempered the overall loss.

Meanwhile, both the industrial and the commercial sectors recorded their second consecutive monthly decrease. Ontario (-$33.0 million) led the industrial decline, with six other provinces and two territories posting decreases.

Quarterly review: multi-unit residential sector increases in fourth quarter

In the fourth quarter, the total value of building permits increased $3.7 billion to $38.7 billion, marking the largest quarterly increase since the fourth quarter of 2021. The residential sector was the primary contributor to the growth in the fourth quarter of 2025.

Residential construction intentions rose $2.4 billion to $24.0 billion in the fourth quarter, with the multi-unit component (+$2.3 billion to $16.3 billion) leading the growth.

In the fourth quarter, Ontario (+$994.2 million) led the multi-unit component’s growth, with the Toronto census metropolitan area (+$665.7 million) contributing the most to the province’s increase for the second quarter in a row. Quebec (+$486.6 million) and Alberta (+$445.1 million) also contributed to the component’s increase, along with six other provinces and one territory.

The single-family component’s moderate growth (+0.5%) in the fourth quarter was also led by Ontario (+$66.7 million), followed by Alberta (+$36.2 million). Meanwhile, declines in four provinces and two territories, led by Quebec (-$63.7 million) and Nova Scotia (-$29.2 million), tempered the overall gains.

In the fourth quarter, the value of non-residential building permits rose $1.3 billion to $14.7 billion. The commercial (+$630.3 million) and institutional (+$570.1 million) components led the growth in the sector, supported by the industrial component (+$104.7 million).

Ontario led the quarterly gains observed in the commercial (+$642.6 million) and industrial (+$387.7 million) components in the fourth quarter. The province also contributed to institutional component growth (+$61.3 million). Overall, five provinces and one territory contributed to the non-residential sector’s quarterly increase.

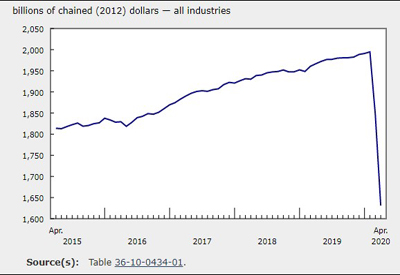

Annual review of 2025: Weak single family and industrial construction intentions drive declines in residential and non-residential permit values

Year over year, the total value of building permits rose $3.3 billion to $149.7 billion in 2025. On a constant dollar basis (2023=100), the total value of building permits declined 1.3% from 2024 to $139.6 billion.

The remainder of this release will use constant dollars (2023=100) to highlight real annualized permit values.

The residential sector decreased $1.0 billion to $86.6 billion in 2025. This decline was driven by single-family construction intentions, falling 7.0% to $29.6 billion, the lowest annual level in the series.

Conversely, the multi-family component increased $1.2 billion to $57.0 billion in 2025, the second-highest level in the series.

Meanwhile, the number of units authorized for construction was up 19,100 to 308,600 in 2025, a record high. Gains in authorized multi-unit dwellings (+22,600) were moderated by declines in intentions to build single-family homes (-3,500).

The total value of non-residential building permits fell $739.8 million to $52.9 billion in 2025, the first annual decline since 2020. Quebec (-$2.1 billion) and Ontario (-$1.5 billion) contributed the most to the decline. Gains in Alberta (+$2.0 billion) and British Columbia (+$1.1 billion) along with three other provinces and one territory moderated the losses in the sector.

After reaching a record high in 2024, the total value of industrial building permits fell $3.4 billion to $9.4 billion in 2025. This decline offset the strong growth in the institutional (+$1.9 billion) and commercial (+$797.0 million) components.

The gains in the institutional component were mostly attributed to large construction intentions for hospitals and long-term care facilities concentrated in Ontario, British Columbia, Saskatchewan and Alberta. Overall, Alberta (+104.7%; +$1.5 billion) and British Columbia (+68.0%; +$1.5 billion) drove the component’s annual gain, as Alberta experienced its largest recorded increase in 2025.