The State of Electrical Distribution eCommerce, and the Opportunity

September 6, 2023

By David Gordon, President, Channel Marketing Group

E-commerce, defined as “website ordering, continues to be low for electrical distributors according to the NAED 2022 PAR report but by no means does this diminish the importance of distributor websites.

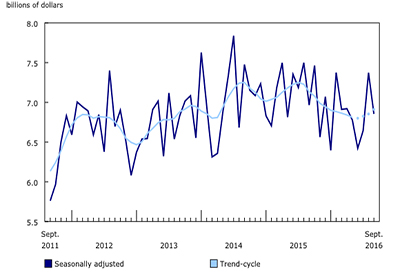

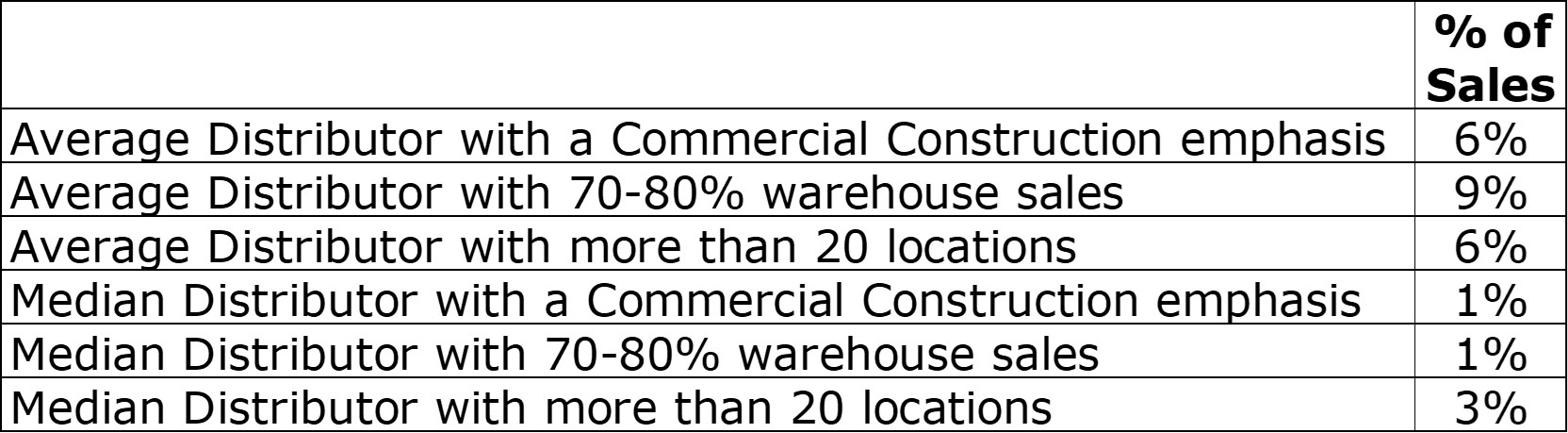

According to the PAR report, which aggregated information from 90 distributors,

- Distributors, on average, generated 4.3% of sales from their websites.

- The mean is 1.6%, and

- The top performer was 7.7%

So, if the mean is 1.6%, that means some companies are significant out-performers.

Digging deeper,

However, numerous conversations with contractors over the past 6 months in support of customer satisfaction research we’ve conducted reinforce the value of distributor websites.

These customers reinforce that distributor websites, with robust product content, are essential sales and customer support tools.

This is defined as omni-service.

The contractors told us they are visiting distributor websites for product information, spec sheets, pricing information for their estimates, and inventory availability. And then they order via other means.

They also told us some distributor sites are better than others … and remember they purchase from multiple distributors within the market.

So, the question becomes, how could your website be improved?

A year ago, we surveyed and interviewed over 300 electrical and mechanical engineers about their website usage and how websites could be improved. The research focused on manufacturer sites. However, engineers and contractors have similar website usage needs (aside from ordering and some account management services), and the informational experiences of distributor and manufacturer sites are comparable.

At the end of the day, both audiences are seeking product information.

We wrote a white paper (email me for a copy).

Electrical Engineer eCommerce Survey Says

In a rapidly evolving market shaped by the COVID pandemic and generational change (as engineers with less than 5 years’ experience were using the web more), distributor websites play a crucial role in meeting the shifting needs and expectations of engineers. The comprehensive survey yielded valuable insights into customer preferences, behaviors, and website differentiators. For distributors, understanding these findings and adapting their websites accordingly can provide a competitive advantage and foster stronger customer relationships that can result in sales opportunities … and sales.

Keys to Capturing Website Preference

- Catering to Technical Information: Engineer feedback highlighted the significance of CAD files and technical information in the decision-making process. Distributor websites should prioritize providing comprehensive technical details and easily accessible CAD files to enhance product suitability evaluations.

- Addressing Product Availability and Lead-Time: Engineers seek insight into product availability and lead-times. Distributors can gain an edge by offering transparent information on stock levels and delivery timelines, making it easier for engineers to make informed decisions.

- Capitalizing on Generational Shift and Brand Affinity: Younger engineers, with different preferences and limited brand exposure during COVID, present an opportunity for distributor websites. By offering extensive product information, interactive tools, and top-notch content, distributors can attract and retain the attention of these engineers.

- Enhancing Search Functionality and Content: Engineer satisfaction relies heavily on user-friendly search functions. Distributors should prioritize website optimization, making it easy for engineers to find specific products quickly. High-quality content in various formats can also improve website traffic and organic search rankings.

Strategies for Converting Search to Action

To better serve engineers and drive business growth, distributor websites can become more supportive by offering more pre-sale support. This could take the form of distributors collaborating closely with manufacturers to offer online sample ordering and, if samples are not feasible, robust product information in the form of .pdfs, videos, multiple graphics, case studies, application guides as well as immediate access to product specialists via Virtual Agents, live chat, and “instant / on-demand” video conferencing.

As the market landscape continues to evolve, distributor websites play a pivotal role in meeting the needs of engineers and gaining a competitive edge. By aligning websites with the insights gained from the survey, distributors can create a seamless user experience that attracts engineers and drives product conversions.

Embracing technology, optimizing content, and prioritizing customer support will enhance distributor websites to deliver for customers … and the distributors.

Takeaways

- Content is key

- Content is becoming more important to engineers and contractors. Understanding the contractor buying process, and their systems, is key. This was discussed in a recent Trimble / DDS webinar, held on ElectricalTrends, about crafting a winning strategy for product data to help win business.

- Value-added content is important.

- Online customer service is becoming more important. On our recent webinar with Microsoft, we talked about the power of Virtual Agents and building your own based upon your value proposition, knowledge, product content, and more (if interested, contact Matt Petersen to learn more … and mention ElectricalTrends.)

- Ease of site search is important

Your website may not become a major sales generator, but it will increase in importance as a sales and support tool.

Email me for a copy of the report with a special section with additional takeaways for distributors.

And, as a sidebar, if you are a distributor, you don’t need to spend “$1+ million” to build a robust website. Technology today enables you to have a quality site, that will be robust with much of the features your customers expect, and quality content, cost-effectively. The key is understanding customer expectations. We can help guide you.