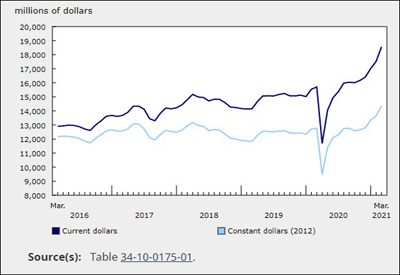

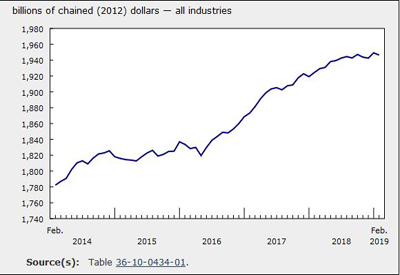

GDP Contracted 0.1% in February But Construction Up 1.2%

May 9, 2019

Following 0.3% growth in January, gross domestic product contracted 0.1% in February as both goods-producing and services-producing industries declined. The 20 industrial sectors were nearly evenly split between gains and losses.

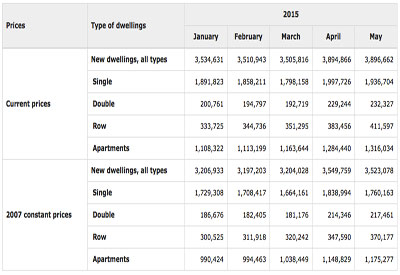

Construction continues to grow

Construction (+0.2%) increased for the second month in a row in February, following seven consecutive months of decline. Leading the growth was a 1.2% expansion in residential construction due to gains in single, semi-detached, row and apartment type-dwellings. Non-residential construction edged up 0.1% as growth in industrial construction more than offset declines in public and commercial construction. Repair construction declined 1.0% in February, following three months of growth, while engineering and other construction activities edged down 0.1%.

The mining, quarrying and oil and gas extraction sector declines for the sixth consecutive month

Mining, quarrying and oil and gas extraction (-1.6%) was down for the sixth consecutive month, as all subsectors declined.

The largest impact on the sector’s decline in February came from a 4.4% decrease in mining and quarrying (except oil and gas), as nearly all types of mining were down due to lower international demand. Metal ore mining was down 4.8% with reduced output of most types of metals. Non-metallic mineral mining decreased 3.7% largely due to a 6.9% contraction in potash mining as exports to the United States declined. Coal mining was down 6.1%, the largest monthly decrease since November 2017.

Oil and gas extraction was down 0.6% in February, following a 2.6% decline in January. Oil and gas extraction (except oil sands) was down 1.1% as both natural gas and crude petroleum extraction fell. Following a 4.1% contraction in January, oil sands extraction edged down 0.1% in February as the Government of Alberta eased oil production cuts by 75,000 barrels a day on January 30. Support activities for mining, oil and gas extraction was down 0.6% in February as growth in support activities for oil and gas extraction was more than offset by a decline in support activities for mining.

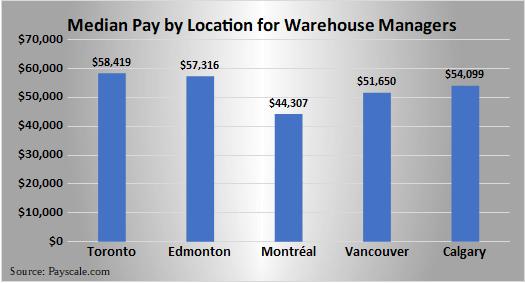

Transportation and warehousing contract as rail transportation drops

Transportation and warehousing was down 1.6% in February, the largest decline since June 2011, largely due to a 10.8% drop in rail transportation. There were widespread declines in rail movement of products, such as iron ore, potash and fuel oils and crude petroleum. Cold weather and heavy snowfalls across many parts of the country and a train derailment near Field, BC that closed an important rail line through the Canadian Rockies in the early part of the month all had adverse effects on rail transportation.

Transit, ground passenger, scenic and sightseeing transportation (-1.6%), support activities for transportation (-0.7%) and truck transportation (-0.5%) also contributed to the decline. Pipeline transportation (+1.1%) was up for the third consecutive month, as growth in pipeline transportation of natural gas more than offset a slight decrease in crude oil and other pipeline transportation.

Finance and insurance sector down

The finance and insurance sector declined 0.6% in February, offsetting the previous two monthly increases. Decreased issuance of new securities and lower trading in the bond and money markets contributed to declines in financial investment services, funds and other financial vehicles (-2.2%) and depository credit intermediation and monetary authorities (-0.5%). Non-depository credit intermediation increased 0.2% in February, while activities related to credit intermediation declined 0.3%. Insurance carriers and related activities edged down 0.1%.

Manufacturing declines

Following January’s growth (+2.1%), which was the largest in close to 15 years, the manufacturing sector contracted 0.4% in February as both durable and non-durable manufacturing declined.

Durable manufacturing contracted 0.4% in February, as 8 of the 10 subsectors declined. The largest contributions to the decline came from wood products (-4.2%), furniture and related products manufacturing (-6.3%) and primary metal (-2.7%). Gains were posted in machinery (+5.2%) and fabricated metal products (+3.1%) manufacturing.

Non-durable manufacturing was down 0.3% in February. The nine subsectors were relatively evenly split between gains and losses. Increases in plastic and rubber products (+4.6%) and petroleum and coal products (+3.2%) manufacturing were offset by declines in food (-2.3%) and chemical (-2.8%) manufacturing.

Utilities up due to record-setting cold weather in Western Canada

Utilities were up 1.5% in February, the fourth increase in five months. Record-setting cold temperatures in February in Western Canada, along with cooler temperatures in the rest of the country, contributed to higher demand for electric power generation, transmission and distribution (+1.6%), and natural gas distribution (+1.8%).

Other sectors

Real estate, rental and leasing declined 0.2%, the first decrease since February 2018. Activity at offices of real estate agents and brokers was down 6.6%, the fourth decline in five months, as there was lower housing resale activity in Ontario, Quebec and British Columbia.

Professional, scientific and technical services rose 0.4% in February with gains in most subsectors.

The public sector edged up 0.1%, with all three components (education, health care and public administration) rising.

Retail trade edged up 0.2%, partly offsetting the previous month’s decline, as 5 of 12 subsectors grew. The largest gains were in general merchandise stores (+3.6%) and motor vehicle and parts dealers (+0.8%), while there were notable declines at clothing and clothing accessories stores (-1.7%) and building materials and garden equipment and supplies dealers (-1.9%).

Wholesale trade edged up 0.1% as five of the nine subsectors increased. Motor vehicles and parts wholesalers increased 8.6%, mainly on higher imports of motor vehicles. Building materials and supplies declined 4.5% on lower sales of lumber. Farm product wholesaling declined 8.8%, reflecting in part rail transportation issues in Western Canada.

Accommodation and food services edged down 0.1%, as an increase in accommodation services was more than offset by a decrease in food services and drinking places.

Agriculture, forestry, fishing and hunting was essentially unchanged in February as the subsectors were relatively evenly split between gains and losses.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190430/dq190430a-eng.htm