Annual Wholesale Trade, 2020

Jan 18, 2022

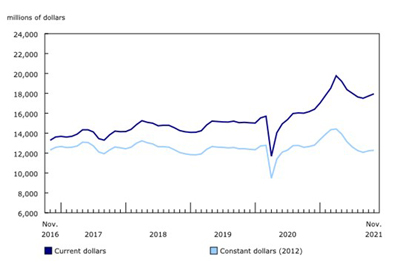

The operating revenue of Canadian wholesalers declined 8.2% in 2020, falling to just below $1.1 trillion. The declines were primarily due to petroleum and petroleum products (-25.7%), as well as the motor vehicle and motor vehicle parts and accessories (-18.0%). Six of the seven remaining subsectors saw revenues increase in 2020.

The cost of goods sold, which represents the cost of acquiring goods for resale, fell 9.5% to $898.4 billion in 2020.

As a result, gross margins for wholesalers (the difference between total operating revenue and the cost of goods sold, expressed as a percentage of total operating revenue) increased from 16.1% in 2019 to 17.3% in 2020.

Total operating expenses, which include labour remuneration, were down 1.3% to $136.3 billion. Total operating expenses declined in five of nine subsectors.

Overall, the operating profits of wholesalers as a percentage of total operating revenue increased from 4.4% in 2019 to 4.7% in 2020, as higher gross margins were only partly offset by declining expenses.

Wholesale revenue driven down by petroleum and autos

The largest decline in operating revenue was observed in the petroleum and petroleum products subsector, down 25.7% to $232.9 billion in 2020, as the price of crude oil declined.

Despite the decline in revenue, wholesalers of petroleum and petroleum products continued to account for the largest proportion (21.4%) of operating revenue in the wholesale trade sector in 2020, down from 26.5% in 2019.

The second largest decrease in revenue was observed in the motor vehicle and motor vehicle parts and accessories subsector, which was down 18.0% to $128.5 billion in 2020 as both imports and exports declined.

Excluding these two subsectors, operating revenue increased by 1.5% as six of the seven remaining subsectors posted increases. Among wholesale merchants, the largest increase in dollar terms was reported in the food, beverage and tobacco subsector, which posted a $6.9 billion (+4.7%) increase to reach $155.0 billion in 2020.

Gross margins increasing due to declining share of petroleum

Expressed as a percentage of total operating revenue, gross margins increased from 16.1% in 2019 to 17.3% in 2020. This was mainly due to the declining share of the petroleum subsector, which had the lowest gross margins (3.7%).

Gross margins varied widely among subsectors, depending on the cost structure of the different types of wholesalers. Among wholesale merchants, the highest gross margin was in the machinery, equipment and supplies subsector (26.7%), followed by the personal and household goods subsector (24.6% in 2020, down from 24.7% in 2019).

Operating profits increase slightly

In 2020, six of the nine subsectors posted annual increases in their operating profits as a percentage of total operating revenue, while two decreased and the remaining one was unchanged. Overall, operating profits increased slightly from 4.4% to 4.7% in 2020.

Among wholesale merchants, personal and household goods wholesalers posted the largest increase in their operating profits, increasing from 5.1% in 2019 to 5.8% in 2020.

Wholesale revenue down across Canada

In 2020, all provinces and territories reported lower wholesale operating revenue compared with 2019. Overall, operating revenue in Canada decreased by $97.6 billion in 2020. Declines were led primarily by Ontario and Alberta, which saw their revenues decrease by a combined $82.5 billion.

Overall, wholesale operating revenue in Ontario remained the highest among all the provinces, decreasing 4.5% to $445.2 billion. The declines in Ontario were driven primarily by revenue declines in the motor vehicle and motor vehicle parts and accessories (-21.1%), as well as the petroleum and petroleum product (-27.3%) subsectors.

In 2020, wholesalers in Alberta reported an annual decline in operating revenue of 18.3% to $274.3 billion. The decrease was mainly attributable to the petroleum and petroleum product subsector (-23.7%), which accounted for over two thirds of wholesalers’ operating revenue in the province. Five of the eight remaining wholesale subsectors in Alberta saw their revenue decrease in 2020. The second largest wholesale subsector in Alberta was machinery, equipment and supplies, which posted a decline of 10.2% in operating revenue to $24.9 billion.

Wholesalers in Quebec posted the third highest provincial total operating revenue in 2020, at $168.3 billion, down from $171.6 billion in 2019. The decrease was mainly due to the petroleum and petroleum product subsector, which saw its revenues decline by 35.1% in 2020 to $13.0 billion. Six of the eight remaining wholesale subsectors in Quebec saw their revenue increase in 2020 led by the food, beverage and tobacco subsector which was up 8.9% to $37.5 billion.

Cannabis

In 2020, cannabis wholesalers generated $1.5 billion in total operating revenue, up 110.3% compared with 2019. The cost of goods sold was up 115.5% to $1.1 billion, resulting in a gross margin of 25.3%, down from 27.0% in 2019. Total operating expenses amounted to $201.8 million, up 62.0% from 2019. In the second full year after the legalization of cannabis for recreational purposes, wholesalers earned a profit equal to 11.5% of total operating revenue, up from 9.2% in 2019.

Cannabis distribution rules vary from province to province, and as a result, cannabis wholesale activities are concentrated in Ontario and the provinces to the west. Ontario accounted for the largest share of the Canadian market, with $652.5 million in revenue. Alberta came in second, posting $418.1 million in operating revenue.

Wholesale trade commodities

Wholesalers across Canada buy and sell a wide variety of commodities, ranging from petroleum products, motor vehicles, pharmaceuticals, wood products and clothing to a large selection of food products.

The Annual Wholesale Trade Survey measures the sales and costs of goods sold for these and other products, classifying them according to the North American Product Classification System.

In 2020, Canadian wholesalers sold slightly below $1.1 trillion worth of commodities. Compared with 2019, sales decreased 8.4% led by declines in petroleum and petroleum products. Higher sales were seen in 34 of 66 commodity subclasses in 2020 compared with 2019.

In 2020, 34 of 66 commodity subclasses saw their cost of goods sold decrease, while the rest posted increases.

In dollar terms, petroleum and petroleum products drove the decline in sales, down $71.0 billion to $233.4 billion in 2020. The cost of goods sold decreased $69.4 billion to $226.0 billion.

The top five commodity subclasses accounted for 45.8% of all sales in 2020, down from 50.0% in 2019. These commodity subclasses cover a wide variety of goods distributed by Canadian wholesalers, from non-durable goods such as petroleum, food and pharmaceuticals to durable goods such as motor vehicles and farm equipment.

In 2020, the largest commodity subclass in dollar terms was petroleum and petroleum products, comprising a 22.1% share of total wholesale sales, down from 26.4% in 2019. Sales in this subclass declined by 23.3% in 2020 compared with 2019.

Sales of medical, scientific, laboratory, measuring, control and other professional equipment declined 1.1% to $12.2 billion in 2020 as medical device distributors were impacted by the widespread cancelation of elective procedures. Meanwhile, sales of home health care equipment and appliances (+70.9%), as well sales of medical and dental supplies (+11.8%).

Impact of COVID-19 on wholesale trade

Businesses in the wholesale trade sector were impacted in a variety of ways by the COVID-19 pandemic.

From the survey results, 2,286 wholesalers reported additional expenses due to the pandemic, of which 1,957 reported additional labour expenses totaling $97.5 million, while 2,192 reported other additional expenses totaling $286.7 million.

Among the various ways in which wholesalers were impacted by the pandemic, the most common response was the adoption of a contactless business model which was reported by 3,022 wholesalers. The second most common response was the adoption of working from home, which was reported by 2,249 respondents.

In response to the economic impact of the pandemic, governments across Canada adopted various programs to provide financial relief to businesses. In 2020, 2,043 wholesalers reported receiving public financial relief via the Canada Emergency Wage Subsidy and the Temporary 10% Wage Subsidy programs, totalling $2.5 billion.