Building Permits, October 2024

December 13, 2024

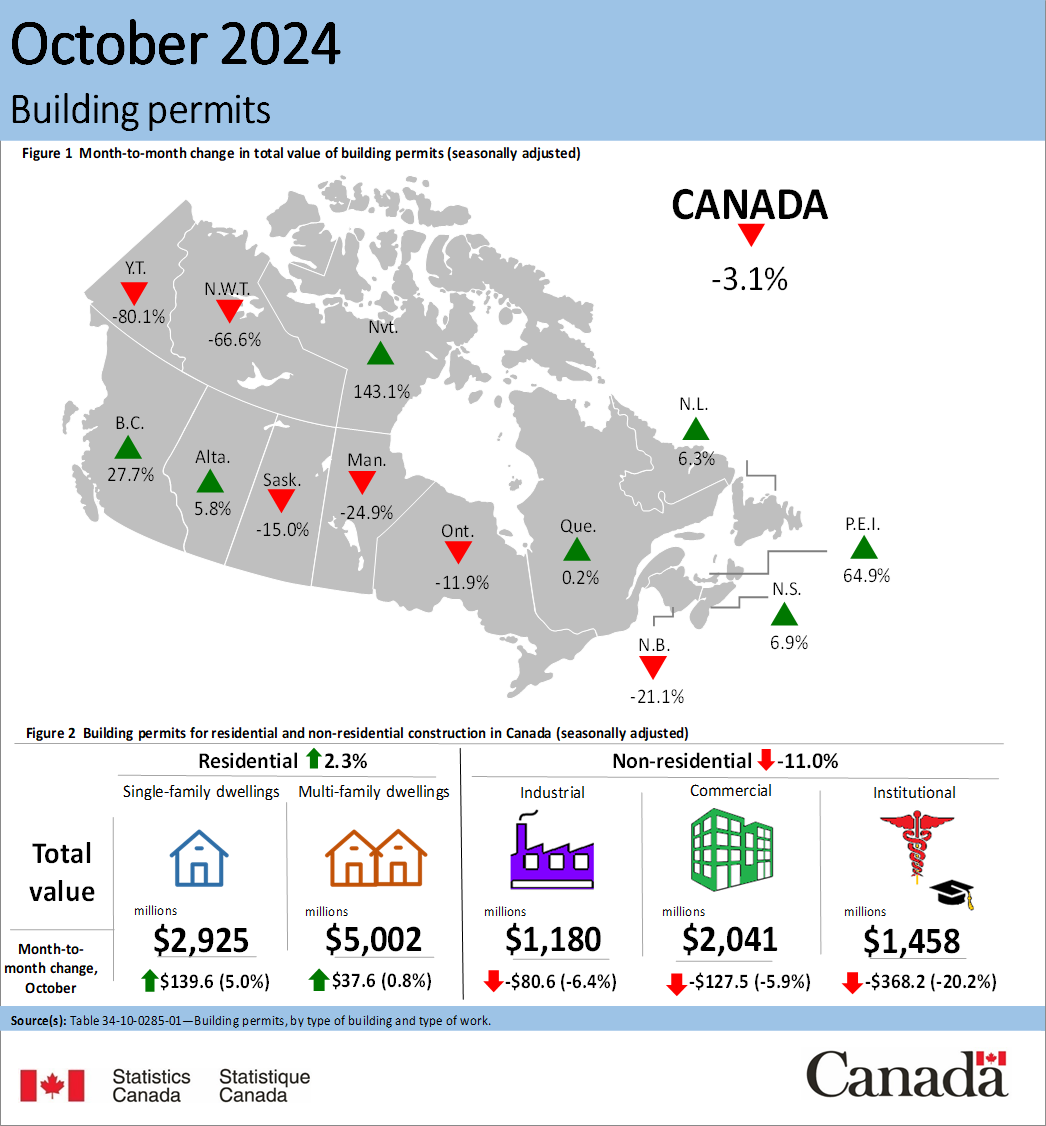

The total value of building permits issued in Canada decreased by $399.1 million (-3.1%) to $12.6 billion in October. This comes on the heels of a strong September, during which construction intentions rose by $1.3 billion to the second-highest level in the series. Despite the monthly decline in October, the total value of building permits was the fourth-highest level in the series. In October, Ontario’s construction intentions (-$696.4 million) significantly contributed to the national non-residential decline, tempering total residential growth, after fuelling both sectors’ gains in September.

On a constant dollar basis (2017=100), the total value of building permits in October decreased 3.6% from the previous month and was up 8.1% on a year-over-year basis.

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, October 2024

Declines in Ontario and Manitoba construction intentions push down the non-residential sector

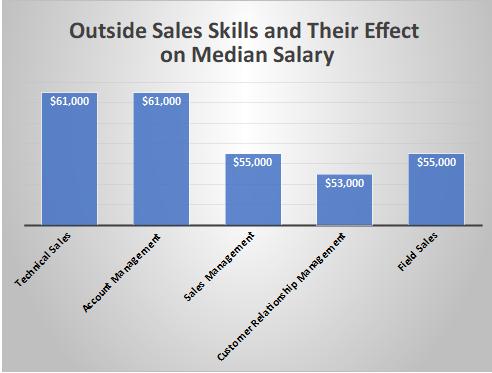

The total value of non-residential building permits decreased by $576.3 million (-11.0%) to $4.7 billion in October, led by Ontario (-$300.9 million) and Manitoba (-$207.5 million). Overall, declines were seen across the institutional (-$368.2 million), commercial (-$127.5 million) and industrial (-$80.6 million) components.

Ontario’s non-residential sector decrease in October was driven by the institutional component (-$241.9 million), following the province’s record-high level reached in September. Manitoba’s decrease was driven by the industrial component (-$141.0 million) in October.

Chart 2

Value of building permits for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

British Columbia and Alberta lead residential growth, while Ontario multi-family dwellings temper national gain

Residential construction intentions increased by $177.1 million (+2.3%) to $7.9 billion in October. British Columbia (+$275.6 million) and Alberta (+$158.9 million) led residential sector growth, which was also supported by Nova Scotia (+$73.7 million) and Manitoba (+$61.3 million).

The multi-family component edged up by $37.6 million in October. Monthly gains were observed in seven provinces and one territory, led by British Columbia (+$261.4 million) and Alberta (+$129.8 million). The gains were tempered by a decline in Ontario (-$472.8 million), following a sharp increase driven by several large multi-family dwellings construction projects in September. British Columbia’s increase in October was supported by a large multi-family dwelling construction project in Burnaby, while Alberta’s expansion was broad-based.

The value of single-family permits rose by $139.6 million in October, driven by Ontario (+$77.3 million), which was also supported by contributions from seven other provinces and territories.

Across Canada, 21,300 new multi-family dwellings and 4,900 single-family dwellings were authorized in October, representing a 6.7% monthly increase in the total number of units approved for construction through permit issuance. The 12-month cumulative total of units authorized from November 2023 to October 2024 rose by 2.7% to 274,100, compared with 266,800 units authorized from November 2022 to October 2023.