Copper Giveth and Copper Can Taketh, but Beware

May 17, 2022

The past few years have seen copper prices increase. A combination of construction increases, EVs and supply constraints have benefited distributors as the price of copper has risen. And with rising prices has come increased gross margin dollar windfall for distributors as their COGs increased and gross margin percentages remained the same.

We’ve all heard the stories about contractors who commented (complained) how they quoted a project “a while ago” and by the time they won the project and placed the order, the price had changed. We empathized and sympathized, but little could be done in most cases.

Many distributors adjusted their purchasing processes, no longer trying to “time” the market and being more cognizant of the value of their wire inventory.

Yesterday (Tuesday, May 10) copper closed at $4.16. It started the year about $4.42 and reached a high of $4.94. A year ago it was at $4.65. The net … your inventory has probably been devalued and your are earning less gross margin dollars / pound sold.

Why is this important?

With wire and cable representing 15-20% of distributor sales, a decline in gross margin dollars can have a significant impact on the bottom line. At the same time, some may think they should “time the market” and buy now, but “who knows if we’re at the bottom”, or perhaps we’re at the top.

There are many drivers of copper but, for that we turn to John Gros (Dr. Copper) to explain. He shared this input in his last two weekly newsletters:

From John’s April issue

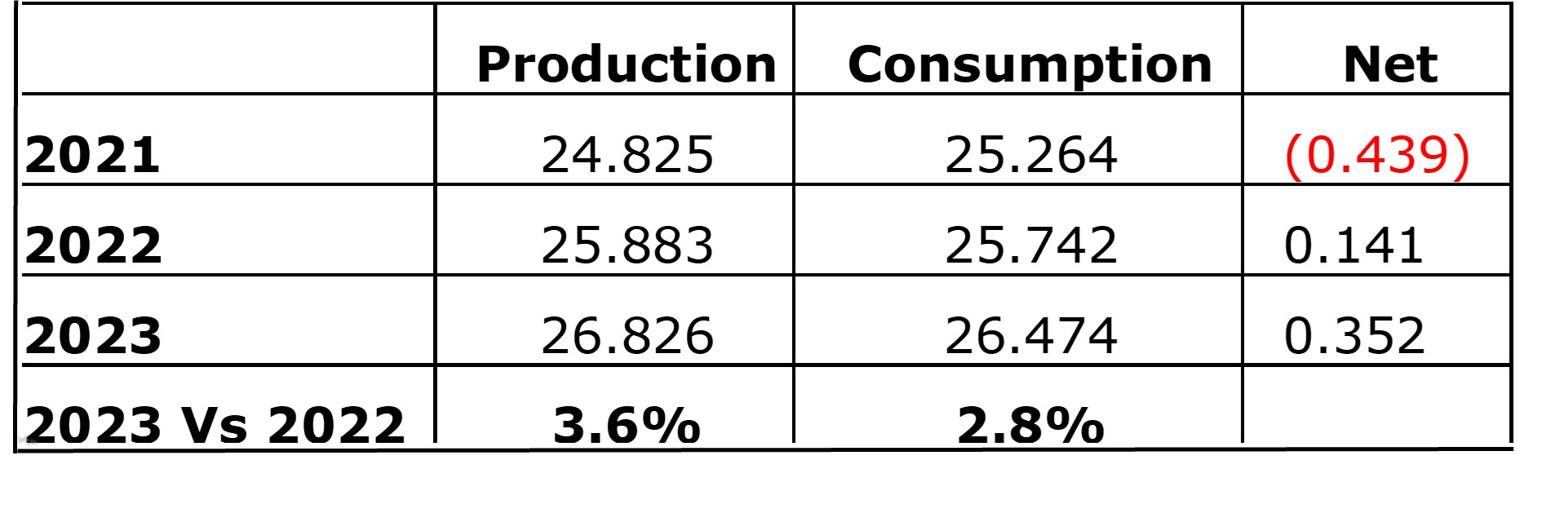

“Our friends at the International Copper Study Group released their forecast of global production and consumption of copper for this year and next, with the expectation that we will see continued growth on both sides of the equation. Here is a summary of their analysis in millions of metric tonnes:

Interestingly, in May of 2021 the ICSG was expecting a nearly balanced market for that year with a small 79,000 mt surplus. So, what happened? Their expected production of 25.2 mmt fell short by 400,000 mt to 24.8 mmt due to the impact of covid, weather, logistics, and a variety of events that impacted output of metal. On the consumption side, ICSG expected usage to come in at 25.1 mmt, but the number was better than expected by more than 100,000 mt, coming in at 25.2 mmt. Thus, the global market saw a deficit, rather than an anticipated surplus.

In the grand scheme of things, a +/- 1% – 2% variance isn’t going to change the world from one year to the next. Going a step further, as the global copper market has grown over the years, it has also become increasingly complex in terms of monitoring statistics, particularly as some of the largest participants are not eager to share information.

The same risk applies to price forecasting – perhaps even more so, because there are too many variables, with human nature being the biggest culprit and contributing factor to confusion, as our emotions of hope, greed, and fear can vacillate in a flash.

Anyway, the good people at the Chilean Copper Commission are expecting copper to average $4.40 per pound this year, reflecting an 11% upward revision from their $3.95 estimate in January. A recent Reuters poll sees copper averaging $9,900 pmt, or $4.49 per pound this year, but Goldman Sachs may be the most bullish bull of them all, as they see copper climbing to $12,250 pmt, or $5.55 before year end.

So, we’ll see. Thus far copper has averaged $4.56 through April, which at this point is a record high, but we have a way to go before the year is over. Looking at copper during April specifically, it was not one to write home about. Although the monthly average of $4.64 was down just 4¢ from March, on a daily basis, the Spot price fell 35¢ from $4.74 at the end of March to $4.39 on the last trading day of April.

Sure, there are compelling reasons for copper to remain strong, but we’ve all been down this road before, and have seen market sentiment change in a heartbeat.

And in his May issue Dr. Copper shared:

“Copper has fallen for four consecutive weeks now giving up 46¢ in the process to close at $4.26, representing a six-month low. And, as you can see on the bar chart, copper is edging closer to the lower end of it’s $4 – $5 range that it has been in since February of last year. Rising inventories haven’t helped copper’s cause, with some 110,000 mt of excess metal going into warehouse since the year began. But 300,000 mt of metal held in inventory, relative to a 25 million tonne market is not a significant number, however, it does tell us that currently there is a surplus. The precious metals continue ignoring any bullish sentiment, as they all seem to be trying to find a floor, or at least an area of support to hold on to.

The Takeaway

A couple of thoughts …

- Copper’s pricing since the beginning of the year reinforces that there may be no rationale for copper pricing, other than what each person wants to create as their reasoning.

- Macro-economic issues are impacting copper pricing more than every before … not just supply (from the mine) and demand (what customers need).

- Timing the market inevitably will be a fool’s game.

- Distributors need to be cautious about promoting their “growth” in inflationary times (defined as inflation as well as the vagaries of commodity pricing). Make sure you have different activity and unit-based measures for evaluating your performance and your purchasing.

- If you are a “gambler / stock trader” and think you can “take advantage of” lower copper pricing, beware. Could go lower, could go higher. Just remember that you are treating your inventory as Wall Street trader stock (and do you want your purchasing department investing your monies this way?)

- Be cautious of what you quote, the terminology on your quote (duration of the quote) and how your people advise your contractors.

- When times are “prosperous” distributors should consider utilizing free cash flow to fund investments that can generate future revenues or cost savings (designed to enhance profitability).

Longer-term, due to infrastructure development, electrification of “power” and mine capacity, the price of copper won’t implode, and experts expect it to rise, but be cautious daily.

Consider copper pricing as a stock … sometimes you double down, sometimes you take some profits and diversify your investments.