Trade and Productivity: What Data Can Tell Us

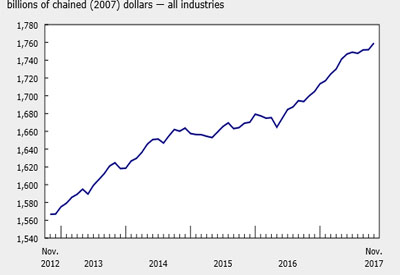

Canada’s productivity performance has mirrored changes in Canada’s trading environment that have facilitated or hindered access by Canadian manufacturers to export markets. To better understand this link, Statistics Canada has conducted a set of studies that investigated whether and how changes in the trading environment contributed to productivity growth in the manufacturing sector.

A new research paper, “Empirical Evidence from Canadian Firm-level Data on the Relationship Between Trade and Productivity Performance,”* provides an overview of the key Canadian empirical findings, focusing on studies that analyze how the manufacturing sector adapted following trade liberalizations in the 1990s and the sharp currency appreciation in the post-2000 period.

A common theme emerging from the firm-level research is that adapting to new larger markets, whether domestic or foreign, is beneficial to productivity growth. Larger markets raise productivity, by allowing firms to exploit economies of scale and/or product specialization, by encouraging firms to become more efficient in response to increases in competitive pressure and by offering firms more incentives and possibilities to invest in innovation.

The empirical evidence also suggests that learning-by-exporting takes place — learning from foreign buyers that allow exporters to benefit from the adoption of foreign technologies and to increase innovation.

The benefits from access to larger markets do not come automatically to all exporters. Plants that succeed are those that invest in advanced technologies, in research and development, and in training, all of which help to develop the capacity to learn and integrate international best practices.

Empirical results show that the reallocation of resources from less efficient to more efficient firms is another important source of the growth in productivity that has accompanied trade liberalization. Tariff reductions led the least productive firms to exit and the more productive ones to expand.

The size of trade-induced productivity gains is sometimes attenuated by movements in the exchange rate that change the competitiveness of exporters. Recent evidence highlights the challenges faced by the Canadian manufacturing sector, which made heavy investments in the 1990s to serve new U.S. markets only to face a lower presence in this market a decade later, as the Canadian dollar sharply appreciated against the U.S. dollar.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/150616/dq150616d-eng.htm?cmp=mstatcan.