Canadian Wholesale Trade, September 2020

Nov 17, 2020

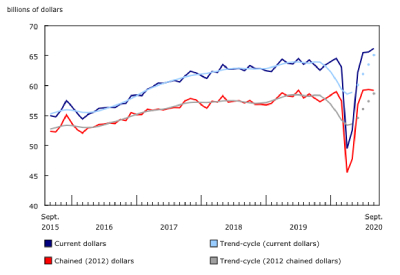

Wholesale sales grew 0.9% to $66.2 billion in September and remained higher than February’s pre-COVID-19 level for the third straight month. In September, four subsectors recorded higher sales, with the food, beverage and tobacco and the personal and household goods subsectors contributing the most.

In volume terms, wholesale sales fell 0.2%.

Food and pharmaceutical and pharmacy supplies lead the gains

Following a 2.8% decline in August, sales in the food, beverage and tobacco subsector increased 3.6% to $12.4 billion in September, almost entirely due to a 4.2% gain in the food industry. This was the highest growth for both the subsector and the industry since they each grew 7.7% in March at the beginning of the pandemic when people were stockpiling in anticipation of lockdowns and food shortages.

The personal and household goods subsector increased 3.4% to $10.0 billion in September after rising in four of the previous six months. The increase reflects a 7.2% growth in the pharmaceutical and pharmacy supplies industry. With sales at $5.3 billion, this industry accounted for 53% of the sales in this subsector.

Sales grew for a fifth consecutive month in the motor vehicle and motor vehicle parts and accessories subsector, increasing 1.1% to $11.0 billion. However, sales were about $700 million or 6.0% below pre-COVID-19 levels. Similar movements were observed in the international merchandise trade data, which showed that the imports of motor vehicles and parts were up 2.1% in September to a level that was 5.8% below the February level.

Third quarter sales

The nature of the wholesale sector and the substitutions Canadians made in their everyday spending over the first six months of 2020 have allowed the sector to remain strong despite the severe economic impact of the pandemic elsewhere. The strength in the wholesale sector does not reflect an economy-wide recovery from the pandemic. It is more likely the fact that the wholesale sector has been the beneficiary of decisions by Canadians to spend money differently than they have in the past (a substitution effect), and an increase in Canadians’ disposable income.

For example, while restaurants and bars have been closed or operating at substantially reduced capacity, sales in the food, beverage and tobacco wholesale subsector have remained strong throughout the pandemic. And while the travel, live entertainment, and sporting events have all been largely shut down by COVID-19 restrictions, wholesale sales of building materials—partly for home renovations—reached an all-time high in August. In both cases, Canadians appeared to have made spending substitutions or used available disposable income and this has had the effect of maintaining or raising sales in the wholesale sector.

In the third quarter of 2020, the wholesale sector grew rapidly, indicating that it has been able to recover well from the original shock of the pandemic. Sales in the quarter grew 20.1% to $197.4 billion—the highest level on record. Notably, sales were higher than both the first quarter of 2020—which included a rail strike in Canada and the first few weeks of the impact of the pandemic—and the fourth quarter of 2019. This increase was also reflected in the constant dollar measures of the wholesale sector, where sales have also grown beyond pre-pandemic levels. Constant dollar sales in the third quarter were 1.7% higher than in the first quarter of 2020 and 1.1% higher than in the third quarter of 2019.

Total sales for the first nine months of 2020 were $553.3 billion, which was 3.3% lower than in the same period of 2019.

Port of Montréal strike

Notwithstanding the increase in wholesale sales in August and September, about 7% of survey respondents indicated that the strike at the Port of Montréal had a negative impact on their business over those two months.

Even though the strike ended in August, the backlog at the port cost wholesalers approximately $600 million in sales over the two months. The decrease in sales and inventory was most noticeable in the personal and household goods, building material and supplies, and machinery, equipment and supplies subsectors, although respondents from all subsectors reported various degrees of the negative impact of the strike.

As the Port is an important hub for many supply chains, the disruption left containers backlogged in the Port of Montréal or rerouted to other domestic and international ports. This required many businesses to bear higher costs in port storage or resort to additional air or ocean freight costs.

The significant delay in receiving products led to the interruption of business operations, the shortage of inventory, and the delay or cancellation of orders. Moreover, it can take weeks for containers to be cleared up and delivered, so there may be some residual short-term impact.

Higher sales in seven provinces

Sales increased in seven provinces in September, accounting for more than 90% of total wholesale sales and led by Quebec and Ontario.

Sales in Quebec grew 2.8% in September to $12.8 billion, the fifth consecutive monthly increase. Higher sales were recorded in six out of the seven subsectors, led by the food, beverage and tobacco subsector (+8.2% to $3.1 billion) and the machinery, equipment and supplies subsector (+3.6% to $1.9 billion). Gains in the food, beverage and tobacco subsector were mainly attributable to the higher sales in the food product industry. In September, sales of food, beverage and tobacco were 0.8% lower than their highest level, seen in March 2020. The machinery, equipment and supplies subsector saw an increase in three out of their four industries, led by growth in the construction, forestry, mining, and industrial machinery, equipment and supplies industry. The machinery, equipment and supplies subsector was 2.9% lower than its record high in September 2019. Quebec also saw strong growth in the pharmaceuticals and pharmacy supplies industry, but the gains were partially offset by declines in the home furnishings industry, which dampened the growth in the personal and household goods subsector.

Ontario wholesale sales rose 0.9% to an all-time high of $34.3 billion in September. Higher sales were recorded in three of the seven subsectors, led by the personal and household goods subsector (+4.9% to $5.9 billion) and the food, beverage and tobacco subsector (+4.3% to $5.3 billion). Higher sales in the pharmaceuticals and pharmacy supplies industry contributed to the growth in the personal and household goods subsector and, similar to Quebec, these gains were offset by losses in the home furnishings industry. The strong growth in the personal and household goods and the food, beverage and tobacco subsectors was in turn partially offset by a decrease in sales in the machinery, equipment and supplies subsector (-2.6% to $7.1 billion).

Inventories rise

Wholesale inventories increased by 0.7% to $90.7 billion in September. It was the second straight positive month after three consecutive months of declining inventories. The gain is consistent with the 0.7% increase reported by the Monthly Survey of Manufacturing.

Inventories increased 1.9% in the machinery, equipment and supplies subsector to $26.9 billion. These gains were in large part due to higher inventories in the construction, forestry, mining, and industrial machinery, equipment and supplies industry and the other machinery, equipment and supplies industry.

Inventories in the food, beverage and tobacco subsector rose 4.2% to $9.8 billion. The increase in September was the subsector’s largest monthly growth since May 2019. Increases in the food industry led to most of the gains as this subsector was up 4.7% to $8.7 billion in September.

The inventory-to-sales ratio was unchanged at 1.37 from August to September. This has been the lowest level since August 2018. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Go HERE for more information