Building Permits, November 2024

January 14, 2025

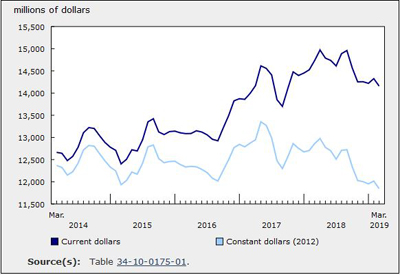

The total value of building permits issued in Canada decreased by $739.5 million (-5.9%) to $11.7 billion in November, a second consecutive monthly decline. The residential sector led the decrease, followed by the non-residential sector.

On a constant dollar basis (2017=100), the total value of building permits issued in November declined 5.8% from the previous month and was up 2.1% on a year-over-year basis.

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, November 2024

Multi-unit construction intentions push-down the residential sector

The total value of residential permits decreased by $588.1 million (-7.5%) to $7.2 billion in November. Multi-unit construction intentions (-$522.3 million) drove the decrease, while the single-family component (-$65.8 million) contributed modestly to the decline.

The decrease in the multi-unit component in November was driven by British Columbia (-$375.4 million), largely due to lower construction intentions in the Vancouver census metropolitan area (-$346.7 million).

Across Canada, 17,300 multi-family dwellings and 4,700 single-family dwellings were authorized in November, representing a 15.0% monthly decrease in the total number of units approved for construction. The 12-month total number of units authorized from December 2023 to November 2024 rose 2.4% to 273,300, compared with 267,000 units authorized over the same period one year earlier.

Chart 2

Value of building permits for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

Ontario non-residential sector decrease is mitigated by gains throughout other provinces

Non-residential construction intentions decreased by $151.4 million (-3.2%) to $4.5 billion in November, driven by Ontario (-$414.2 million). Gains in British Columbia (+$139.4 million), Quebec (+$111.9 million), Prince Edward Island (+$74.1 million) and four other provinces tempered the decline. Overall, the industrial component (-$238.6 million) fell, while the institutional (+$60.9 million) and commercial (+$26.3 million) components increased.

Ontario’s industrial (-$372.5 million) and commercial (-$159.5 million) components decreased in November, contributing to the decrease in the province’s non-residential sector, while the institutional component (+$117.8 million) tempered the decline.

In British Columbia, both the institutional (+$92.5 million) and commercial (+$67.0 million) components led the non-residential sector growth in the province.

Quebec’s non-residential sector was boosted by growth in the industrial component (+$201.5 million), driven by construction projects for a cathode active precursor materials facility in Bécancour and a large transit service centre in Québec. The commercial component (+$98.3 million) also supported Quebec’s non-residential sector.

Prince Edward Island’s institutional component (+$59.0 million) fueled the province’s non-residential increase.