Investment in Building Construction, July 2025

September 26, 2025

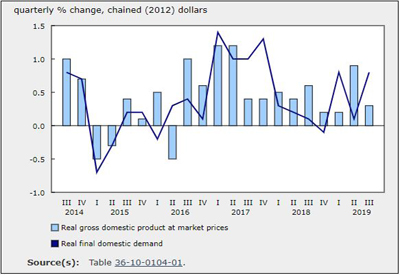

Overall, the total value of investment in building construction increased 0.4% (+$87.4 million) to $22.7 billion in July. Both the residential and non-residential sectors recorded increases of 0.4%. Year over year, investment in building construction grew 8.8% in July.

On a constant dollar basis (2023=100), the total value of investment in building construction edged up 0.1% from the previous month to $21.2 billion in July, and was up 5.0% year over year.

Chart 1

Investment in building construction, seasonally adjusted

Decline in multi-unit component moderates growth in residential sector

Investment in residential building construction increased $62.1 million to $16.0 billion in July. This rise was driven by the single-family component (+2.5%) and was tempered by the multi-unit component (-1.2%).

In July, single-family home investment increased $173.1 million to $7.1 billion. The growth was primarily attributed to Ontario (+$121.5 million), followed by Quebec (+$95.7 million). Meanwhile, decreases were recorded in four provinces and all territories, led by Nova Scotia (-$35.3 million).

Investment in multi-unit construction decreased $110.9 million to $8.9 billion in July. The decline was driven by Ontario (-$176.3 million) and was partially offset by growth in Quebec (+$64.8 million).

Infographic 1

Investment in residential building construction, July 2025

Chart 2

Investment in residential building construction, seasonally adjusted

Institutional component leads non-residential sector

In July, the value of investment in non-residential building construction increased $25.3 million to $6.8 billion. Growth in the institutional component (+1.9%) was moderated by declines in the industrial (-0.8%) and the commercial (-0.1%) components.

Investment in the institutional component increased $38.9 million to $2.1 billion in July, led by growth in Alberta (+$40.1 million) and tempered by Quebec (-$4.8 million).

Meanwhile, the industrial component decreased $11.1 million to $1.4 billion in July, with declines recorded in five provinces and three territories, led by British Columbia (-$6.1 million).

Investment in the commercial component declined $2.5 million to $3.3 billion in July. The decline was led by British Columbia (-$14.0 million), followed by Nova Scotia (-$2.8 million) and Saskatchewan (-$2.6 million), and was largely offset by Ontario (+$15.1 million).

Infographic 2

Investment in non-residential building construction, July 2025