The Answers Are There. You Just Need to Dig for Them…

Sept 30, 2021

By John Kerr

EFC’s recent conference was full of great information on so many fronts. I was lucky enough to speak at a session on benchmarking and best practices. From that session I welcomed numerous questions after the meeting, and I thought I might share some thoughts on the topic.

The reality is most distributors and their teams are setting the bar too low. They haven’t truly accessed the market around them, they haven’t done a deep dive on the competition, and few have rallied their team and partners to help them really see what’s out there.

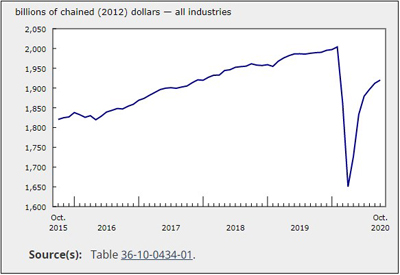

Sure, the market is booming right now, and yes all indicators are positive, but are you really capitalizing on your locations and your position?

Looking internally, all the resources are available to you in house, right now, but when was the last time you had a war room mindset to attack the opportunities and open news fronts?

The electrical market is changing, and the rules that once gave us advantages may and probably will change soon.

So, it’s time to audit the market you serve and understand the dynamics. Here are a few questions to ask yourself and your team:

1. Who is my competitor? Be careful with your answer and don’t limit it, today especially, to that other distributor nearby. Look deep into the market and at all those folks selling electrical equipment. Include all the distributors whether they are full line, lighting, wire and cable, or automation. Also look at retail, electrical motor repair and industrial.

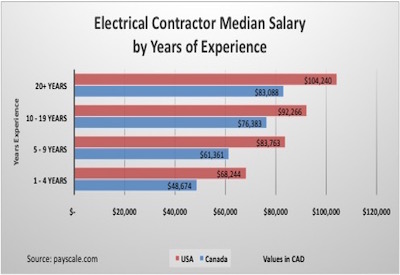

2. What does your market look like and what will be driving it for the next three years? How many OEMs are there? How many contractors? Are there any special niches you could factor in? Two examples could be custom home builders and systems integrators.

3. Who is currently buying from you? Do you know what they are buying? Segment buyers and look into what else they may need, such as safety or control products …

With this information you may be able to increase customer share and market share, but taking one more step will really accelerate your market intel. Get your salespeople to start looking differently at their customers:

• have them track customer size by the number of employees

• ensure your salespeople are truly knowledgeable about what these customers buy from you and what your sales today can tell you.

• have them segment their customers by type, and when and what they buy. If one OEM is buying a ton of control cable and another isn’t, there could be an opportunity.

Just a few insights on best practices to help you gain your fair share today.

John Kerr is Publisher of CEW; johnkerr@kerrwil.com.