Wholesale Sales Rise in April for 5th Consecutive Month

July 1, 2019

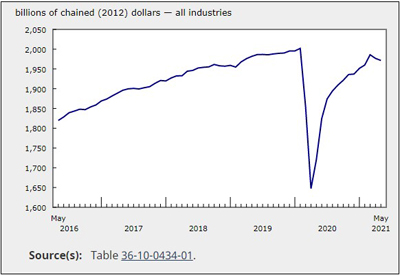

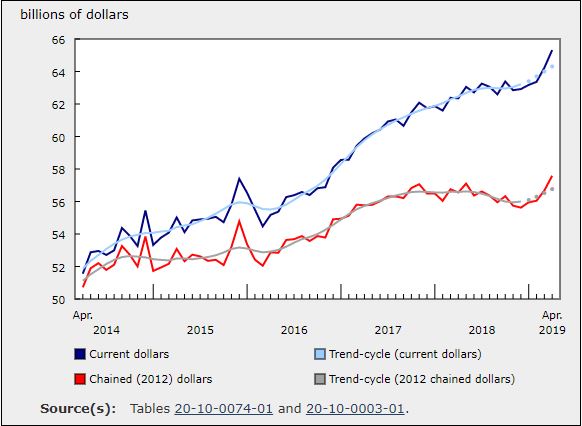

Wholesale sales increased 1.7% to $65.3 billion in April, the fifth consecutive monthly increase. Higher sales were recorded in five of seven subsectors accounting for 86% of total wholesale sales. The motor vehicle and motor vehicle parts and accessories subsector was the leading contributor to April’s gains, followed by the machinery, equipment and supplies subsector.

After removing the effects of price changes, wholesale sales increased 1.6% from March to April.

The motor vehicle and motor vehicle parts subsector leads the gains in April

Following a 1.9% decline in March, wholesale sales in the motor vehicle and motor vehicle parts and accessories subsector increased 3.2% to $11.8 billion in April—the highest level since November 2017. After trending downward in 2018, sales in the subsector have risen substantially so far this year, with sales in April being 10.9% higher than in January. Most of the increase in April was attributable to the motor vehicle industry (+3.3%), which accounted for 80% of sales in the subsector. In volume terms, sales in the subsector increased 3.5%.

The machinery, equipment and supplies subsector posted a second consecutive increase, as sales were up 2.2% to $13.9 billion. The construction, forestry, mining, and industrial machinery, equipment and supplies industry (+5.4%) contributed the most, followed by the other machinery, equipment and supplies industry (+3.9%). After increasing in March, sales in the computer and communications equipment and supplies industry declined 3.4% in April. In volume terms, sales in the subsector increased 1.9%.

Sales in the personal and household goods subsector rose 3.1% to $9.3 billion as four of six industries recorded gains, with the pharmaceuticals and pharmacy supplies industry (+4.0%) increasing the most.

Sales up in four provinces, led by Alberta

In April, sales increased in four provinces, which together represented about 90% of total wholesale sales. Alberta led the gains.

Wholesale sales in Alberta rose for the second consecutive month, up 5.9% to $7.3 billion, the highest level since May 2018. Sales were up in four of seven subsectors, led by the machinery, equipment and supplies subsector (+13.4%), a second consecutive monthly increase.

Central Canada contributed to the strength in sales in April as both Quebec and Ontario posted gains. In Quebec, sales increased 3.3% to $12.2 billion. Sales were up in five of seven subsectors, led by the personal and household goods (+5.2%) and the motor vehicles and motor vehicle parts and accessories (+6.8%) subsectors. Wholesale sales in Ontario increased 1.1% to $33.3 billion in April. Sales increases were widespread, led by the building material and supplies (+7.6%) and the personal and household goods (+3.6%) subsectors.

Sales in British Columbia increased for the third time this year, up 1.6% to $6.5 billion in April, driven by the motor vehicles and motor vehicle parts and accessories subsector.

In Manitoba, sales decreased for the third time in four months, down 5.9% to $1.6 billion. Widespread declines were led by the miscellaneous subsector.

In April, sales were down in all of the Atlantic provinces. Sales declined in New Brunswick (-3.4%) due to lower sales in the machinery, equipment and supplies subsector. Sales also decreased in Nova Scotia (-2.1%), Newfoundland and Labrador (-4.1%) and Prince Edward Island (-3.0%).

Inventories continue to rise

Wholesale inventories increased for the eighth consecutive month, up 0.4% to $90.6 billion in April. Gains were recorded in five of seven subsectors, which together represented 78% of total wholesale inventories.

Inventories in the personal and household goods subsector increased for the fifth consecutive month, up 1.1%, led by the textile, clothing and footwear industry (+7.3%).

In the building material and supplies subsector, inventories rose for the second consecutive month, up 0.9% in April.

Wholesale inventories in the miscellaneous subsector were down for the third time in 2019, decreasing 0.7% from the previous month. Three of five industries reported declines, led by the other miscellaneous industry (-4.3%).

The inventory-to-sales ratio decreased from 1.40 in March to 1.39 in April, the second consecutive decline. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190625/dq190625a-eng.htm?CMP=mstatcan