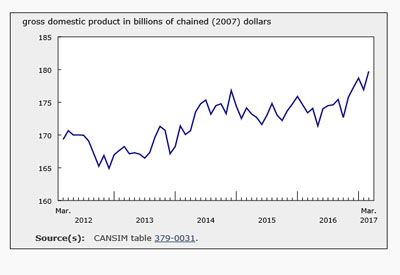

GDP Rises 0.5% in March

Real gross domestic product (GDP) increased 0.5% in March, following no change in February. Growth was widespread across goods-producing and service-producing industries.

Service-producing industries rose 0.3% in March, and have grown continuously since September 2015. Goods-producing industries grew for the fourth time in five months, increasing 0.9% in March.

Manufacturing leads the growth

The manufacturing sector was the largest contributor to the growth in GDP in March, growing 1.6% and more than offsetting a 1.0% contraction in February.

Non-durable manufacturing (+1.7%) rose for the fourth time in the last five months based on widespread growth. With the exception of paper manufacturing, all subsectors posted gains, led by chemical products (+2.4%), petroleum and coal products (+2.6%) and plastic and rubber products (+2.4%). Food manufacturing rose 0.9% as seven of nine industry groups registered growth.

Durable manufacturing rose 1.5% in March as the majority of subsectors were up. Leading the growth in durable manufacturing were machinery manufacturing (+3.9%) and computer and electronic products (+4.8%). Transportation equipment increased 0.9%, reflecting growth in motor vehicle, motor vehicle body and trailer, motor vehicle parts, and aerospace product and parts manufacturing. Miscellaneous transportation equipment manufacturing contracted 4.5%. Other subsectors posting declines were manufacturers of furniture (-2.8%) and non-metallic minerals (-2.4%).

Utilities up from higher demand for heating

Utilities rose 1.6% in March after edging down 0.1% in February. Electric power generation, transmission and distribution rose 1.4% in March, while natural gas distribution was up 4.1% as unusually low temperatures across the country increased the demand for heating.

Retail trade and wholesale trade continue to grow

Retail trade grew for the eighth time in nine months, rising 1.0% in March. Eight of 12 subsectors registered higher activity. Leading the growth were motor vehicle and parts dealers (+4.2%), primarily on the strength of more activity at new car dealers, and general merchandise stores (+2.6%).

Wholesale trade increased for the sixth month in a row, up 0.7% in March from widespread growth across subsectors. With the exception of machinery, equipment and supplies wholesalers, which contracted 1.9%, all other subsectors rose or were unchanged in March. Leading the growth was a 2.9% increase at building material and supplies wholesalers, reflecting the growth in lumber, millwork, hardware and other building supplies wholesaling as well as metal service centres.

Construction up for a fifth consecutive month

Construction increased for a fifth consecutive month, gaining 0.8% in March. Residential construction was up 1.2% in part due to increases in single, double and row housing construction, as well as in alterations and improvements. Engineering and other construction activities (+1.0%) and repair construction (+0.2%) also rose.

Non-residential construction contracted for the sixth month in a row, edging down 0.1% as institutional and governmental construction and industrial construction both declined.

Finance and insurance sector continues to grow

Finance and insurance rose 0.8% in March, growing for the sixth time in seven months. Depository credit intermediation and monetary authorities were up 1.3%. Financial investment services, funds and other financial vehicles grew 0.4% on the strength of increased market activity while insurance services and related activities remained unchanged.

Real estate and rental and leasing sector up

The output of the real estate and rental and leasing sector increased 0.3% in March. Activity by real estate agents and brokers grew 2.5% on the strength of continued higher home resale activity in Ontario and British Columbia.

Mining, quarrying, and oil and gas extraction grows

Mining, quarrying, and oil and gas extraction rose 0.3% in March following a 0.3% decline in February.

Support activities for mining and oil and gas extraction grew for the eighth month in a row, up 9.9% in March, after declining for most of 2015 and the first half of 2016. There were increases in drilling and rigging services, as well as in support activities for mining and quarrying.

Oil and gas extraction declined 0.4% in March. Growth in conventional oil and gas extraction (+2.0%) was more than offset by a decline in non-conventional oil extraction (-3.1%), as a fire and explosion at an oil upgrader facility in the Fort McMurray area disrupted production.

After decreasing 3.5% in February, mining and quarrying excluding oil and gas extraction further declined 2.1% in March. The largest contributor to the decline was a 7.2% contraction in non-metallic mineral mining, as potash mining declined for a third consecutive month due in part to lower exports. Metal ore mining edged down 0.1% in March as an increase in iron ore extraction was offset by declines in other types of metal ore mining. Coal mining grew 4.5% in March after three months of declines in part due to higher exports to Asia.

Transportation and warehousing grows

Transportation and warehousing services rose 0.3% in March, led by growth in air transportation (+1.4%) as movement of both passengers and goods increased. Pipeline transportation was up 1.1% as the transportation of natural gas (+2.0%) and crude oil (+0.3%) grew in part because of higher exports. Growth was partly offset by a 1.4% decline in postal and courier services, as postal as well as courier and messenger services declined.

Other industries

The public sector (education, health care and public administration) edged up 0.1% in March as education and healthcare rose, while public administration remained essentially unchanged.

Arts, entertainment and recreation services were up 0.6% in March. The 2.2% growth in performing arts, spectator sports and heritage institutions was partly offset by a 0.6% decline in amusement, gambling and recreation industries.

Accommodation and food services edged down 0.1% in March as growth in accommodation services was more than offset by a decline at food services and drinking places.

Agriculture, forestry, fishing and hunting was down for the fifth time in six months, declining 0.4% in March.

First quarter of 2017

The value added of goods-producing industries rose 1.7% in the first quarter of 2017, marking three consecutive quarters of growth. The value added of service-producing industries increased 0.9%. Growth in both goods-producing and service-producing industries was widespread, as all sectors recorded gains, with the exception of agriculture, forestry, fishing and hunting and management of companies and enterprises.

The main contributor to growth in goods-producing industries was a 2.6% rise in mining, quarrying, and oil and gas extraction. This increase is attributable in large part to support activities for mining and oil and gas extraction, which grew 30%, following a 23% increase in the previous quarter, reversing a downward trend that started in mid-2014.

Manufacturing was up 1.8%. Gains were shared across durable (+1.9%) and non-durable (+1.7%) manufacturing, as most subsectors showed growth.

Construction grew 1.7% in the first quarter, led by an increase in residential construction (+3.0%), the largest gain since the first quarter of 2012. Non-residential construction was down for the sixth consecutive quarter.

The largest contributor to growth in service-producing industries in the first quarter was wholesale trade, which grew 3.0%, its highest level of growth since the fourth quarter of 2010. This was partly a result of increased activity by machinery, equipment, and supplies wholesalers (+5.4%) and motor vehicle and parts wholesalers (+7.3%).

Real estate and rental and leasing rose 0.8% as activity by real estate agents and brokers was up 2.2%. Retail trade (+1.9%) grew for a third consecutive quarter, with increases in 10 of 12 subsectors. Finance and insurance (+1.4%) increased for the seventh quarter in a row. The public sector (education, health and public administration) grew 0.3%.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/170531/dq170531b-eng.htm.