Joint Business Planning: The Key to Accelerating Growth, Part 1

November 14, 2016

By David Gordon and Victoria Gustafson

With 2016 coming to a close, planning for 2017 is here. Manufacturers and distributors are finalizing their sales and marketing plans, setting sales and operational goals, and hopefully jointly discussing ways to increase sales and make both parties more profitable.

During this time, top-down and/or bottom-up forecasts will be reconciled, and new goals will be passed down. Since the economy is forecasted to grow at low single-digit rates, manufacturers and distributors are forced to find new sources of growth to deliver growth and gain market share. A targeted, effective joint business planning (JPB) process between key partners is the instrument that can deliver just that.

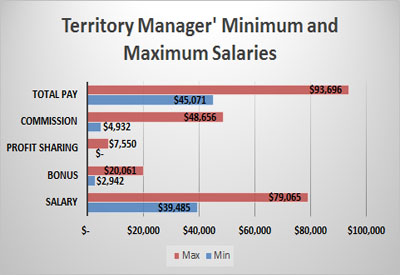

The planning cycle in most companies consists of:

1. creating the base plan

2. adjusting it for market conditions

3. using joint business planning to find incremental opportunities (see Figure 1)

Figure 1

Base plans take into account sales in the previous year, major business changes, such as mergers, acquisitions and divestitures, and corporate goals, such as compensating for increase in the cost of goods sold. For the purposes of illustration, let’s assume the base plan should, based on 2016 performance, contribute 97% of 2017 plans. These plans are then adjusted to incorporate market conditions.

Although specific indicators taken into account vary by industry, most often they are things like inflation, GDP, construction / industrial production forecasts, industry-specific metrics and changes in industry, or company distribution (gain or loss major accounts, entering new territories, etc). Under current economic conditions this adjustment will result in 3% growth. Combinations of these plans will add up to 100% of the “realistic” 2017 plan — a solid plan that ensures the company grows at the same pace with the market.

But it will not deliver incremental growth or market share increases.

To ensure real growth, companies must look to incremental opportunities that are below the surface. These usually consist of regional, account-specific, end-user driven opportunities that require careful planning and execution. Based on research in other industries, in particular consumer packaged goods (CPG), partners who participate and execute a joint business planning process on average grow at almost 4% faster than those who do not. This means that in a lukewarm market companies can double their growth rate by exercising and executing a JBP.

Due to its importance in driving growth, Channel Marketing Group, in partnership with Verde Associates, conducted extensive research that pursued a three-fold goal:

1. understand how a joint business process works today for many manufacturers and distributors

2. assess satisfaction with the current process

3. uncover improvement opportunities that can be implemented for the 2017 planning cycle

The research included a survey of manufacturers and electrical distributors, in-depth interviews with key decision-makers and a deep dive into the important topic of rebates, which is also a driver of joint business planning.

Our research showed that although most companies do go through joint business planning with their major partners, the process is not optimal for most companies and many plans are open to a major overhaul. While there are specific elements that may need to change, a key element is changing the expectation level to be more optimistic about the potential outcome.

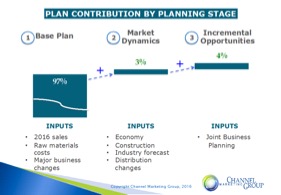

Of the six steps of the current process, three function relatively well, and three need major improvement (see Figure 2).

Figure 2

In fact, half of distributors and the majority of manufacturers are not fully satisfied with today’s JBP process. The good news is that there is wide acknowledgement that the process is needed and that it works pretty well with some partners.

The reasons for dissatisfaction are uniform between manufacturers and distributors. They have to do with the focus, quality and dedication to the process. If it’s not well thought through and executed, it becomes just another exercise to go through, but participants don’t get any value from it. So, there is a big opportunity to revamp the process to make it of value and help drive growth and improved profits.

Based on our research, major areas for improvements include:

1. Topics covered by JBP

· focus on value-add issues

· broaden customer needs discussions

· extend time horizon

2. Quality and granularity of market research used to generate insights

· regional and trading area-level insights

· end-customer research

3. Value received from the process

· meaningful and actionable outcomes

· minimize efforts/maximize results

4. JPB effectiveness

· implementation in the field

· periodic measurement and accountability

What we found is that manufacturers and distributors are looking for more relevant and meaningful topics that truly uncover joint opportunities. This is directly connected to the quality of research that goes into finding these opportunities, especially local market and end-customer research. Increasing the value of the process is of high importance, again, because of its resource intensity, but, more importantly, a lost opportunity to find growth where there is very little of it occurring naturally. And, finally, the effectiveness of the process that comes from measurement, accountability, and holding all parties responsible for results.

In a nutshell, the process does exist and is exercised but it has a ways to go to produce the results that companies want and expect from it.

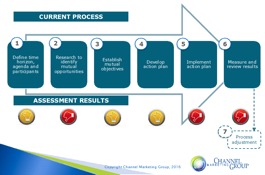

When asked about top value topics that drive the JBP process, manufacturers and distributors agreed that sales, market share and strategic alignment were the key contributors.

The third area of value centred on customers, specifically customer training, events and account-specific strategies – in essence, all customer engagement and relationship-oriented tactical elements. The focus is clearly tactical. There is an opportunity to extend the discussion to include strategic, long-term objectives, such as customer loyalty, customer acquisition and revenue retention.

Figure 3

Our research showed that rebates have a very special place in the JBP process. In particular, over 50% of distributors feel that planning improves their potential of achieving goals tied to rebates. We discovered that rebate achievement is a “hope” strategy for many rather than a carefully planned and executed plan. We also saw that, in some instances, a rebate is table stakes for manufacturers to engage distribution.

Market research is an underutilized strategic and joint business planning tool. Few use it to uncover opportunities to achieve incremental growth. Resources do exist to facilitate this, however, typically manufacturer sales personnel are not exposed, educated, or trained on the tools or information.

There is also a marketing research dichotomy. Manufacturers think they do a better job leveraging research during the planning process with distributors than distributors feel they do. While distributors were either Dissatisfied or Very Dissatisfied with the market research that manufacturers put into JPB presentations, almost half of distributors feel the research is only adequate. So the issue becomes – how do you amplify knowledge without amplifying costs? The key is to determine what information is needed to address the issue and drive the business and then seek appropriate information. Every industry / market has information available. Sometimes it helps to have a third party to help decipher and find it.

Much opportunity lies in measurement and accountability, as both are integral to a successful JBP. None of the survey participants said that any of their implementations were Extremely Effective. The overall feeling is that while in-field implementation (sales planning) does take place, it could use improvements to really deliver on agreed upon goals (see Figure 4)

Figure 4

On the positive side, it works if the plan is executed correctly and measured consistently and if follow through and periodic reviews takes place.

Our research showed that there is inconsistency in JBP development and execution within a company and nationally. JBP is highly dependent on distributor and manufacturer engagement and can be directly proportional to the level of management involved as well as pre-meeting information sharing. Respondents also pointed out that implementation needs follow-through and accountability, coupled with razor-sharp focus to achieve desired results.

The takeaway from the research is that individual companies that seek above average growth need to change their JBP planning process to capture sales and market share. The question becomes “Are companies committed to making a change or is it lip service?”

When asked about their willingness to change their joint business planning process for the 2017 planning cycle, the majority of manufacturers and half of distributors said yes. In particular, the following improvement opportunities were identified:

· more transparency

· pro-activity

· more granular information sharing

· making the process more valuable and selective, implementing a clear set of metrics with rigid periodic reviews

· require higher efficiency through better preparation and better tools, build in tracking and accountability, and focus on most valuable opportunities

To summarize, here are some recommendations to improve your joint business planning effectiveness:

· Commit to extract value from planning and to remember that it’s a revenue driver, not an obligation. Without accountability there will be no delivered value and that others will not respect what is not expected… and compensated or recognized. Hope is not a viable strategy.

· Come to meetings prepared and expect the same of your planning partner.

· Determine if the meeting objective is revenue generation or profit improvement (or what % each). Research shows that manufacturers always want to focus on sales, whereas distributors are primarily focused on profitability and secondarily on sales growth.

· Excellent ability to develop and deliver on JBP plans can be a differentiator and reputation builder for both manufacturers and distributors. People, and companies, want to work with those who are committed to helping them grow… and can do it by executing upon a plan.

· Engage at appropriate levels and drive communications downstream.

· Remember: data identify, quantify and prioritize opportunities. Discussion determines if there is a desire to pursue them.

· Consider selective and customized planning approach. Not all “partners” are created equal.

· Planning must be important to management and be management-driven, otherwise it is usually poorly executed and a waste of time.

The key to JBP? Develop the plan, implement the plan, measure achievement to identify areas ongoing improvement and you’ll get the planned results.

David Gordon is President of Channel Marketing Group, a strategic planning, marketing planning and market research firm focused on supporting manufacturers and distributors in the construction and industrial trades. He can be reached at dgordon@channelmkt.com or 919-488-8635. Victoria Gustafson is a partner at Verde Associates. Verde works with companies to accelerate growth through data-driven decision-making and process improvement. The two collaborate on clients to bring multiple perspectives and skill sets to bear on client challenges.