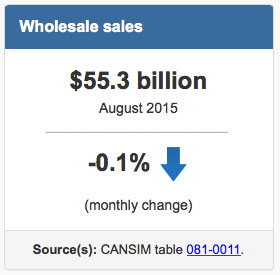

Wholesale Trade Dips Slightly in August 2015

Wholesale sales edged down 0.1% to $55.3 billion in August due to declines in four subsectors, particularly the machinery, equipment and supplies subsector. The four subsectors accounted for 72% of wholesale sales. In volume terms, wholesale sales decreased 0.5%. Higher sales in the miscellaneous subsector partially offset these declines.

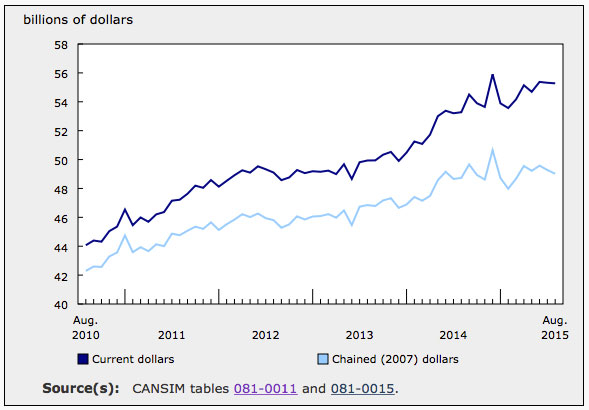

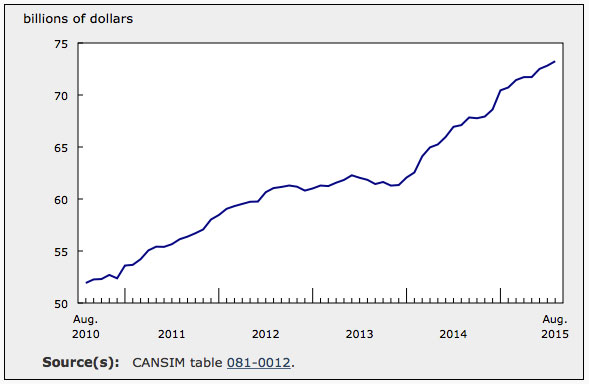

Chart 1: wholesale sales August 2010-2015

Lower sales in four subsectors

Following two consecutive gains, the machinery, equipment and supplies subsector decreased 2.4% to $11.0 billion, its lowest level since April 2014. The computer and communications equipment and supplies industry (-6.9%) led the subsector’s decline, more than offsetting the gain in this industry in July. Imports of electronic and electrical equipment and parts were also lower in August.

Following two consecutive gains, the motor vehicle and parts subsector declined 1.2% to $10.1 billion. All of the subsector’s industries contributed to the decrease, led by the motor vehicle industry (-1.3%). Despite the decline, year-to-date sales for the subsector were 7.9% higher compared with the same period in 2014.

Sales in the food, beverage and tobacco subsector declined for a second consecutive month, down 0.4% to $10.7 billion in August. In dollar terms, the food industry (-0.3%) contributed the most to the decline, although all industries in the subsector recorded lower sales.

The miscellaneous subsector rose 4.3% to $7.3 billion, its highest level in four months, led by gains in the agricultural supplies industry (+15.7%). August’s increase offset the preceding three consecutive months of declines in this industry.

Sales in the building material and supplies subsector rose 1.0% to $7.7 billion in August, more than offsetting their decline in July. The lumber, millwork, hardware and other building supplies industry (+3.8%) accounted for the gain in August with its third increase in four months.

Sales in the farm product subsector rose 6.9% to $690 million, offsetting most of the decline in July.

Sales down in six provinces

In August, sales were down in six provinces, which together accounted for 82% of wholesale sales. Ontario contributed the most to the decline.

Following two consecutive gains, sales in Ontario decreased 1.1% to $27.7 billion. Lower sales in the machinery, equipment and supplies subsector and the motor vehicle and parts subsector led the decline. These subsectors had contributed to the gains in June and July.

Sales decreased for the eighth time in nine months in Alberta, down 0.9% to $6.6 billion. The machinery, equipment and supplies subsector was the largest contributor to the decline.

In Quebec, sales were down 0.4% to $9.9 billion, a second consecutive decrease. Lower sales in the miscellaneous subsector and the food, beverage and tobacco subsector led the decline.

The machinery, equipment and supplies subsector and the food, beverage and tobacco subsector contributed to lower sales in all three Maritime provinces. Both Nova Scotia, down 2.6% to $770 million, and New Brunswick, down 2.3% to $528 million, recorded a second consecutive decrease in August. In Prince Edward Island, sales declined 7.1% to $60 million following three consecutive gains.

Sales in Saskatchewan rose for the first time in eight months, up 9.3% to $2.3 billion, their highest level in four months. The agricultural supplies industry in the miscellaneous subsector accounted for most of the gain. This industry also contributed to the increase in Manitoba, where sales rose 5.8% to $1.5 billion.

In British Columbia, sales rose 1.4% to $5.4 billion, a fourth consecutive increase, on the strength of gains in the building material and supplies subsector.

Sales in Newfoundland and Labrador were up 11.8% to $451 million, mostly offsetting their decline in July. The miscellaneous subsector led the gain.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/151020/dq151020a-eng.htm