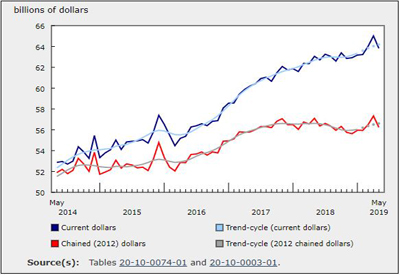

Wholesale Sales Dip 1.8% in May after 5 Months of Increases

July 25, 2019

Wholesale sales were down 1.8% in May to $63.8 billion, following five consecutive monthly increases. Lower sales were observed in six subsectors, accounting for 86% of total wholesale sales. The motor vehicle and motor vehicle parts and accessories subsector was the leading contributor to May’s retreat, followed by the miscellaneous subsector. In volume terms, wholesale sales decreased 1.9% from April to May.

Decrease in May reflects lower sales in six of seven subsectors

Sales in the motor vehicle and parts subsector declined 4.3% to $11.2 billion in May, following a 2.7% increase in April. The decline in May was the subsector’s largest monthly drop since February 2018. Sales fell in each industry, led by the motor vehicle industry (-5.2%). With the majority of sales in the motor vehicle industry comprising vehicles imported from other countries, the 5.2% decline in wholesale sales for May coincides with a 3.9% decrease in imports of passenger cars and light trucks over the same period.

Sales in the miscellaneous subsector decreased 4.2% to $8.0 billion in May, down 6.4% compared with December 2018. Declines were recorded in four of five industries, with the agricultural supplies industry (-11.1%) posting the largest monthly decrease.

The food, beverage and tobacco subsector declined 1.2% to $11.9 billion in May. All three of the industries fell, with the majority of the decrease attributable to lower sales in the food industry (-1.0%).

Wholesale sales in the machinery, equipment and supplies subsector decreased 0.9% to $13.7 billion, following two consecutive monthly increases. Two of four industries recorded declines, led by the construction, forestry, mining and industrial machinery, equipment and supplies industry (-2.7%).

Lower sales in seven provinces

Wholesale sales declined in seven provinces in May, which together represented 98% of total wholesale sales in Canada. Alberta posted the largest decrease in sales, followed by Ontario, British Columbia and Saskatchewan.

Sales in Alberta were down 8.7% to $6.8 billion in May, with six of seven subsectors reporting declines, led by the machinery, equipment and supplies (-14.8%) and the miscellaneous (-15.3%) subsectors.

In Ontario, sales decreased for the second time in 2019, down 1.0% to $32.7 billion in May. Four of seven subsectors posted declines, with the motor vehicle and motor vehicle parts and accessories (-4.1%) and the personal and household goods (-1.5%) subsectors contributing the most.

Sales in British Columbia declined for the first time in three months, down 1.7% to $6.4 billion. Lower sales were recorded in four of seven subsectors, led by the motor vehicle and motor vehicle parts and accessories (-14.0%) and the miscellaneous (-5.6%) subsectors.

In Saskatchewan, sales decreased 3.4% to $2.3 billion, with lower sales in two of seven subsectors. The miscellaneous subsector accounted for most of the decline in May, down 14.1% to $952 million and more than offsetting the 9.1% gain in April.

Inventories rise in May

Wholesale inventories increased for a ninth consecutive month, up 1.1% in May to $91.6 billion. In contrast, December 2013 marked the beginning of a 21-month streak of inventory increases.

In May, gains were recorded in six of seven subsectors, representing 83% of total wholesale inventories.

In dollar terms, the food, beverage and tobacco subsector (+3.5%) reported the largest gain, on the strength of higher inventories in the food industry. This was the third monthly increase in 2019 for both the subsector and the industry.

Inventories in the personal and household goods subsector (+1.4%) grew for the sixth consecutive month. Gains were recorded in four of six industries, led by the textile, clothing and footwear, and the personal goods industries.

The machinery, equipment and supplies subsector (+0.7%) posted its fourth consecutive monthly inventory gain, led by the other machinery, equipment and supplies industry.

The inventory-to-sales ratio increased from 1.39 in April to 1.43 in May, a level last seen in October 1995. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

Source: Statistics Canada, https://www150.statcan.gc.ca/n1/daily-quotidien/190722/dq190722b-info-eng.htm