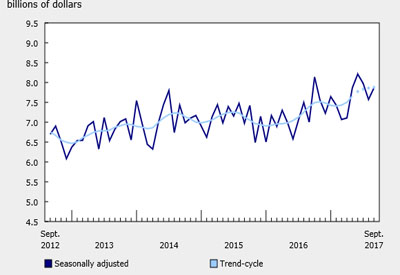

Real Gross Domestic Product Grows 0.9% in Q3 2016

December 13, 2016

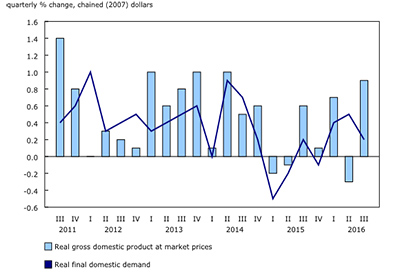

Following a 0.3% decline in the second quarter, real gross domestic product (GDP) grew 0.9% in the third quarter. Exports of energy products, rebounding from a second quarter decline, boosted growth. Growth in final domestic demand decelerated to 0.2%.

Exports increased 2.2%, making up some ground lost in the second quarter (-3.9%). Growth was driven by a 6.1% increase in the energy sector, following a 5.1% decline in the second quarter as a result of the Fort McMurray wildfires. Exports of goods grew 2.3%, while services advanced 1.4%.

Growth in household final consumption expenditure was 0.6%, a pace similar to the previous two quarters. The growth was mainly in services (+0.9%). Expenditures on goods increased 0.3% despite a 0.6% decline in outlays on durables, particularly motor vehicles. Investment in residential structures (-1.4%) fell for the first time since the first quarter of 2014.

Government final consumption expenditure declined 0.3% following a 1.3% increase in the second quarter.

Business investment on machinery and equipment fell 3.2% in the third quarter, while intellectual property products declined 4.5% on reduced investment in mineral exploration and evaluation (-26.3%). Investment in non-residential structures rose 3.7%, largely due to the import of a module destined for the Hebron offshore oil project in Newfoundland and Labrador.

Businesses added $4.8 billion to inventories, as manufacturing, wholesale and retail inventory levels all increased. Retail inventories of motor vehicles grew by $3.0 billion in the third quarter.

Expressed at an annualized rate, real GDP rose 3.5% in the third quarter. In comparison, real GDP in the United States grew 3.2%.

Exports grow following a decline in the second quarter

Exports of goods and services rose 2.2% in the third quarter, following a 3.9% decline in the second quarter.

Exports of goods were up 2.3%, following a 4.7% decline in the second quarter. Exports of energy products grew 6.1%, following a 5.1% decline brought on by the Fort McMurray wildfires and scheduled maintenance shutdowns in the second quarter. An exception was natural gas, natural gas liquids and related products, which declined 3.8%. Exports of consumer goods rose 3.6%, following a 6.4% decline in the second quarter. Metal ores and non-metallic minerals (+5.7%), industrial machinery, equipment and parts (+3.7%) and forestry products and building and packaging materials (+2.7%) also grew.

Exports of services rose 1.4% following a 0.3% decrease in the previous quarter. The increase was led by travel (+3.0%) and commercial (+1.0%) services.

Imports of goods and services rose 0.8%, twice the pace of the second quarter. Imports of goods rose 1.0% while imports of services were flat.

Household spending grows

Household final consumption expenditure grew 0.6% after increasing 0.5% in the second quarter. Conversely, durables fell 0.6%, driven by lower purchases of vehicles (-0.8%). Purchases of non-durable (+0.7%) and semi-durable goods (+0.5%) increased.

Outlays on services increased 0.9% following 0.6% growth in the previous quarter. Food, beverage and accommodation services (+1.4%) and recreational and cultural services (+2.1%) contributed to the increase. Transport services (+2.5%) were also higher.

Expenditures by Canadians abroad rose 1.7% following a 0.9% increase in the second quarter.

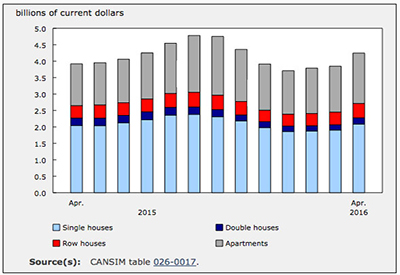

Investment in housing decreases

Business investment in residential structures contracted 1.4% following nine consecutive quarters of growth. Ownership transfer costs (-5.7%), which reflect movement in the resale housing market, contributed the most to the decline. A new tax on home purchases by non-residents in British Columbia came into effect in August, contributing to lower total ownership transfer costs. Investment in new construction (-0.2%) was also lower while renovation investment edged up 0.1%.

Decline in business investment continues

Business investment in machinery and equipment decreased 3.2% following a 1.0% gain in the second quarter.

Business investment in intellectual property products fell 4.5% after edging up 0.2% in the second quarter. Mineral exploration and evaluation (-26.3%) largely contributed to the decline, with reduced exploration activity in oil and gas. Research and development (-2.1%) and software (-0.7%) investment also declined.

Investment in non-residential structures rose 3.7%, following seven consecutive quarterly declines. Increased investment in engineering structures (+5.4%), driven by the import of a module destined for the Hebron offshore oil project in Newfoundland and Labrador, was partially offset by lower investment in non-residential buildings (-1.3%).

Overall, business gross fixed capital formation decreased 0.5% in the third quarter after edging down 0.1% in the previous quarter. This marks the eighth consecutive quarterly decline.

Inventories accumulate

Businesses accumulated $4.8 billion in inventories in the third quarter after adding $531 million in the previous quarter.

Non-farm inventories grew $3.6 billion. Manufacturing added $1.6 billion in good to inventories, with stocks of non-durable goods increasing $2.9 billion and stocks of durable goods decreasing $1.3 billion. Retail added $643 million, with lower sales of motor vehicles resulting in a $3.0 billion increase of inventories. Wholesalers accumulated $1.2 billion in inventories, with stocks of durable goods increasing by $1.5 billion. Farm inventories accumulated by $1.0 billion for a second consecutive quarter.

The economy-wide stock-to-sales ratio decreased from 0.751 in the second quarter to 0.747 in the third quarter.

Household disposable income grows

Household disposable income increased 2.2% in the third quarter (nominal terms). Compensation of employees (+0.5%) grew at the same pace as in the second quarter, while the net property income of households rose 5.1%. Federal government transfers to households increased 5.4%, aided by the introduction of the new Canada Child Benefit program, which came into effect July 1. Personal income tax paid declined 2.5%.

The household saving rate rose to 5.8% in the third quarter, as household disposable income increased at a faster pace than household spending. The debt-service ratio was 13.97%, down from 14.14% in the previous quarter.

Gross operating surplus rebounds

The gross operating surplus of non-financial corporations grew 4.0% following three consecutive quarterly declines. The increase was primarily in the oil and gas extraction and petroleum and coal product manufacturing industries, in tandem with higher energy exports. The gross operating surplus of financial corporations (+46.6%) rebounded strongly following a 30.2% drop in the second quarter. Insurance claims due to the Fort McMurray wildfires contributed to the second quarter decline.

Overall, the gross operating surplus increased 6.4% after declining 3.4% in the second quarter.

Governments increase borrowing

Government revenues edged down 0.3% in the third quarter, while outlays rose 0.8%, leading to an increase in the overall net borrowing position of the government sector. At the federal level, revenues (-1.1%) were pulled down by declining taxes on incomes (-1.6%). Federal expenditures on goods and services declined 2.3%, while current transfers to households increased 5.4%. Measured on a national accounts basis, the federal net borrowing position continued to grow.

Real gross national income advances

Real gross national income rose 0.9% after increasing 0.4% in the second quarter. Export prices rose 2.1% following three consecutive quarters of decline. Import prices rebounded 1.3% after falling 1.5% in the second quarter, and the terms of trade improved for a second consecutive quarter.

The price of final domestic demand rose 0.4%, while the GDP implicit price index (the price of goods and services produced in Canada) rose 0.6%.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/161130/dq161130a-eng.htm.