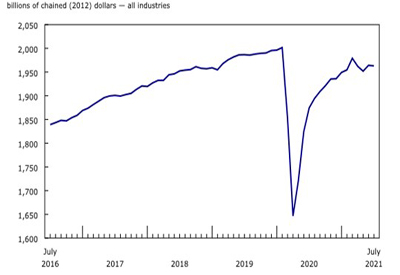

Gross domestic product by industry, July 2021

Oct 1, 2021

Chart 1

Real gross domestic product edges down in July

Real gross domestic product (GDP) edged down 0.1% in July following a 0.6% increase in June. Total economic activity in July was approximately 2% below the pre-pandemic level of February 2020.

Overall, 13 of 20 industrial sectors were up, led by a second strong monthly increase in the accommodation and food services sector. However, these increases were more than offset by declines in agriculture, utilities, manufacturing and wholesale trade.

Preliminary information indicates an approximate 0.7% increase in real GDP for August. The increases in the accommodation and food, manufacturing and retail trade sectors were partly offset by lower activity in agriculture, as drought conditions continued to impact crop production. Because of its preliminary nature, this estimate will be revised on October 29 with the release of the official GDP data for the August reference month.

Easing of public health measures helps growth in accommodation and food services

The accommodation and food services sector rose 12.5% in July, the second double-digit growth in a row. Both subsectors were up.

Food services and drinking places rose 9.5%, following a 14.4% gain in June. Summer weather, expanded patio capacity and loosened public health restrictions on indoor and outdoor dining across the country, all contributed positively to the growth.

Accommodation services rose 21.2% in July, driven by a jump in traveller accommodation, as both domestic and international travel rose in the month. As of July 5, fully vaccinated eligible travellers entering Canada were no longer required to complete a mandatory 14-day quarantine.

Growth in the arts, entertainment and recreation sector

The arts, entertainment and recreation sector was up 8.1% in July, mainly on the strength of the amusement, gambling and recreation industries. The easing of restrictions across many parts of the country facilitated reopening or increased capacity at amusement parks, indoor and outdoor recreational facilities (including gyms, yoga studios, pools, and arenas) and casinos.

Transportation rises

The transportation and warehousing sector grew 1.1% in July, following a 0.8% uptick in June, with growth in air transportation leading the way. Air transportation rose 67.7% as movements of passengers both domestically and internationally increased. There was also an uptick in the movement of goods. Nevertheless, the air transportation subsector was nearly 83% below its pre-pandemic level of activity.

Support activities for transportation rose 2.4%, while transit, ground passenger, and scenic and sightseeing transportation (+3.4%) benefitted from an increase in public transit ridership. Offsetting some of the gains were postal service, couriers and messengers (-2.3%) and rail transportation (-1.8%).

Extreme heat stymies agriculture, forestry and fishing

Agriculture, forestry, fishing and hunting dropped 5.5% in July as record-setting heat and drought conditions in Western Canada greatly affected the national annual crop production estimates.

Crop production (except cannabis) dropped 13.2% in July, reaching its lowest level since the fall of 2007, driven by ongoing drought conditions in Western Canada which have severely impacted wheat, canola and other grains production.

Forestry and logging was down in July (-3.9%), as forest fires in British Columbia’s interior and in northwestern Ontario affected production activities. Animal production rose 2.9%, while support activities for agriculture and forestry were unchanged.

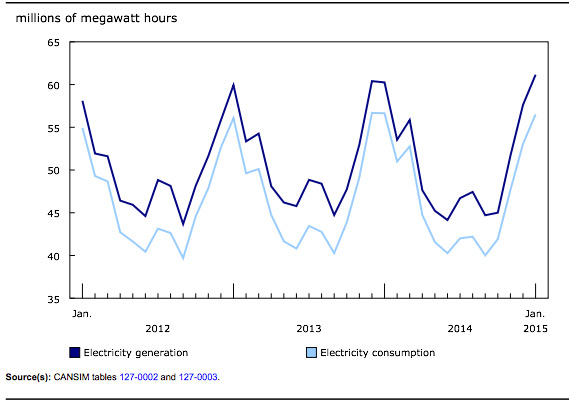

Utilities contract

After increasing 3.6% in June, utilities fell 4.9% in July, driven by a drop in electric power generation, transmission and distribution (-6.0%). Even though Western Canada continued to endure extreme heat and drought, cooler-than-usual temperatures in central and eastern regions of the country led to a decrease in national demand for electricity for cooling purposes.

Natural gas distribution edged down 0.3%, while water, sewage and other systems fell 0.9%.

Manufacturing declines

The manufacturing sector contracted 1.1% in July, largely driven by declines in durable-goods manufacturing.

Durable-goods manufacturing decreased 1.9% in July, the third decline in four months. Miscellaneous (-12.2%), fabricated metal product (-5.2%) and non-metallic mineral product (-4.6%) manufacturing were the main factors in this drop.

Non-durable goods manufacturing edged down 0.1%, and its subsectors were evenly split between increases and decreases. Gains in food (+1.6%) and plastics and rubber products (+3.3%) manufacturing were more than offset by declines in chemical (-2.8%), printing and related support activities (-6.5%) and petroleum and coal product (-1.0%) manufacturing.

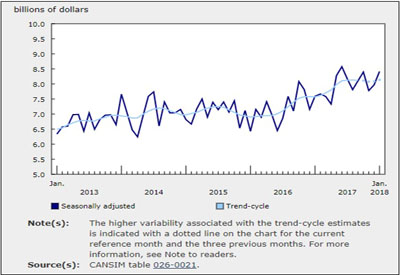

Construction continues to fall

Construction contracted 0.9% in July, a third consecutive decline, largely as a result of lower residential building construction.

Residential building construction fell 2.7% in July, a third straight monthly decline, after reaching a record high in April. Almost all types of residential buildings construction activity were down, led by single-family homes and home alterations and improvements.

Repair construction decreased 1.6% while engineering and other construction activities rose 1.1%.

Non-residential building construction was up 0.5%, as an increase in institutional building construction more than offset drops in commercial and industrial building construction.

Wholesale continues to decline

Wholesale trade fell 1.9% in July, down for the fourth month in a row. Seven of the nine subsectors were contracted, and building material and supplies wholesaling (-9.0%) was responsible for most of the decline.

Offsetting some of the drop were machinery, equipment and supplies (+0.3%) and petroleum and petroleum products wholesaling (+0.9%).

Public sector continues to grow

The public sector (educational services, health care and social assistance, and public administration) advanced 0.4% in July.

Health care and social assistance increased 0.6% as all its subsectors were posting gains, but the increase was led by ambulatory health care services (+1.0%) and hospitals (+0.2%).

The educational services sector advanced 0.5% as all its industries were up, but the increase was led by elementary and secondary schools (+0.4%) and universities (+0.4%).

Public administration edged up 0.2%, with gains observed in the majority of subsectors were up. Local, municipal and regional public administration (+0.8%) and provincial and territorial public administration (+0.3%) rose, as a number of provinces entered new phases of reopening in July. Federal government public administration contracted 0.3%.

Other industries

Retail trade decreased 1.1% in July, with 7 of 12 subsectors posting declines. Food and beverage stores (-3.3%) and building material and garden equipment and supplies dealers (-6.5%) were the biggest factors in the decline, while clothing and clothing accessories stores (+6.2%) and general merchandise stores (+0.8%) offset some of the decreases.

Other services (except public administration) rose 2.5% in July, as the majority of subsectors were posting increases, led by personal and laundry services (+8.8%) and religious, grant-making, civic, and professional and similar organizations (+1.6%).

Professional, scientific and technical services grew 0.5% in July. All industries were up, except legal services (-0.1%), which edged down in July, posting its fourth straight monthly decrease. Similarly, output at the offices of real estate agents and brokers was down for the fourth month in a row, as home resale activity across the country continued to cool following a peak in the first quarter of 2021.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/211001/dq211001a-eng.htm?CMP=mstatcan