Gross Domestic Product by Industry, March 2025

June 2, 2025

Real gross domestic product (GDP) edged up 0.1% in March after contracting 0.2% in February.

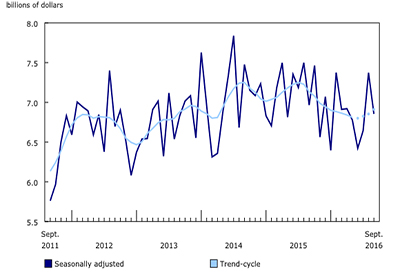

Chart 1

Real gross domestic product edges up 0.1% in March after a 0.2% decline in February

The goods-producing industries aggregate (+0.2%) led the growth for the second time in three months, driven by a rebound in the mining, quarrying, and oil and gas extraction and construction sectors in March. The services-producing industries aggregate edged up 0.1% in the month on increases in retail trade, transportation and warehousing and accommodation and food services and drinking places. Overall, 9 of 20 sectors expanded in March.

Mining, quarrying, and oil and gas extraction sector rebounds

The mining, quarrying, and oil and gas extraction sector was the largest contributor to growth, expanding 2.2%, as all three subsectors registered increases in March.

Chart 2

Mining, quarrying, and oil and gas extraction up 2.2% in March

The oil and gas extraction subsector (+2.0%) led the growth, fuelled by higher activity in both oil and gas extraction (except oil sands) and oil sands extraction industries. Oil and gas extraction (except oil sands) grew 2.7% in March as crude petroleum extraction off the coast of Newfoundland and Labrador resumed activity following disruptions caused by a collision between an oil tanker and an offloading platform in February. The oil sands extraction industry expanded 1.4% in March, reflecting higher synthetic crude production and crude bitumen extraction in Alberta.

The mining and quarrying (except oil and gas) subsector grew 2.3% in March, after posting a decline in February. Coal mining (+16.8%) contributed the most to the increase, recording its largest monthly growth rate since January 2023, coinciding with increased exports. Metal ore mining rose 1.7%, as activity increased in most industries within the group. Other metal ore mining (+13.3%), copper, nickel, lead and zinc ore mining (+2.4%), and iron ore mining (+1.9%) all registered their first increase in three months. A decline in gold and silver ore mining (-3.1%) tempered the growth in the metal ore mining industry group, coinciding with a decline in exports of unwrought gold, silver and platinum metals in March.

The support activities for the mining and oil and gas extraction subsector rose 3.6% in March, posting its third consecutive monthly increase. Higher activity in support activities for oil and gas extraction led the growth, driven by increases in drilling and rigging services.

Construction activity up in March

The construction sector grew 0.5% in March, largely offsetting the decline recorded in February, as most types of construction activities expanded.

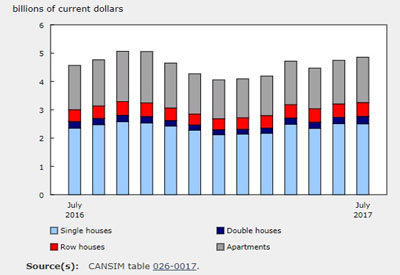

Chart 3

Construction activity rose for the third time in five months in March

Residential building construction (+1.3%) contributed the most to the increase in March, marking its highest level since November 2023. Greater activity in the construction of new single and multi-unit homes contributed to the increase in March, while a decline in home alterations and improvement dampened the growth.

Non-residential building construction (+1.5% in March), which has been following an upward trend since August 2024, in large part driven by higher activity in public and industrial building construction, expanded for the eighth consecutive month. Repair construction (+0.5%) also expanded in March 2025, partially offsetting the decline recorded in February.

Utilities down for the first time in four months

Utilities fell 4.1% in March, largely offsetting the increase posted in the previous three months, as most industries within the sector contracted.

Electric power generation, transmission and distribution was down 4.3% in March, contributing the most to the decline in the sector after showing increases in the previous three months. Demand for electricity for heating-related purposes eased in March as milder weather set in across many parts of the country.

Manufacturing contracts for the first time in three months

The manufacturing sector was down 0.4% in March, following two months of growth, as both the durable goods and non-durable goods manufacturing aggregates declined.

Chemical manufacturing decreased 6.1% in March, largely offsetting February’s growth, as lower activity at nearly all chemical industries contributed to the decline.

The machinery manufacturing subsector (-3.8%) was also among the largest detractors to growth in March, fully offsetting the increase recorded in the previous month.

The transportation equipment manufacturing subsector (+3.1%) tempered the decline in the overall sector, posting its third consecutive increase in March. Motor vehicles and parts manufacturing (+2.4%), which followed a downward trend that began in the fall of 2023 and continued during most of 2024 due in part to retooling activities in auto manufacturing plants, posted its third monthly increase in a row and was among the largest contributors to growth in the subsector in March.

Retail trade rebounds

Retail trade expanded 0.8% in March, partially offsetting the declines recorded in January and February, as 8 of 12 subsectors expanded.

Motor vehicle and parts dealers (+4.0%), which was among the sector’s largest detractors to growth in the previous two months, contributed the most to the March increase, posting its highest growth rate since January 2023, as retail activity increased across all store types, led by new car dealers.

Transportation and warehousing resumes growth after February’s adverse weather

Transportation and warehousing rose 0.8% in March following February’s adverse weather-driven declines, due to major snowstorms that hit Central and Eastern Canada and storms passing through British Columbia.

Urban transit systems was the largest driver of growth in March, expanding 4.3% as urban transit ridership rose following adverse weather conditions in February that impacted road conditions in some of Canada’s largest urban centres.

Rail transportation rebounded 5.4% in March, almost fully recouping the 5.8% decline observed in February, as carloading of most types of commodities recovered in March from the winter storm disruptions in the previous month.

Accommodation and food services up in March, more than offsetting February’s decline

The accommodation and food services sector rose 1.4% in March, as both the food services and drinking places and the accommodation services subsectors rebounded from the declines recorded in the previous month.

Food services and drinking places (+1.3%) was the largest contributor to growth in the sector in March, largely offsetting the decline recorded in February. Meanwhile, accommodation services (+1.7%) also contributed to the growth in the sector as activity in recreational vehicle parks, recreational camps, and rooming and boarding houses, and traveller accommodation services expanded.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in March

Advance estimate for real gross domestic product by industry for April 2025

Advance information indicates that real GDP increased 0.1% in April. Increases in mining, quarrying, and oil and gas extraction and finance and insurance were partially offset by decreases in manufacturing. Owing to its preliminary nature, this estimate will be updated on June 27, 2025, with the release of the official real GDP by industry data for April.

Real gross domestic product by industry continues expanding in the first quarter

Real GDP by industry rose 0.4% in the first quarter, following a 0.4% increase in the previous quarter. Goods-producing industries (+0.8%) led the increase for the first time since the first quarter of 2022. Services-producing industries increased for the 19th consecutive quarter with a 0.2% expansion in the first quarter.

Mining, quarrying, and oil and gas extraction (+1.4%) was among the main drivers of growth in the first quarter of 2025, led by an increase in oil and gas extraction (+2.0%) for the second consecutive quarter. Oil sands extraction increased 2.3%, driven by higher crude bitumen extraction in Alberta. Support activities for mining and oil and gas extraction (+1.5%) was another large contributor to growth in the first quarter of 2025, driven in large part by higher drilling activity.

Wholesale trade (+1.5%), which was among the main drivers of growth in the fourth quarter of 2024, was also among the top contributors to growth in the first quarter of 2025, as most subsectors increased. Machinery, equipment and supplies wholesalers (+2.8%) was the largest driver of growth for the second consecutive quarter. Motor vehicle and motor vehicle parts and accessories wholesalers (+3.4%) also posted a second consecutive quarterly increase, further contributing to growth in the first quarter of 2025.

The utilities sector rose 3.4% in the first quarter, which more than offset the decrease in the previous quarter (-0.9%). Electric power generation, transmission and distribution (+3.5%) accounted for most of the increase in the first quarter, driven by hydroelectric power generation as drought conditions in parts of the country continued to ease and cooler than typical temperatures contributed to higher demand for heating-related purposes.

Natural gas distribution further contributed to the increase with a 5.8% rise in the first quarter, spurred on by higher deliveries to industrial, commercial and residential customers.

Finance and insurance expanded 0.7% in the first quarter, as all subsectors were up. This was the sixth consecutive quarterly increase for the sector. Depository credit intermediation drove the increase, in large part due to increases in loans and chequable and non-chequable deposit activity at chartered banks, as the Bank of Canada lowered the policy rate twice in the quarter.

The manufacturing sector was up for the first time since the first quarter of 2023, rising 0.4% in the first quarter of 2025. Transportation equipment manufacturing (+4.6%) was the largest contributor to growth in the first quarter, after following a downward trend since the final quarter of 2023. Other transportation equipment manufacturing contributed the most to the increase in the subsector in the first quarter of 2025.

The real estate and rental and leasing sector (-0.4%) was the largest detractor to growth in the first quarter of 2025, following nine consecutive quarterly increases. Offices of real estate agents and brokers and activities related to real estate (-13.9%) contributed the most to the decline in the first quarter, posting its largest decrease since the second quarter of 2022 as home resale activity in many markets across the country cooled down. The legal services industry (-2.3%), which derives much of its activity from real estate transactions, posted its first quarterly decline since the third quarter of 2023.

Chart 5

Main industrial sectors’ contribution to the percent change in gross domestic product in the first quarter