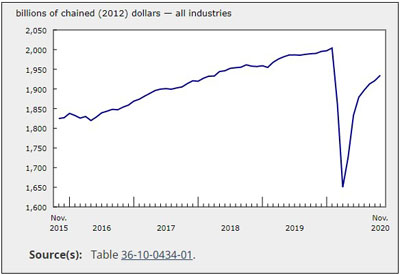

GDP Grew for 7th Consecutive Month in November

Jan 29, 2021

Real gross domestic product (GDP) grew 0.7% in November, following a 0.4% increase in October. This seventh consecutive monthly gain continued to offset the drops in March and April in Canadian economic activity, which were the steepest on record. However, total economic activity was about 3% below the pre-pandemic level in February.

Both goods-producing (+1.2%) and services-producing (+0.5%) industries were up, as 14 of 20 industrial sectors posted gains in November.

Preliminary information indicates an approximate 0.3% increase in real GDP for December. The public sector, real estate and rental and leasing and the mining, quarrying, and oil and gas extraction sector all contributed to growth, while retail, accommodation and food services, and wholesale declined. This flash estimate points to an approximate 1.9% increase in real GDP in the fourth quarter of 2020 and to an approximate decline of 5.1% for the year. Owing to their preliminary nature, these estimates will be revised on March 2, 2021, with the release of the official GDP data for December and the fourth quarter.

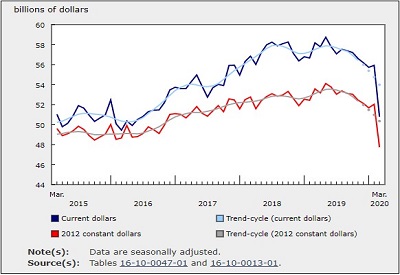

Mining, quarrying, and oil and gas extraction sector grows

The mining, quarrying, and oil and gas extraction sector grew 3.9% in November on the strength of all of its three subsectors.

Mining and quarrying (except oil and gas) rose 6.1% as all types of mining and quarrying activities expanded in November, spurred by higher international demand. Non-metallic mineral mining and quarrying jumped 13.9% as both potash mining (+26.7%) and other non-metallic mineral mining (except potash) (+9.5%) rose in November. Metal ore mining grew 3.3% as increases in copper, nickel, lead and zinc (+6.0%), iron ore (+3.4%) and gold and silver ore mining (+1.4%) all contributed to the growth, fuelled by higher international demand for these commodities. Coal mining increased 3.8% in November, nearly reaching the activity level recorded in March.

Oil and gas extraction expanded 1.7% in November, up for the third consecutive month. Oil sands extraction rose 5.3%, driven by higher synthetic oil production in Alberta as a number of facilities restarted production. Oil and gas extraction (except oil sands) contracted 2.1% as a result of declines in both oil extraction and natural gas extraction. Support activities for mining, and oil and gas extraction grew 14.0% in November as all types of support activities were up in the month. This was the subsector’s fifth consecutive monthly increase, following four consecutive declines in the first half of the year. Despite the gains, the subsector’s output was about 41% below the pre-pandemic level in February.

Manufacturing sector grows

Following a 0.5% contraction in October, the manufacturing sector grew 1.7% in November, largely as a result of higher inventory formation. Both durable and non-durable manufacturing were up. This was the sixth increase in seven months, bringing the sector’s output to within 3% of its pre-pandemic level of activity.

Durable manufacturing rose 2.0%, led by fabricated metal products (+7.1%), machinery manufacturing (+3.8%) and non-metallic mineral product manufacturing (+5.6%). Transportation equipment, down for the second consecutive month, decreased 1.3% as the majority of industries were down.

Non-durable manufacturing was up 1.3% in November as all subsectors, with the exception of chemical manufacturing (-0.8%), were up. Contributing most to growth were plastics and rubber products (+4.1%), petroleum and coal product (+3.0%), paper (+3.0) and beverage and tobacco (+2.7%) manufacturing.

Finance and insurance sector continues to grow

Finance and insurance increased 1.3% in November on widespread growth across all subsectors. As market sentiments improved, following multiple global COVID-19 vaccine announcements, activity in equity and mutual funds markets drove increased activity on the Toronto Stock Exchange in November.

Foreign investment in Canadian securities, through acquisition of Canadian shares in secondary markets and purchases of federal government securities, rose to their highest levels in months. At the same time, households’ mortgage debt grew, expanding 7.4% year over year in November. All of these developments contributed to a 3.5% gain in financial investment services, funds and other financial vehicles and a 1.1% expansion in depository credit intermediation and monetary authorities. Insurance carriers and related activities were up for the seventh consecutive month, increasing 0.6% in November.

Retail continues to grow

The retail trade sector grew 1.1% in November as 8 of 12 subsectors were up. Food and beverage (+6.1%) led the growth as higher activity at supermarkets and other grocery stores, along with beer, wine and liquor stores, contributed to the increase. Building material and garden equipment and supplies (+3.4%) grew for the fourth consecutive month, and non-store retailers rose 3.1% following two months of decline. Clothing and clothing accessories stores (-5.4%), and health and personal care stores (-1.8%) offset some of the growth, as did motor vehicle and parts dealers, which contracted 0.6% following six months of growth.

Wholesale resumes growth

The wholesale trade sector was up 1.0% in November as seven of nine subsectors contributed to the growth. This was the sector’s sixth expansion in seven months, and it fully offset the declines recorded in March and April. Machinery, equipment and supplies wholesaling (+2.8%) led the growth as the majority of industries were up, following high levels of exports and imports of machinery in previous months. Motor vehicle and motor vehicle parts and accessories wholesaling was down 1.8% as lower production and international trade of passenger cars and light trucks contributed to the decline.

Public sector grows

The public sector (educational services, health care and social assistance, and public administration) grew 0.3% in November, as two out of three components were up. Health care services rose 0.7% as a continued increase in ambulatory health care services (+1.8%) more than offset a 0.1% decrease in hospitals. Education was up 0.3%, led by a 0.8% gain in elementary and secondary schools. Public administration edged down 0.2% in November, following six months of growth.

Transportation and warehousing sector grows

The transportation and warehousing sector rose 1.4% in November, the third consecutive monthly increase, as all but one subsector grew. Air transportation (+41.8%) contributed most to the gain as passenger traffic and trips abroad by Canadian residents were up in November. Nevertheless, air transportation was about 84% below the January 2020 level. Rail transportation (+1.6%), and transit, ground passenger and scenic and sightseeing transportation (+2.1%) were up; pipeline transportation grew 1.0% as higher crude oil movement offset lower natural gas movement by pipelines. The warehousing and storage subsector was essentially unchanged in November.

Other industries

Professional services rose 0.6% in November as all types of services were up, led by increases in computer systems design and related services (+0.6%) and other professional services including research and development (+0.5%).

Following a 1.9% decline in October, activity at the offices of real estate agents and brokers was down 2.6% in November. Housing resale activity decreased in the majority of Canadian urban centres, with Greater Toronto, Greater Vancouver, Montréal, Ottawa, Edmonton and Calgary contributing the most to the decline.

Utilities declined 1.2% in November, as milder weather across many parts of the country reduced demand for electricity for heating purposes.

Construction edged up 0.1% in November. Engineering and other construction activities increased 0.6% and repair activities edged up 0.1%. Partly offsetting these gains was a 0.9% decline in non-residential construction, while residential construction was unchanged in November.

Accommodation and food services edged up 0.1%, as a 6.0% increase in accommodation services largely offset a 2.1% contraction in food services and drinking places.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210129/dq210129a-eng.htm?CMP=mstatcan