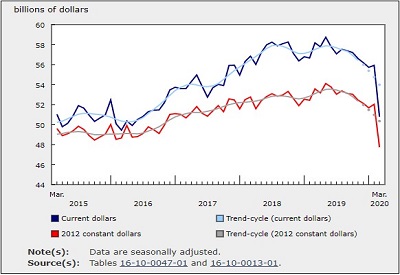

Manufacturing Sales Slipped 9.2% in March

May 18, 2020

Manufacturing sales fell 9.2% to $50.8 billion in March, the lowest level since June 2016 and the largest percentage decline since December 2008, during the previous recession.

Manufacturing sales in March were substantially affected by COVID-19 as many plants were shut down or faced sharply lower demand during the last two weeks of the month. Given ongoing lower demand, together with continued challenges to global supply chains and ongoing physical distancing measures, the March decline in sales is expected to continue into April.

Sales were down in 17 of 21 industries, led by steep declines in the transportation equipment and petroleum and coal product industries. In contrast, sales were up in food, paper, as well as the beverage and tobacco industries.

In volumes terms, manufacturing sales fell 8.3%, indicating that a lower volume of products was sold in March.

COVID-19 has major impact on the manufacturing sector

Over three-quarters (78.3%) of establishments in the manufacturing sector reported that their activities were impacted by COVID-19. Furniture and related product (91.2%), miscellaneous (88.9%) and transportation equipment (88.3%) industries reported supply issues, with some shutting down several plants in response to lower global demand or in response to physical distancing requirements.

Over four-fifths (86.8%) of firms in the printing and related support activities industry reported that COVID-19 had affected their activities, as they lost clients in the wake of the closure of restaurants, schools and sporting events.

Paper (62.8%) and food (61.8%) manufacturers reported that COVID-19 had affected their activities. For both industries, higher consumer demand boosted overall sales in these industries during the month of March.

Based on respondent feedback, the largest estimated impacts of COVID-19 on manufacturing sales in dollar terms were in the transportation equipment (-$2.9 billion), fabricated metal product (-$376 million), petroleum and coal product (-$331 million), machinery (-$295 million), plastic and rubber product (-$277 million) and primary metal (-$219 million) industries. It should be noted that these estimated impacts are on an unadjusted basis and should be interpreted with caution. However, they provide an estimate of the magnitude to which COVID-19 may have lowered sales.

Shutdowns at assembly plants and motor vehicle parts suppliers

Sales in the transportation equipment industry fell by over one-quarter (-26.5%) to $7.6 billion in March. All transportation equipment industries reported lower sales. The largest declines were in the motor vehicle (-33.8%) and motor vehicle parts (-31.6%) industries. During the last two weeks of March, all Canadian assembly plants and several motor vehicle parts suppliers in North America lowered production in the wake of COVID-19.

Refineries ramp down production

Sales declined for the third consecutive month in the petroleum and coal product industry, down by one-third (-32.2%) to $3.9 billion in March. The drop in sales reflected lower prices and quantities, as refineries curtailed production in response to the world oil supply glut and falling demand as drivers stayed home in response to lockdown orders. Furthermore, many refineries have announced in the media that they will postpone their spring turnaround works as a result of the pandemic to avoid bringing in extra workers and contractors.

Sales also decreased in the plastic and rubber (-10.9%), primary metal (-7.4%), fabricated metal product (-4.9%), furniture and related product (-16.6%), non-metallic mineral product (-11.7%), printing and related support activities (-16.2%) and machinery (-3.9%) industries. Most of the decline registered in these industries was attributable to plant closures or reduced production during the last two weeks of March in the wake of COVID-19, as well as due to lower demand.

On the other hand, higher sales of plastic packaging for essential products—such as flexible food packaging, garbage bags and plastic containers—partly offset the decline in the plastic and rubber industry. Increased sales of COVID-19 signage for essential services partly offset the decrease in printing and related support activities.

Sales were up in the food (+8.2%), paper (+8.4%) and beverage and tobacco (+6.7%) industries. The gains in these industries largely stemmed from increased demand for meat and dairy products along with higher sales of beer, wine and soft drinks. The gain in the paper industry largely reflected panic buying of toilet paper and hygiene products across the country.

Ontario and Quebec lead the declines

Manufacturing sales were down in eight provinces in March, led by Ontario and Quebec. In contrast, Manitoba and Nova Scotia reported higher sales.

Manufacturing sales in Ontario fell 14.3% to $22.3 billion, the lowest level since January 2014. Sales declined in 15 of 21 industries, led by the motor vehicle (-35.8%), motor vehicle parts (-32.7%) and petroleum and coal product (-30.6%) industries. Gains in the food, chemical, beverage and tobacco, paper and miscellaneous industries were mostly attributable to higher consumer demand for their products during COVID-19.

Sales in Quebec declined for a second consecutive month, falling 4.1% to $13.1 billion. Sales were down in 17 of 21 industries, led by the petroleum and coal product, fabricated metal product, transportation equipment, and furniture and related product industries. The decreases were partly offset by higher sales in food and paper industries.

The largest monthly increase in dollar terms was in Manitoba (+8.2%), mainly due to higher sales of non-durable goods—particularly food. Sales in Nova Scotia rose 2.9% mostly on higher sales of the transportation equipment and paper industries.

Inventory levels edge up

Inventory levels edged up 0.1% to $87.5 billion in March. Inventories rose in 13 of 21 industries, led by the transportation equipment industry (+5.3%). This was mostly offset by lower inventories in the petroleum and coal product industry (-20.7%), as prices for crude oil and refined products fell sharply in March.

The inventory-to-sales ratio increased from 1.56 in February to 1.72 in March, mostly due to lower sales. This was the largest monthly increase in the inventory-to-sales ratio since December 2008. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

Unfilled orders decline

Unfilled orders decreased 0.4% to $96.8 billion in March. The decline was mainly attributable to lower unfilled orders in the transportation equipment (-0.9%) and machinery (-3.5%) industries.

These declines were partially offset by higher unfilled orders in the fabricated metal product (+3.2%) and chemical (+18.6%) industries.

New orders fell 11.3% to $50.4 billion in March, mostly reflecting lower new orders in the transportation equipment (-38.5%) and the petroleum and coal product (-32.1%) industries.

Capacity utilization rate falls

The unadjusted capacity utilization rate for the manufacturing sector declined 3.6 percentage points to 72.8% in March. This was 8.8 percentage points lower compared with March 2019.

The capacity utilization rate for the transportation equipment industry fell 17.7 percentage points to 65.1% in March. The decrease was mostly attributable to lower production at motor vehicle assembly and motor vehicle parts plants associated with the two-week shutdown at the end of March.

The capacity utilization rate of the petroleum and coal product industry declined for the third consecutive month, falling 11.8 percentage points to 65.1% in March. The decrease was attributable to lower production across the country due to lower demand and shutdowns at some refineries.

First quarter results

Manufacturing sales fell 4.4% to $162.4 billion in the first quarter, the third consecutive quarterly decline. In volume terms, manufacturing sales decreased 3.9% in the first quarter, mostly due to lower volumes sold in the transportation equipment (-15.7%) and petroleum and coal products (-9.5%) industries.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200514/dq200514a-eng.htm?HPA=1