The Dumping of Aluminum Wire and Cable into North America: Industry Impacts and a Call to Protect Domestic North American Manufacturing

September 8, 2025

By John Kerr

The North American aluminum wire and cable market is facing a critical threat from the dumping of below-cost imports, primarily from China and Vietnam and other offshore suppliers.

This unfair trade practice jeopardizes committed domestic North American manufacturers such as Southwire, Nexans, Northern Cables, Electro Cables, Deca, Shawflex and Prysmian. All key brands committed to serving the Canadian market. But beyond manufacturing, the entire electrical ecosystem from distributors to contractors and specifying engineers will be exposed to risks arising from possible erosion of industry standards and inferior product quality. Furthermore, retail channels like Costco selling low-cost offshore wire add complexity to an already pressured market. And, in Canada specifically the government is now challenged to respond firmly by matching U.S. import tariffs to defend local industry and uphold safety and quality.

Aluminum wire and cable is not a commodity. It involves specialized design, manufacturing, and certification processes that vary by application and performance requirements. Unlike commodity products that are largely interchangeable, aluminum wire and cable must meet strict North American standards such as CSA (Canadian Standards Association) and UL (Underwriters Laboratories) to ensure safety, reliability, and durability for residential, commercial, and industrial uses.

North American manufacturers produce aluminum cable tailored to specific environments and electrical demands, using precise conductor compositions and advanced insulation and jacketing materials. These products are engineered to withstand varying conditions like corrosion, temperature extremes, mechanical stresses, and electrical load requirements, which demands technical expertise and quality control far beyond simple commodity production. And they all play to the same set of rules and value proposition.

Furthermore, aluminum wire and cable products often come with certifications that guarantee compliance with stringent electrical codes and safety standards. This certification process involves rigorous testing to verify performance and safety, making these products a critical piece of engineered electrical systems rather than undifferentiated bulk goods. And this accreditation is so critical it has resulted in some offshore manufacturers claiming they also comply when in fact they do not.

We must not in this discussion ever ignore the complexity and quality differentiation that distinguish aluminum wire and cable as specialized industrial product necessitating skilled manufacturing and supply chain controls, underscoring their non-commodity status in the market

Aluminum wire and cable imports have been dumped into North America at prices below fair market value, with evidence of government subsidies exacerbating this distortion. The U.S. International Trade Commission (ITC) affirmed in a 2025 sunset review that removing antidumping and countervailing duty orders on aluminum wire and cable from China would cause continued injury to the U.S. aluminum cable industry. This decision, along with associated documentation, can be found in the USITC’s public report on Aluminum Wire and Cable from China (Inv. Nos. 701-TA-611 and 731-TA-1428 (Review), USITC Publication 5635, June 2025)

These duties as detailed by the ITC June 2025 Publication number 5635, currently range from approximately 81% to over 200% on specific Chinese imports and have been essential to protecting domestic producers. We ask why under the CUSMA are we in Canada, not doing this as well when it comes to Aluminum wire and cable.

The ITC’s unanimous vote and the Department of Commerce’s determinations better allow all North American firms to compete on a level playing field with Chinese producers of wire and cable.

Canadian manufacturers face similar challenges and so many of us in the industry also forget this important point with respect to the environmental and trade inequities. In Canada, aluminum wire and cable manufacturers predominantly use hydroelectric power, resulting in a significantly lower carbon footprint compared to Chinese imports that are mostly produced using coal-generated electricity. When factoring in the additional emissions from ocean freight fuel, the carbon footprint of imported aluminum wire and cable is at least four to five times higher than that of domestically produced products.

Despite this substantial environmental advantage, Canadian manufacturers still bear the burden of carbon taxes while competing against dumped goods that face no such duties or carbon-related costs. Given these circumstances, it seems obvious that Canada should take a firm stand by removing the carbon tax on domestic aluminum producers and implementing appropriate duties on dumped imports. This approach would not only level the playing field economically but also reinforce Canada’s commitment to environmentally sustainable manufacturing.

If we allow sustained dumping of aluminum wire and cable into North America, we should access the serious long-term effects on North American domestic production capacity.

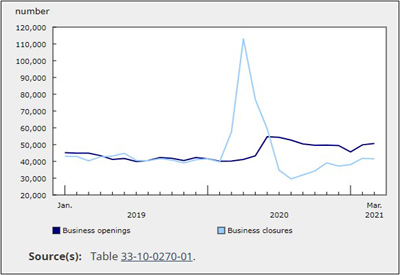

The sustained dumping of aluminum wire and cable at unfairly low prices has steadily undermined the profitability of North American manufacturers, placing enormous strain on their ability to modernize plants and sustain operations. As these companies grapple with continuous price undercutting, the risk of plant closures increases, alongside reductions in production capacity and the loss of skilled technical expertise. This erosion ultimately shrinks North America’s domestic manufacturing base, threatening the long-term viability of the sector.

With profit margins squeezed, manufacturers find their resources depleted for research and development. Investment in sustainable manufacturing practices and the adoption of cutting-edge technologies suffers as financial pressures mount. Consequently, the industry’s capacity to adapt to evolving regulatory, environmental, and market demands diminishes, limiting its competitive edge and ability to innovate.

This weakening of the domestic manufacturing base introduces significant vulnerabilities to the North American supply chain. Greater dependence on foreign suppliers heightens exposure to global supply disruptions, trade conflicts, and geopolitical risks. Such fragility can jeopardize the steady availability of critical materials essential for infrastructure development and large-scale projects, undermining supply security.

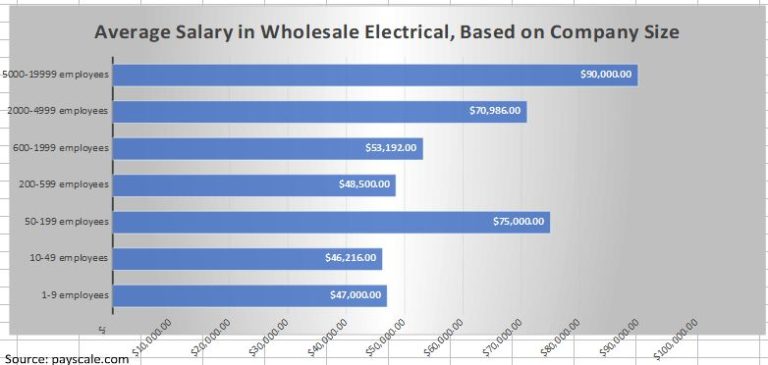

The economic fallout from shrinking manufacturing capacity extends beyond the companies themselves. Job losses in metal fabrication, cable assembly, and related industries will reduce economic activity and deplete the skilled labor pool essential for sustaining the electrical manufacturing ecosystem. The loss of these jobs limits opportunities for workers and affects regional economies tied to manufacturing.

And are we prepared to accept the risk of inconsistent product quality and failures to meet stringent North American safety standards increases. Electrical systems relying on imported aluminum wire face potential reliability and safety issues, raising hazards related to installation and operation. Ensuring compliance and quality becomes more challenging with fragmented and international supply chains.

Finally, the long-term decline of a robust domestic aluminum wire and cable industry threatens North America’s strategic industrial autonomy. The capacity to support burgeoning sectors such as renewable energy, electric vehicles, and smart grids is weakened without a strong homegrown manufacturing foundation. This dependency on imports could impair the region’s ability to meet future technological and environmental goals.

Also most important are the downstream effects of aluminum wire dumping that extend well beyond manufacturers. Electrical distributors and wholesalers, pressured to offer lower-price products, may resort to importing or stocking cheaper offshore aluminum wires. While attractive superficially, these products often lack consistent quality or certification, exposing distributors to supply reliability risks and contractual liability. And in many cases be forced to overstock as dependence on reliable supply chains will add to the true cost overall with lower turns on inventory.

Electrical contractors and plant maintenance personnel face increased hazards with substandard offshore aluminum wire. Aluminum wiring, sensitive to oxidation and thermal expansion, can cause connection failures and fire risks if not manufactured and installed to stringent standards.

Consulting and specifying engineers face erosion of trust in product consistency and certification compliance. The dilution and circumvention of recognized Canadian electrical safety standards such as CSA and certification bodies like UL complicate engineering specifications and increase liability. Where codes and certifications are lax or uneven, installation safety and system reliability erode.

Imported aluminum wire often circumvents or undermines code enforcement and certification standards. CSA and UL certifications are critical for ensuring product safety, fire resistance, and conductivity and these ultimately will face challenges as offshore producers flood markets with products of inconsistent or unknown compliance. Having the potential of a two-tier product landscape threatens electrical system safety across residential, commercial, and industrial sites. It undermines inspection efficacy, increases likelihood of electrical fires, and risks severe operational consequences.

We were surprised with Canada’s Costco’s entry into selling low-cost wire, albeit in this case copper, further complicating the market dynamics. While offering benefits for budget-conscious consumers, these retail offerings often lack the rigorous vetting and quality assurance processes traditional electrical distributors provide. Such retail channel penetration creates a parallel supply route for uncertified or lower-quality wiring, increasing risks for installers and end users while undermining established professional supply chains.

The North American aluminum cable market was valued at approximately 80 billion (Canadian) growing at a rate well above industry projections for the next five years. This growth is driven by renewable energy expansion, smart grid investments, urban electrification, and energy efficiency regulations.

The U.S. has responded with robust trade defense mechanisms imposing high antidumping and countervailing duties on aluminum wire imports, preserving a more level playing field for domestic manufacturers. See the fact sheet HERE. Canada, however, has lagged in adopting similar measures, leaving Canadian manufacturers exposed to unfair competition. Its time for Canada to stand up for its domestic wire and cable manufacturers!

Strong government action to impose similar tariffs and enforce compliance with Canadian electrical codes and certifications is essential to protect jobs, maintain safety, and encourage sustainable industry growth. Only through matched trade protections, rigorous enforcement of codes and certifications, and support for sustainable innovation can Canada secure a resilient, safe, and competitive aluminum wire and cable industry. And while they are doing that maybe they look at copper too!

Aluminum wire and cable dumping into North America presents a clear threat to domestic industry viability and electrical safety. The consequences ripple through the supply chain of distributors, the end users, and contractors, those that specify, the consulting electrical engineers, perhaps its time we all looked at this issue and come together for a stronger North American focus first.