Can You Afford Declining Margins?

January 16, 2017

David Gordon

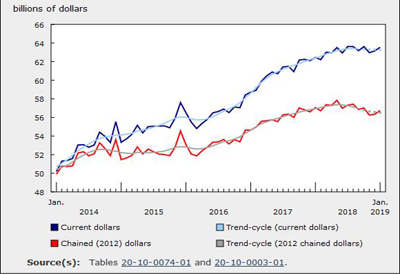

2016 seems to have been the year of pricing. A number of distributors either discussed or undertook pricing initiatives last year. In many instances it was a desire to reverse an industry trend: eroding margins. Others recognized that if they invested in e-commerce they needed to ensure that the price shown on their website was the same that the customer received at the counter or when they called inside sales. Some initiated the strategy based on a recognition that they needed to make more money.

And in some cases senior managers realized that their pricing had declined just… because.

In other words, “the inmates had taken over the asylum” or “salespeople made up their own pricing.”

Regardless, pricing has been a topic of discussion for many distributors.

Some claim it’s to meet the market; others say their salespeople are not good on overcoming pricing objections. However, the drive to reduce price because a customer “asks” is beginning to be reversed by some distributors. These distributors are recognizing that

• customers expect pricing consistency across branch locations, salespeople, and order methodologies

• proper matrices improve productivity and profitability

• price override reports, when properly communicated, help correct errors and, more importantly, adjust behaviours

• increased commission models to increase gross margins typically don’t work

• price management is a sales management issue (and sometimes supported by a pricing group or purchasing management for setting up pricing systems)

Recently a distributor asked us if we had a sales training program to help inside / counter salespeople overcome pricing objections. While we don’t, we commented that managing and maintaining pricing has been a challenge for years and that counter and inside salespeople have had the luxury of being able to adjust pricing to accommodate their customers. We commented that leading distributors are realizing that moving forward this cannot continue, especially due to e-commerce, and they have seen the amount of profit that they are losing. These companies are

• minimizing overrides, except for commodities, through either technology and proactive communications

• locking down their pricing

• reviewing their matrices to address customer specific issues

Further, from a training perspective, the challenge is that distributor salespeople “hear” it for a day and then migrate back to their old habits. Institutionalizing process change enables them to “blame it on management.” Inevitably, when they look at price overrides on a customer and SKU basis they realize 1) it is small dollars and 2) how much they cost themselves (if they are commission-based).

Also, we suggested engaging these salespeople in a discussion on why they are override price, in a group setting, which can generate an interesting dynamic. And part of the conversation should focus on “What is your value-added,” and “Are you worth a tip.”

Many salespeople defer on price and client conflict when they don’t have conviction in the value of their offering. Leading salespeople, and frequently these are also the top revenue and GP$ performers, know their customers, manage their expectations, and sell the value of their company, hence commanding appropriate margins.

Improving your pricing for stock business as well as optimizing your SPA pricing (and utilization) are essential to improving overall profitability. The project market is vulnerable to the vagaries of the marketplace. Stock and SPA pricing are much more manageable and should be predictable. If you don’t have the internal resources to review and implement a price management / profit optimization strategy, there are resources that can help.

Worst case scenario: the increased profits can pay for increased benefit or technology costs.

While price management isn’t easy, it is easy to race with your competitors to the bottom and leave your business with ever decreasing profitability. But can you afford to play that game?

How are you fighting to improve your profitability?

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. He can be reached at 919-488-8635 or dgordon@channelmkt.com.