Manufacturing Sales Rose 20.7% in June

Aug 14, 2020

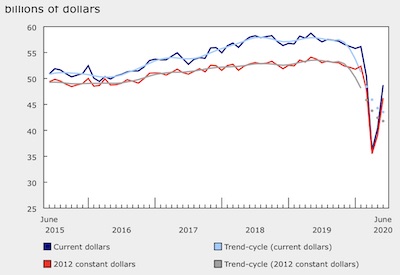

Manufacturing sales rose by a record 20.7% to $48.7 billion in June, following an 11.6% increase in May. Many factories operated at a much higher capacity in June, with the capacity utilization rate (not seasonally adjusted) for the total manufacturing sector increasing 10.9 percentage points to 73.3%. Consistent with the increase in sales and capacity utilization in June, the May reference month release of the Canadian Survey on Business Conditions indicated that almost one-fourth (23.9%) of manufacturers expected to increase their number of employees over the next three months. Still, the capacity utilization rate remained 8.0 percentage points below the June 2019 level (81.3%).

Sales were up in all 21 industries, led by the motor vehicle and motor vehicle parts industries. Excluding these two industries, manufacturing sales increased 10.3%. Nevertheless, total manufacturing sales in June were 13.2% below their pre-pandemic level in February.

In real (or volume) terms, manufacturing sales increased 18.4%, indicating a higher volume of products sold in June.

Large quarterly decreases for manufacturing sales

Total manufacturing sales decreased from $162.4 billion in the first quarter to $125.3 billion in the second quarter, a record 22.8% decline. The value of sales in the second quarter was at its lowest since the third quarter of 2009. In volume terms, manufacturing sales decreased 20.5% in the second quarter, mostly because of lower volumes sold in the transportation equipment (-50.6%) and petroleum and coal product (-28.5%) industries.

Manufacturers anticipated an 18.5% decrease in capital spending in 2020 (down to $18.1 billion from $22.1 billion) when compared with 2019, as reported in the revised intentions for non-residential capital and repair expenditures release. The decline in capital spending intentions may impact manufacturing capacity utilization in the future, as well as demand for machinery and equipment.

The impact of the pandemic on manufacturing sales

Based on respondent feedback, the largest estimated impacts of the pandemic on manufacturing sales in dollar terms were in the transportation equipment (-$1.1 billion), machinery (-$481 million), fabricated metal product (-$463 million), petroleum and coal product (-$385 million), food (-$319 million), and primary metal (-$260 million) industries. It should be noted that these estimates are on an unadjusted basis. However, they provide a snapshot of the magnitude with which the pandemic may have lowered sales.

Motor vehicles and motor vehicle parts account for more than half of the sales gain in June

Sales in the transportation equipment industry rose for the second consecutive month, more than doubling (+144.3%) to $8.8 billion in June. The largest increases were in the motor vehicle (+281.6%) and motor vehicle parts (+190.3%) industries, as most plants returned to full production following shutdowns earlier in the pandemic. Despite this monthly increase, sales of motor vehicles and motor vehicle parts were down by one-quarter (-24.4%) compared with June 2019.

Sales rose for the second consecutive month in the petroleum and coal product industry, up by almost one-third (+31.5%) to $3.3 billion in June. This increase reflects higher prices and volumes—refineries ramped up production in response to greater fuel demand as provinces across Canada continued to ease physical distancing measures and implement their economic recovery plans in June. Nevertheless, total sales of petroleum and coal products were down by almost half (-46.9%) compared with June 2019.

Sales rose by two-thirds (+66.8%) in the aerospace product and parts industry and by over one-quarter (+27.3%) in the plastics and rubber products industry.

Manufacturing sales also increased in the fabricated metal product (+9.9%), primary metal (+8.4%), wood product (+11.7%) and food (+2.3%) industries.

Sales rise in Ontario and Quebec

Manufacturing sales were up in eight provinces in June, with Ontario and Quebec accounting for 92.4% of the national increase.

Sales in Ontario increased for the second consecutive month, up by more than one-third (+35.8%) to $22.5 billion in June. Sales increased in 18 of 21 industries, led by the motor vehicle (+288.9%), motor vehicle parts (+200.7%), plastics and rubber products (+33.8%), petroleum and coal product (+35.8%), fabricated metal product (+18.5%), and primary metal (+16.3%) industries.

In Quebec, manufacturing sales were up for the second consecutive month, rising 16.9% to $12.5 billion in June. Sales increased in 19 of 21 industries, led by the transportation equipment, petroleum and coal product, plastics and rubber products, and primary metal industries.

Sales were down in Manitoba (-1.7%) and Prince Edward Island (-7.2%), mainly because of lower sales of durable goods.

Manufacturing sales increase in the census metropolitan areas of Toronto and Montréal

On an unadjusted basis, manufacturing sales rose in 10 of the 12 census metropolitan areas covered by the survey in June, led by Toronto (+37.6%) and Montréal (+32.0%).

In Toronto, the increase in the transportation equipment industry (+197.3%) was mostly attributable to motor vehicles and motor vehicle parts.

In Montréal, higher sales of transportation equipment (+88.5%) and primary metals (+63.3%) drove the growth in June.

Manufacturing sales in Regina were down 14.3%, mostly because of lower seasonal sales in the chemical industry.

Inventory levels decrease

Inventory levels declined for the third consecutive month, decreasing 0.3% to $87.1 billion in June. Inventories were down in 14 of 21 industries, led by the fabricated metal product (-7.4%), primary metal (-4.3%), transportation equipment (-1.4%) and wood product (-4.3%) industries. These decreases were partly offset by a 21.5% increase in petroleum and coal product inventories.

The inventory-to-sales ratio declined from 2.16 in May to 1.79 in June. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

Unfilled orders decline

Total unfilled orders for the manufacturing sector declined 1.6% to $94.2 billion, the third consecutive monthly decrease. Overall, unfilled orders were down in 8 of 21 industries, with the largest decreases in the transportation equipment and fabricated metal product industries.

This was partially offset by higher unfilled orders in the primary metal, chemical, and plastics and rubber products industries.

New orders rose for the second straight month, up 23.6% to $47.2 billion in June—mostly on higher orders of transportation equipment.

Capacity utilization rate increases

The capacity utilization rate (not seasonally adjusted) for the total manufacturing sector rose from 62.4% in May to 73.3% in June.

The capacity utilization rate for durable goods rose 17.0 percentage points to 70.8%, mostly attributable to higher production at motor vehicle assembly and motor vehicle parts plants after some of these plants were shut down as a result of the pandemic in May.

The capacity utilization rate for non-durable goods rose 4.2 percentage points to 76.1% in June, partly reflecting ramped up production of plastics and rubber products.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200814/dq200814a-eng.htm?HPA=1