Investment in Building Construction, May 2025

August 6, 2025

The total value of investment in building construction decreased by $491.4 million to $21.8 billion in May. Investment in the residential sector fell 3.0%, while the non-residential sector edged down 0.4%.

On a constant dollar basis (2023=100), the total value of investment in building construction in May was down 2.3% from the previous month and was up 3.1% on a year-over-year basis.

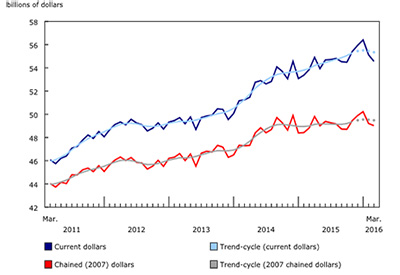

Chart 1

Investment in building construction, seasonally adjusted

Multi-unit component leads residential construction decline

Investment in residential building construction declined by $462.6 million to $15.0 billion in May. Losses were recorded in the construction of both multi-unit dwellings (-3.4%) and single-family homes (-2.5%).

In May, investment in multi-unit construction dropped by $295.2 million to $8.5 billion. The monthly decline was largely attributed to Ontario (-$166.4 million) and Quebec (-$159.0 million). Meanwhile, Alberta (+$50.4 million) saw notable gains, followed by Saskatchewan (+$20.2 million).

Single-family home investment decreased by $167.4 million to $6.6 billion in May. Ontario (-$80.4 million) accounted for nearly half of the decrease, followed by six other provinces and three territories.

Infographic 1

Investment in residential building construction, May 2025

Chart 2

Investment in residential building construction, seasonally adjusted

Non-residential investment declines slightly

The value of non-residential investment in building construction edged down by $28.8 million to $6.8 billion in May. Declines in the industrial (-1.3%) and commercial (-0.5%) components were mitigated by a gain in the institutional component (+0.2%).

Investment in the industrial component decreased by $18.0 million to $1.4 billion in May. The fall was largely due to declines in Quebec (-$10.9 million) and Ontario (-$7.1 million). Nova Scotia (+$2.3 million) led the increases recorded in five provinces and one territory.

Investment in the commercial component declined by $15.9 million to $3.3 billion in May. Decreases were recorded in eight provinces and two territories, led by Ontario (-$8.8 million).

Meanwhile, investment in the institutional component edged up by $5.1 million to $2.1 billion in May. Gains in Alberta (+$8.5 million) and six other provinces were partially offset by a decline in Quebec (-$13.9 million).

Infographic 2

Investment in non-residential building construction, May 2025