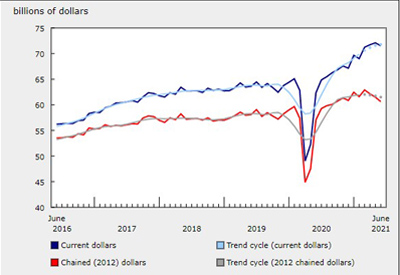

Wholesale Sales Declined 0.8% in June

Aug 16, 2021

Wholesale sales fell 0.8% in June to $71.5 billion, ending three consecutive monthly increases with only the third decline since May 2020. June’s sales reflect sharp declines in the building material and supplies, as well as the machinery, equipment and supplies subsectors. Moreover, excluding sales in the lumber, millwork, hardware and other building supplies industry, wholesale sales rose 0.4%.

Wholesale sales fell 0.8% in June to $71.5 billion, ending three consecutive monthly increases with only the third decline since May 2020. June’s sales reflect sharp declines in the building material and supplies, as well as the machinery, equipment and supplies subsectors. Moreover, excluding sales in the lumber, millwork, hardware and other building supplies industry, wholesale sales rose 0.4%.

Sales fell in three of seven subsectors representing 56% of the sector.

Most of the drop was offset by gains in the personal and household goods, and motor vehicles and motor vehicle parts and accessories subsectors.

Wholesale volumes fell 1.4% in June.

Sales up in second quarter

Despite the decrease in June, second quarter 2021 sales of wholesale goods were 2.6% higher than the first quarter, the fourth consecutive quarterly increase. An 11.4% jump in sales of building materials and supplies drove the gains as prices for lumber surged in the late winter and early spring of 2021. The food, beverage and tobacco, and personal and household goods subsectors, each recorded gains of more than 3%. All three subsectors recorded their highest quarterly sales ever in the second quarter of 2021.

The largest decline for the quarter was posted in the motor vehicle and motor vehicle parts and accessories subsector, which fell for the second consecutive quarter, down 2.8%. An ongoing shortage of semiconductors worldwide directly led to a lack of supply of motor vehicles, which only started to resolve itself in June.

June sales diverge from second-quarter results

While sales for the second quarter were higher overall, sales in June were down.

Sales of building materials and supplies fell 5.4% in June to $12.6 billion. The decline was entirely due to lower sales in the lumber and other building supplies industry, as the other two industries in the subsector posted gains. Lumber, millwork, hardware and other building supplies sales fell 10.2%. The price of lumber fell 6.8% in June according to the Industrial Product Price Index, indicating that the drop in the lumber and other building supplies industry has both price and volume elements.

Machinery, equipment and supply sales dropped 3.5% in June to $14.6 billion. It was the second consecutive decline in the subsector, and the lowest level of 2021 so far. Sales of construction, forestry, mining and industrial machinery, equipment and supplies fell 5.2%, as did receipts in the computer and communications equipment and supplies industry.

Sales of motor vehicles and motor vehicle parts and accessories rose 3.1% in June, the largest increase since August 2020. For the last several months, companies across the automotive sector have been dealing with a chronic shortage of semiconductors. In June, there was a start of a rebound in the automotive elements of the economy, with motor vehicle manufacturing sales up 25.6%, exports of motor vehicles and parts up 14.9% and capacity utilization by auto manufacturers up 3.4 percentage points.

The personal and household goods subsector posted a 4.3% increase in June, the fourth increase in the past five months. Sales in June were $10.7 billion, the highest level on record for the subsector. The increase came entirely from the pharmaceuticals and pharmacy supplies industry, which rose 8.7% in June. There is no one element of the pharmaceuticals and pharmacy supplies industry that generated the increase, as gains were widespread across a number of companies that supply a range of products.

Sales down in six provinces

Wholesale sales decreased in six provinces and two territories in June, accounting for 75% of the national total. The drop in sales for British Columbia and Ontario combined represented 91% of the overall decline in national wholesale sales.

Wholesalers in British Columbia reported the largest decrease in sales, down 3.8% to $7.8 billion in June. Four subsectors in the province dominated the declines. Sales of building material and supplies dropped the most, down 6.8% to $2.8 billion. Lumber, millwork, hardware and other building supply wholesalers accounted for 77% of sales in the subsector, and sales in that industry decreased 9.2%. Excluding the building material and supplies subsector, wholesale sales decreased by 2.0% in June.

Monthly sales in Ontario dropped 0.6% in June to $35.3 billion. Four subsectors in the province had lower sales in June, and they accounted for 70% of Ontario sales that month. Machinery, equipment and supplies wholesale sales were down 5.3% to $7.6 billion. Sales of construction, forestry, mining, and industrial machinery, equipment and supplies decreased by 19.9% in June to $1.6 billion. Computer and communications equipment sales decreased 2.9% to $3.6 billion. Meanwhile, personal and household goods wholesalers reported a 7.8% increase in sales to $5.9 billion. All of the component industries of the subsector reported higher sales except for home furnishings, which is also the smallest industry. Pharmaceuticals and pharmacy supplies, which accounted for 52% of the subsector in June, reported a 10.8% increase in monthly sales for a total of $3.1 billion.

June concludes the second quarter of 2021. As such, seven provinces and three territories reported higher sales in the second quarter. These provinces and territories contributed 45% of national wholesale sales for the second quarter. Quarterly wholesale sales increased 8.3% in Quebec, to $43.7 billion. Alberta’s quarterly sales increased 7.3% to $22.3 billion, and British Columbia’s increased 5.7% to $23.7 billion. During the same quarter, Ontario’s sales decreased 1.0% to $105.8 billion.

Lower inventories in June

Wholesale inventories fell 0.6% to $94.6 billion in June. Lower inventories were reported in four of the seven subsectors, which combined, accounted for 55% of total inventories. Notwithstanding the decline, June’s inventories were the second highest on record. Inventory levels rose 1.4% from the close of the first quarter to the end of the second quarter of 2021, and were 4.6% higher than in June 2020.

The motor vehicle and motor vehicle parts and accessories subsector posted the largest inventory decrease, down 4.7% to $11.9 billion in June. The subsector accounted for 13% of total inventories in the wholesale sector, and generated more than 90% of the decrease in June.

Inventories in the machinery, equipment and supplies subsector rose 1.1% to $26.1 billion in June. Inventories in the farm, lawn and garden machinery and equipment industry increased by 6.8% in June and 3.9% in the other machinery, equipment and supplies industry, while the construction, forestry, mining, and industrial machinery, equipment and supplies industry’s inventories decreased 2.8%.

The building material and supplies subsector had increasing inventories for the ninth consecutive month. Inventory levels rose by 0.5% to $16.7 billion, setting a record high for the third consecutive month. On a year-over-year basis, this was 15.2% higher than in June 2020, and a 10.5% increase in the second quarter of 2021. Inventories in June increased 2.1% in the electrical, plumbing, heating and air-conditioning equipment and supplies industry and 0.8% in the metal service centres. Following 11 consecutive months of increases, inventories in the lumber, millwork, hardware and other building supplies industry shrank 0.5%.

The inventory-to-sales ratio remained constant at 1.32 in June. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210816/dq210816a-eng.htm?CMP=mstatcan