Wholesale Trade, February 2022

April 18, 2022

Wholesale sales fall for first time in seven months

Wholesale sales fell 0.4% in February to $78.8 billion, the first decline since July 2021. Lower sales were posted in the personal and household goods, building material and supplies, and motor vehicle and motor vehicle accessories and parts subsectors, while sales in all other subsectors increased.

Volumes of wholesale goods sold fell 1.4% in February.

Sales of personal and household goods records largest decline

Sales of personal and household goods fell 5.1% in February to $11.4 billion. Notwithstanding the decline, sales in February were the second highest on record for the subsector. The decline largely reflects a 6.1% drop in sales of pharmaceuticals and pharmacy supplies. In January, sales of pharmaceuticals and pharmacy supplies rose 15.4% as a result of purchases of COVID-19-related pharmaceuticals by the Government of Canada. Sales dropped somewhat in February 2022 but were still 8.3% higher than in December 2021.

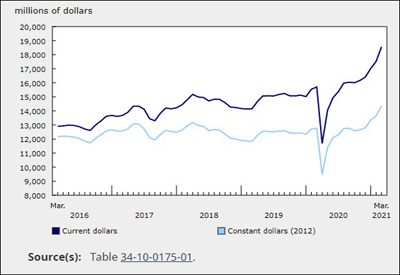

Building material and supplies wholesalers recorded a 2.8% drop in sales to $13.7 billion as activity in the subsector was slower than normal in February. While the price of softwood lumber (the largest component of the subsector) increased and exports grew modestly, overall sales were lower. The decline reflected lower sales among small and medium sized wholesalers in the subsector, as larger companies reported increases.

The motor vehicle and motor vehicle accessories and parts subsector saw sales drop 1.9% in February to $11.0 billion. It was the second consecutive decline in the subsector. The result reflects trade patterns in February, which saw exports in the motor vehicle sector decline 5.0% and imports rise 2.8%.

Partially offsetting the February decrease was a 2.8% rise in sales of machinery equipment and supplies, the sixth consecutive increase in the subsector and the highest level of sales ever recorded. Sales increases in the subsector were led by the other machinery and equipment industry (in particular sales of professional machinery, equipment and supplies), and the computer and electronic product industry.

Ontario leads declines in sales

Sales declined in six provinces and two territories in February, comprising 82.4% of total wholesale sales. Ontario reported the largest decline, followed by Quebec and Alberta. Higher sales in British Columbia, Saskatchewan, and Manitoba dampened the national decline.

In Ontario, sales fell 1.2% to $39.2 billion in February, following seven consecutive months of increases. Sales fell in five of seven subsectors, accounting for 76% of sales. The largest decrease came from the building material and supplies subsector, down 6.9% to $5.6 billion. Sales were lower in all component industries, and proportional to their share of the subsector’s sales, each contributed equally to the decrease. Sales of personal and household goods fell to $6.1 billion, a 3.3% drop from January.

Wholesale sales in Quebec were down 1.6%, falling to $15.1 billion in February. This decline was largely driven by an 11.0% drop in sales of personal and household goods. All five component industries reported lower sales, with half of the decline coming from textile, clothing and footwear industry.

Sales in British Columbia grew for the fifth consecutive month, up 4.2% to $8.5 billion. Over three-quarters of the increased sales value in the province was attributed to a 12.3% increase in sales of building material and supplies, largely led by the lumber, millwork, hardware and other building supplies industry. Conversely, sales of building material and supplies declined in the nine other provinces in February.

Saskatchewan and Manitoba saw higher sales in February, on the strength of the agriculture industry. Sales in Saskatchewan reached $3.5 billion, up 5.4% from January. The miscellaneous subsector was the only subsector to report increased sales, nearly all of which were attributed to the agriculture supplies industry. In Manitoba, sales grew 3.0% to $1.8 billion, with the machinery, equipment and supplies subsector contributing most of the growth, specifically the farm, lawn and garden machinery and equipment industry.

Inventories rise in February

The value of wholesale inventories rose 1.7% to $107.9 billion in February, led by the machinery equipment and supplies, and motor vehicle and motor vehicle parts and accessories subsectors. Following a small drop in January, inventory levels reached another record high, making the last nine of ten months record breaking. Five of seven subsectors had larger inventories at the end of February, comprising 70% of the value of inventories in the sector.

Inventories in the machinery, equipment and supplies subsector grew 2.5% to $30.3 billion in February. Two of four component industries had higher inventories, with three-quarters of the increases owing to a 10.0% rise of other machinery, equipment and supplies, reaching $6.8 billion. This industry includes wholesalers of medical and laboratory equipment. The computer and communications equipment and supplies industry also contributed as it saw its inventories rise 5.8% to $4.0 billion.

Motor vehicle and motor vehicle parts and accessories closed the month with inventories at $12.4 billion, a 6.2% increase from January. Inventories in all component industries grew, but new motor vehicle parts and accessories accounted for over two-thirds of the increase. This industry was up 9.7% to $5.6 billion, as imports of tires, motor vehicle engine and motor vehicle parts increased by 17.6% in February.

Wholesalers of the miscellaneous subsector had notable gains in inventories, up 2.8% to $15.0 billion. While all component industries had higher inventory levels, over half of the accumulation was of agricultural supplies.

The inventory-to-sales ratio increased from 1.34 in January to 1.37 in February. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their levels.

Protests disrupt transportation of goods

Statistics Canada included questions in February’s survey to assess the impact of blockades of transportation routes on the wholesale sector.

In total, 15% of wholesalers indicated that their business was adversely affected by the protests, with 93% of those companies reporting transportation and/or shipping problems associated with the blockades, and 35% reporting lower sales. Overall, the demonstrations generated a drop in sales of approximately $200 million in the sector.

Respondents also indicated a shortage of inventories due to transportation and border crossing difficulties, particularly with receipt of parts and raw materials. Many noted having higher inventory levels due to shipping disruptions for the transport of goods to end destinations and customers. In some cases, companies opted to delay shipments until conditions improved, and others also worked to increase their inventories to ensure sufficient stock for future months.