Wholesale Trade, April 2022

June 17, 2022

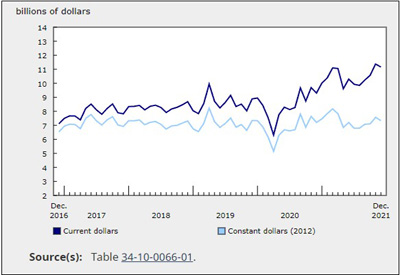

Lower wholesale sales in April

Wholesale sales fell 0.5% in April to $79.8 billion, the second decrease in the past three months. Sales fell in five of seven subsectors comprising more than three-quarters of total wholesale activity in Canada. The largest declines were posted in the miscellaneous goods and the building materials and supplies subsectors. Growth in the machinery equipment and supplies subsector largely offset the declines.

Constant dollar sales fell 0.6% in April.

Miscellaneous merchant wholesalers drive decrease in sales for April

After two months of growth for the subsector, sales in the miscellaneous merchant wholesalers declined 3.4% to $11.5 billion in April. The decrease comes despite the fact that three of the five industries within the subsector posted gains for April. The agricultural supplies merchant industry drove the drop as its sales decreased 13.6% to $3.3 billion. The decline in this industry partly reflects a drop in imports of fertilizer from Russia which had more than doubled from 2020 to 2021. Meanwhile, a 7.7% decrease in the chemical (except agricultural) and allied product merchant industry mostly offset the 10.2% gains in the recyclable material merchant industry.

The building material and supplies merchant subsector dropped for the second time in three months, down 1.4% to $14.0 billion in April. The lumber, millwork, hardware and other building supplies industry generated the bulk of the decline as its sales dropped by 3.8% to $7.5 billion. The decline in April reflected lower prices and volumes in the industry. According to the Industrial Product Price Index, prices for lumber and other wood products decreased 8.2% in April and international trade data showed that exports of lumber and other sawmill products fell 2.6% in April.

Partially offsetting the declines was a 1.8% increase in the sales of machinery, equipment and supplies. Sales in the machinery, equipment and supplies subsector have risen in seven of the past eight months. Three of four industries in the subsector recorded gains in April, led by the farm, lawn and garden machinery and equipment industry.

Quebec leads declines in sales

Six provinces reported lower sales in April, accounting for 86% of the national value. The declines were led by Quebec, followed by Ontario.

Sales in Quebec decreased 2.1% to $14.7 billion in April, as all seven subsectors saw reduced sales. Declines were led by the food, beverage and tobacco merchant wholesalers which decreased 5.2% to $2.9 billion and accounted for half of the provincial decrease. The machinery, equipment and supplies merchant wholesalers (-2.5% to $2.4 billion) and the motor vehicle and motor vehicle parts and accessories merchant wholesalers (-3.2% to $1.5 billion) also contributed to the decline.

Ontario sales fell 0.4% to $40.4 billion in April. Three of seven subsectors saw a drop in sales. The driving force behind the decline was reduced sales in the miscellaneous merchant wholesalers subsector (-5.0% to $5.1 billion) and the building material and supplies merchant wholesalers (-2.5% to $5.6 billion). Partially offsetting the provincial decrease was the gain in the machinery, equipment and supplies merchant wholesalers, up 1.5% to $8.5 billion.

In April, four provinces and all three territories had increased sales. Among them, a 2.0% increase to $8.7 billion in Alberta partially offset the national decline. The gains in Alberta were largely driven by the machinery equipment and supplies merchant wholesalers which increased 6.8% to $2.6 billion and accounted for 68% of the province’s growth. The building material and supplies merchant wholesalers also contributed to the province’s growth, up 3.6% to $1.7 billion.

Inventories continue to rise in April

Inventories rose 1.7% to $111.5 billion in April, the third consecutive monthly increase. All seven subsectors reported increased inventories for the first time since May 2019, led by the machinery, equipment and supplies, and the building material and supplies subsectors.

Inventories in the machinery, equipment and supplies subsector increased by 2.0% to $30.3 billion in April. Inventories grew in all component industries in the subsector, with farm, lawn and garden machinery and equipment reporting the largest growth.

Also contributing to the increase in inventories was the building material and supplies subsector, which grew 2.2% to $21.5 billion. Stocks of electrical, plumbing, heating and air-conditioning equipment and supplies had the greatest growth in the subsector.

Wholesalers of the miscellaneous subsector had gains in inventories of 2.1% to $15.9 billion in April. While all five component industries had greater inventories, 79% of the accumulation was from the miscellaneous and the agricultural supplies industries.

The inventory to sales ratio increased from 1.37 in March to 1.40 in April. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.