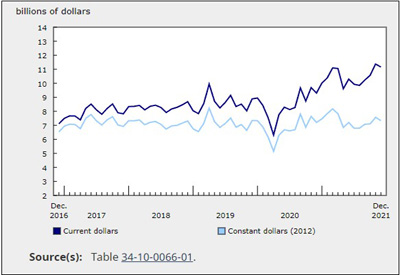

Wholesale Sales Up 1.5% in July

Oct 3, 2017

Wholesale sales rose 1.5% to $62.4 billion in July, following a 0.6% decline in June. Sales were up in five of the seven subsectors, representing 86% of total wholesale sales. The building material and supplies and the food, beverage and tobacco subsectors contributed the most to the advance. Wholesale sales rose 1.5% to $62.4 billion in July, following a 0.6% decline in June. Sales were up in five of the seven subsectors, representing 86% of total wholesale sales. The building material and supplies and the food, beverage and tobacco subsectors contributed the most to the advance.

In volume terms, wholesale sales were up 2.1%.

Sales up in 5 of 7 subsectors, led by the building material and supplies subsector

The building material and supplies subsector reported the largest gain in dollar terms in July, increasing 4.8% to $9.0 billion. Two of three industries within the subsector reported higher sales, led by the lumber, millwork, hardware and other building supplies industry (+9.6%), which posted its fourth increase in five months.

Sales in the food, beverage and tobacco subsector rose 2.4% to $12.2 billion in July, following a 1.2% decline in June. All three industries in the subsector increased, led by the food industry—up 1.3% to $10.9 billion—mostly erasing the 1.4% decline in June.

Sales in the motor vehicle and parts subsector rose 1.4% to $11.6 billion on stronger sales in the motor vehicle industry (+1.5%). Imports of passenger cars and light trucks increased in July.

Sales in the miscellaneous subsector decreased 1.3% to $8.0 billion. Sales were down in four of the five industries in the subsector, with the recyclable material and chemical (except agricultural) and allied product industry contributing the most to the drop.

The farm product subsector declined for a second consecutive month, down 0.3% in July.

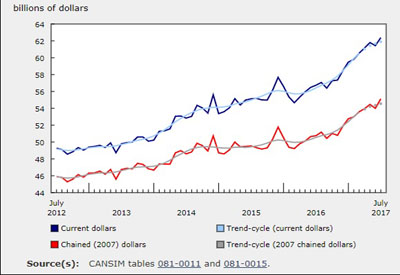

Sales increase in 7 provinces, led by Alberta, British Columbia and Saskatchewan

Sales in Alberta rose for the 9th time in 10 months, up 4.3% to $6.9 billion in July. Six of seven subsectors posted increases, led by the machinery, equipment and supplies (+7.3%) and the food, beverage and tobacco (+5.2%) subsectors. Sales in the machinery, equipment and supplies subsector in Alberta rose for the third time in four months, growing 11.5% over the period.

Wholesale sales in British Columbia rose for the third consecutive month, up 3.4% to $6.6 billion in July on the strength of higher sales in the building material and supplies (+9.2%) and the food, beverage and tobacco (+5.1%) subsectors. The building material and supplies subsector reported a record high $1.8 billion in sales in July.Sales in Saskatchewan rose 9.9% to $2.4 billion in July, with increases in six of the seven subsectors. The majority of the gain was driven by higher wholesale sales in the miscellaneous subsector (+16.8%), the largest subsector within the province.

In Quebec, sales increased 1.4% to $11.1 billion. The machinery, equipment and supplies (+4.8%) and personal and household goods (+5.1%) subsectors were the main contributors to the gain. The building materials and supplies subsector (+2.7%) also contributed to the rise, reaching its highest sales value on record.

Sales in Ontario rose for an eighth consecutive month, up 0.4% to $31.8 billion in July. The increase was attributable to higher sales in the food, beverage and tobacco (+3.3%) and the motor vehicle and parts (+2.0%) subsectors. Wholesale sales in Ontario have grown by 8.2% over this eight month period, In Manitoba, sales rose 0.4% to $1.6 billion with sales up in five subsectors. The majority of the increase was attributable to gains in the building material and supplies subsector, up 6.8% to $225 million in July.

In Newfoundland and Labrador, sales rose 1.1% to $443 million. Sales were up in five of the seven subsectors, with the food, beverage and tobacco subsector contributing the most in dollar terms, up 17.0% to $162 million.

Sales in Nova Scotia (-3.4%) fell in five of the seven subsectors. The decline was mainly attributable to lower wholesale sales in the motor vehicles and parts (-9.9%) and food, beverage and tobacco (-8.5%) subsectors. The loss was partly offset by an increase in the building material and supplies subsector (+9.8%).

Sales in Prince Edward Island were down for a second consecutive month, declining 9.8% to $79 million in July.

In New Brunswick, sales declined 3.2% to $579 million following five consecutive increases. The decrease was led by the food, beverage and tobacco subsector (-12.8%). Wholesale sales were down in all three industries, with the food industry contributing the most to the decline.

Inventories rise in July

Wholesale inventories increased for the fourth consecutive month, up 0.7% to a record $80.8 billion in July. Inventories were up in five of seven subsectors, representing 83% of total wholesale inventories. In dollar terms, the machinery, equipment and supplies subsector (+1.7%) recorded the largest gain, followed by the motor vehicle and parts subsector (+1.8%). This was the third increase in four months for both subsectors.The food, beverage and tobacco subsector (+0.7%) posted its fifth increase of 2017.

In the miscellaneous subsector (+0.3%), inventories rose for the 10th consecutive month.Inventories in the personal and household goods subsector edged up 0.2% in July following a 5.5% gain in June.

The building material and supplies subsector (-0.9%) declined for the first time in three months.The inventory-to-sales ratio declined from 1.31 in June to 1.30 in July. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

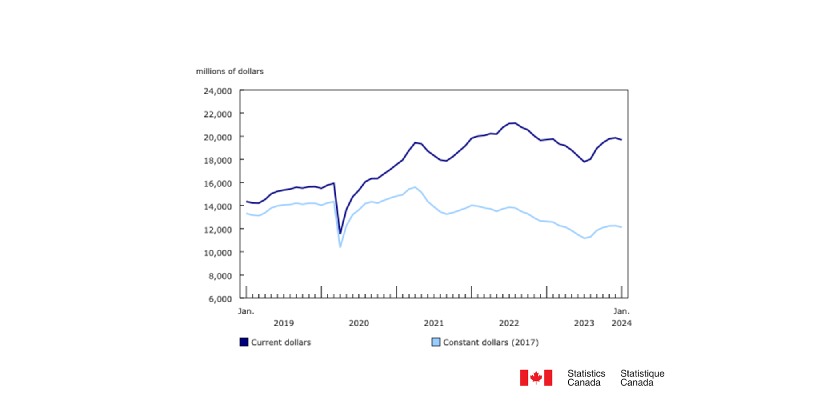

Wholesale trade in British Columbia at a glance.

British Columbia had sales of $69.7 billion in 2016—the fourth largest province in terms of its contribution to total wholesale sales. British Columbia accounted for 10% of wholesale sales in Canada in 2016, preceded by Ontario (51%), Quebec (18%) and Alberta (11%).

British Columbia is an important port of entry, especially with Asia, and wholesalers are significantly involved in imports and exports. British Columbia is the third largest province of entry for imports and the fourth largest province of domestic exports. In terms of exports by wholesalers, British Columbia is the third largest among the provinces. British Columbia led growth in gross domestic product for a second consecutive year in 2016.

The top contributing subsectors in British Columbia

The building material and supplies; food, beverage and tobacco; and machinery, equipment and supplies were the top three wholesale subsectors in British Columbia in 2016.

With the exception of 2008 and 2009, the building material and supplies subsector has been the largest subsector in British Columbia since 2004, followed by the food, beverage and tobacco and the machinery, equipment and supplies subsectors. In 2008 and 2009, the food, beverage and tobacco subsector was the top subsector, largely because sales in the building material and supplies subsector and in the machinery, equipment and supplies subsector declined significantly over this period, while the food, beverage and tobacco subsector was less affected by the recession.

The building material and supplies subsector

The building material and supplies subsector was responsible one-quarter of total wholesale sales in British Columbia in 2016. Among the component industries within this subsector, the lumber, millwork, hardware and other building supplies industry was the largest, accounting for 71% the subsector.

British Columbia accounted for 47% of total Canadian shipments of lumber (softwood and hardwood combined) in 2016 and held 39% of total lumber stocks in Canada.

The recession and recovery

Similar to sales in other provinces, wholesale sales in British Columbia were affected by the economic recession of 2008-2009. Sales declined for seven straight months from September 2008 to March 2009, started recovering since then, exceeded its prerecession high by May 2012, and continued to climb. Sales in the building material and supplies subsector followed a similar pattern. The machinery, equipment and supplies subsector reached its prerecession high in the third quarter of 2014. Conversely, the food, beverage and tobacco subsector contracted less and reached its prerecession level by the fourth quarter of 2011.

Total wholesale sales in British Columbia have been on an upward trend since late 2009, with sales increasing for seven consecutive years from 2010 to 2016. On average, sales grew 6.0% annually from 2010 to 2016, while overall total wholesale sales in Canada grew 4.6% over the same period. Among the top three subsectors in British Columbia, both the building material and supplies and the machinery, equipment and supplies subsectors rose for seven consecutive years from 2010 to 2016, while, the food, beverage and tobacco subsector increased for six consecutive years.

In 2016, only Prince Edward Island (+9.9%), Saskatchewan (+7.0%) and Newfoundland and Labrador (+6.4%) reported average yearly growth rates above British Columbia.

Seasonally adjusted data of wholesale trade subsectors by province.

Beginning in August 2017, the Monthly Wholesale Trade Survey began to publish seasonally adjusted data at the three-digit North American Industry Classification System level for each province and territory. This provides the sales contributions of individual subsectors by province, allowing for a more in-depth analysis of the performance of the provinces and territories within the wholesale trade sector.

From January to July 2017, sales in British Columbia grew 7.5% to $6.6 billion, with the building material and supplies subsector (+16.7% to $1.8 billion) increasing the most in dollar terms, followed by the food, beverage and tobacco (+8.9% to $1.5 billion) and the machinery, equipment and supplies (+4.3% to $1.1 billion) subsectors. Sales also increased in the personal and household goods (+6.7% to $649 million), the motor vehicle and parts (+3.7% to $885 million) and the farm product (+4.7% to $64 million) subsectors over this period. The miscellaneous subsector (-4.6% to $723 million) was the lone subsector to report a year-to-date sales decline in July 2017.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/170921/dq170921b-eng.htm