Wholesale Sales Jumped 18.5% in June

Aug 25, 2020

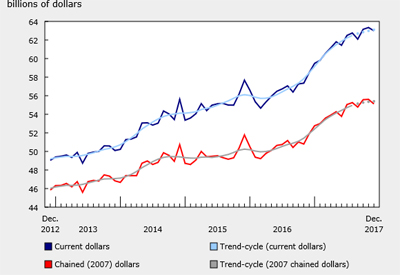

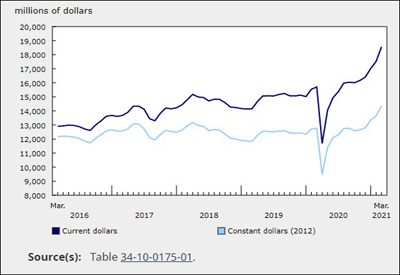

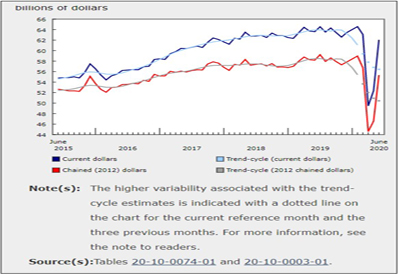

Wholesale sales continued to rebound in June, jumping 18.5% to $62.1 billion, building on a 5.8% gain in May. The increase in June returned wholesale sales to near pre-pandemic levels. All seven subsectors recorded higher sales for the first time since November 2017. In dollar terms, the motor vehicle and motor vehicle parts and accessories subsector led the growth. Excluding this subsector, wholesale sales increased 10.2%.

Wholesale sales volumes were up 18.8%.

Sector continues to recover

Wholesale sales rose by $9.7 billion as large parts of the economy reopened. Sales in June were $2.5 billion below February’s pre-COVID-19 levels, an improvement from May when sales were $12.2 billion below February. The wholesale sector recorded its highest-ever sales level in February 2020, before the pandemic generated a $15.1 billion drop in monthly output over the course of two months. Since then, more than 80% of the drop in monthly sales caused by COVID-19 has been recouped, and June sales were 3.9% below February’s record high.

Excluding motor vehicles and motor vehicle parts and accessories, wholesale sales were 0.5% higher in June than they were in February. Specifically, sales in the miscellaneous subsector reached a record high, and, the food, beverage and tobacco, and the farm product subsectors in June were both higher than they were in February. The personal and household goods, building material and supplies, and machinery equipment and supplies subsectors all recorded sales that were less than 4% below pre-COVID-19 levels.

Sales of motor vehicles and motor vehicle parts and accessories continued to be the slowest to recover. While June’s sales were up 114.8%, sales were 23.7%, or $2.8 billion, below February levels.

Provincially, four provinces’ June sales were higher than their pre-COVID-19 level: Nova Scotia, New Brunswick, Manitoba and Saskatchewan. Notably, sales in Saskatchewan did not drop below February levels during the pandemic—making it the only province that was able to maintain sales at or above that level. The lowest sales in Saskatchewan during the pandemic came in May, when sales were $40 million lower than in January, and $81 million higher than in February. June sales in Ontario and British Columbia were the furthest off their February levels, down 6.2% and 5.9% respectively.

June’s sales were largely consistent with other economic indicators, suggesting that the economy has started a widespread rebound. Monthly manufacturing sales increased 20.7%, largely reflecting the fact that motor vehicle manufacturing sales doubled from May to June, employment rose by nearly one million and exports rose 17.1%.

The growth was also reflected in recent responses to the Canadian Survey on Business Conditions, where 14.9% of wholesalers indicated that they planned to increase the number of employees over the next quarter and another 73.2% expected to maintain employment levels. Notwithstanding the generally more positive situation in June, planned capital expenditures in the wholesale trade sector were down 6.9% compared with pre-pandemic forecasts.

Despite the gains in June, wholesalers by and large did not appear to have specific plans in place to recover from the economic consequences of COVID-19. More specifically, 13.8% of respondents indicated that they had a recovery plan in place, ranging from a high of 22.3% in the machinery, equipment and supplies subsector, to a low of 3.2% in the farm product subsector.

All seven subsectors contribute to the sales growth in June

All seven subsectors posted gains in June, with the motor vehicle and motor vehicle parts and accessories subsector leading the way. The subsector posted a record increase to $8.9 billion, roughly three quarters of the pre-COVID-19 level of $11.7 billion. With automobile production having resumed in most of North America by late May or early June, and trade flowing more freely in and out of the country, sales in the motor vehicle industry increased 191.2% to $6.8 billion.

The personal and household goods subsector saw sales rise 17.3% to $9.7 billion as sales increased in five of six industries. Other subsectors reporting double-digit percentage increases in June were miscellaneous (+18.1%) and building material and supplies (+13.5%).

Sales rise in every province

Every province recorded higher wholesale trade sales in the month of June, led by Ontario, Quebec and British Columbia.

Sales in Ontario rose 27.9% to $31.9 billion, the largest month-over-month dollar-value increase on record for the province. Six of seven subsectors recorded higher sales in June, with the majority of the increase coming from the strength of the motor vehicle and motor vehicle parts and accessories subsector (+188.0% to $5.9 billion). Respondents in the subsector noted that the return of near-capacity employment to wholesaling centres, manufacturing plants and many retail outlets resulted in the higher levels compared with previous months. Despite the increase, the motor vehicle and motor vehicle parts and accessories subsector in Ontario was 28.9% lower than the pre-pandemic high of $8.3 billion.

Quebec recorded a second consecutive month-over-month increase in sales, up 12.0% to $12.0 billion, following an 11.5% increase in May. Six of seven subsectors recorded higher sales, led by the motor vehicle and motor vehicle parts and accessories subsector (+56.6% to $1.4 billion) and the personal and household goods subsector (+15.7% to $2.7 billion). Growth in the personal and household goods subsector was mainly attributable to the pharmaceuticals and pharmacy supplies industry, nearly offsetting the industry’s declines of the previous two months.

Wholesale sales in British Columbia rose 10.0% to $5.9 billion in June, as six of seven subsectors recorded higher sales. Increases in the motor vehicle and motor vehicle parts and accessories subsector (+53.7% to $623 million) and the machinery, equipment and supplies subsector (+12.5% to $1.1 billion) led the gains, as both subsectors recorded their first monthly increase since February 2020.

Inventories continue their descent in June

Wholesale inventories declined 0.7% to $90.6 billion in June. Four of seven subsectors recorded decreases, accounting for 43% of total wholesale inventories.

The personal and household goods subsector posted the largest decline, down 4.7% to $15.7 billion as decreases were seen in all six industries. The toiletries, cosmetics and sundries industry led the decline (-18.3% to $967 million), followed by the pharmaceuticals and pharmacy supplies industry (-2.5% to $7.3 billion). These two industries combined contributed roughly half of the subsector’s decline in inventories.

The inventory-to-sales ratio continued to decrease, dropping to 1.46 in June from 1.74 in May—more in line with pre-COVID-19 ratios. All subsectors recorded decreases in their inventory-to sales ratios, with the motor vehicle and motor vehicle parts and accessories subsector being the main contributor to the inventory-to-sales ratio decline.

Cannabis

Starting with the June reference month, the Monthly Wholesale Trade Survey is publishing data on cannabis. The data series goes back to October 2018 when cannabis was legalized in Canada. Cannabis sales in Canada in June were $96 million, up 26.2% from May.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200819/dq200819a-eng.htm?CMP=mstatcan