While 2016 Wholesale Revenue Decline YOY, Profits Increase

January 15, 2018

The operating revenue of Canadian wholesalers declined 1.4% in 2016 compared with 2015, dropping further below the $1.0 trillion mark reached in 2014. The overall drop was partly caused by a price-induced decline in the petroleum products subsector, as all other subsectors saw increases in revenues. Excluding petroleum, operating revenues rose 3.1% compared with 2015.

Overall, the operating profits of wholesalers as a percentage of total operating revenue increased from 4.3% in 2015 to 4.6% in 2016. Excluding petroleum, operating profits were 5.7% in 2016, up from 5.4% in 2015. Meanwhile, petroleum products wholesalers earned operating profits of 1.0% in 2016, down from 1.3% in 2015.

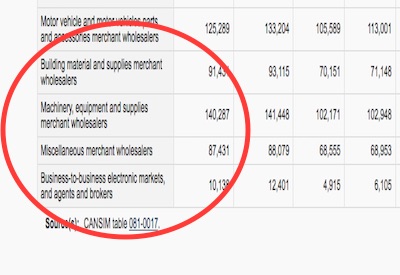

The cost of goods sold, which accounted for 82.4% of total operating revenue, declined 2.2% to $793.0 billion in 2016. This was attributable to the decline in the costs of goods sold by the petroleum subsector, which fell 14.3% from 2015 levels to $206.2 billion in 2016. During that time, the Raw Materials Price Index for conventional crude oil fell 8.0%. The petroleum industry was also impacted by the forest fires in Fort McMurray, which caused a temporary shutdown of some oil sands activity. The declines in the petroleum subsector were partially offset by a 7.0% increase in the cost of goods sold by the motor vehicles and parts subsector to $113.0 billion.

Total operating expenses, which include labour remuneration, were up 1.5% to $124.3 billion. Total operating expenses in the petroleum subsector were down 9.2% to $4.8 billion, but this was offset by increases in total operating expenses in six of the eight remaining subsectors.

Gross margins for wholesalers (the difference between total operating revenue and the cost of goods sold expressed as a percentage of operating revenue) increased from 16.9% in 2015 to 17.6% in 2016. Since the petroleum subsector has the lowest gross margins (3.2%) in the wholesale sector, as its share of total wholesale declines, the overall margins increase. Excluding petroleum, wholesale gross margins edged up to 21.6% in 2016.

All subsectors increase except for petroleum products

In dollar terms, the most substantial change in operating revenue was in the petroleum products subsector, down 14.5% to $213.1 billion in 2016. The petroleum subsector saw revenues decline due to the lower price of oil in 2016 compared with 2015, as well as the temporary decline in output caused by the forest fires in Fort McMurray. It was the lone wholesale subsector with lower operating revenue in 2016.

Wholesalers of petroleum products accounted for the largest proportion of operating revenue in the wholesale trade sector in 2016 with 22.2% of total operating revenue, down from 25.5% in 2015.

The largest increase in revenue was in the motor vehicles and parts subsector, up 6.3% to $133.2 billion in 2016. The main contributor among the three industry groups in this subsector was the motor vehicle industry group, with an 8.5% increase in operating revenue. This industry group accounted for nearly all of the change in total operating revenue for this subsector. Both exports and imports of motor vehicles and parts increased in 2016, which contributed to the higher operating revenue of motor vehicle and parts wholesalers.

Wholesale operating revenue in the food, beverage, and tobacco subsector increased 4.6% to $134.7 billion in 2016. Most of the increase in this subsector was due to food wholesalers, with operating revenue up 4.7% to $120.5 billion.

Gross margins of wholesalers rise

Expressed as a percentage of total operating revenue, gross margins rose from 16.9% in 2015 to 17.6% in 2016. Higher gross margins were reported by five of the nine subsectors, while three were down and one was flat.

Among wholesale merchants, the highest margins occurred in the machinery, equipment, and supplies (27.2%) subsector, followed by the personal and household goods (25.4%) subsector. The lowest gross margin was posted by wholesalers of petroleum products (3.2%).

Building materials and supplies wholesalers saw their gross margins increase from 23.3% in 2015 to 23.6% in 2016, while the gross margins for wholesalers of food, beverage, and tobacco rose from 17.6% to 18.4%.

Operating profits edge up

In 2016, seven of the nine subsectors posted annual increases in their operating profits as a percentage of total operating revenue, while two were down.

Among wholesale merchants, the personal and household goods wholesalers subsector posted the largest gains in operating profit margins, rising from 4.8% in 2015 to 5.4% in 2016. The food, beverage, and tobacco wholesalers subsector posted the second largest gains in operating profit margins, rising from 4.9% to 5.4%. These increases were driven by higher operating profits in the food wholesalers industry group, from 4.5% to 5.1%. Wholesalers of machinery, equipment, and supplies saw their operating profits increase from 6.9% in 2015 to 7.1% in 2016, the highest level among wholesale merchants.

Declining revenue in the Prairies is partially offset by Ontario

In 2016, five provinces and all three territories reported higher wholesale operating revenue compared with 2015. Overall, operating revenue in Canada declined $13.6 billion in 2016. The decline was driven primarily by a $28.0 billion decrease in operating revenue in Alberta, which was partially offset by a $19.8 billion increase in Ontario.

Wholesale operating revenue in Ontario (up 5.5% to $379.7 billion) remained higher than Alberta in 2016, mostly as a result of continued growth in the motor vehicles and parts (+8.9%) and the food, beverage, and tobacco (+6.1%) subsectors. Higher revenue by food wholesalers in Ontario accounted for 87.6% of the increase in the food, beverage, and tobacco subsector in the province.

Wholesalers in Alberta reported a 10.3% annual decrease in operating revenue to $242.7 billion in 2016. The decline was mainly attributable to the petroleum products subsector (-12.8%), which accounted for approximately two-thirds of wholesalers’ operating revenue in Alberta. Seven of nine wholesale subsectors in Alberta saw their revenues decline in 2016.

Wholesalers in Quebec posted the third highest provincial total operating revenue at $147.3 billion in 2016, up slightly from $146.1 billion in 2015. Quebec petroleum wholesalers posted an 18.2% annual decline in operating revenue to $12.9 billion in 2016, but this was offset by gains in seven of the eight remaining wholesale subsectors. In particular, the building materials and supplies wholesalers subsector posted a $1.2 billion increase in revenues to $18.7 billion.

Operating profits in Quebec were up from 4.3% in 2015 to 5.2% in 2016. The cost of goods sold by wholesalers in Quebec declined 0.8% from 2015 to $114.7 billion in 2016. Meanwhile, total operating expenses for Quebec wholesalers were up $565.8 million on the year to $24.9 billion in 2016.