Survey of Innovation and Business Strategy

In 2012, 88% of enterprises focused mainly their long-term business strategy on the positioning of their goods or services, while 12% focused on low-price and cost leadership. Business strategies comprise strategic directions such as long-term focus, product positioning, competition surveillance, and management practices.

Table 1: Enterprises’ most important long-term strategy by regions, all surveyed industries, 2012

A: very reliable (standard error between 0% and 2.49%)

B: reliable (standard error between 2.50% and 7.49%)

E: use with caution

1 .The Atlantic region comprises Newfoundland and Labrador, PEI, Nova Scotia and New Brunswick

2. The rest of Canada comprises Manitoba, Saskatchewan, BC, Yukon, NWT and Nunavut

Human resource management practices

In 2012, 56% of enterprises promoted employees based on their efforts and abilities. The next most common practice was to promote employees partly on the strength of their efforts and abilities and partly on the strength of other factors such as their tenure (38%).

A regional perspective on promotion practices

Most enterprises headquartered in Quebec favoured employee promotion based partly on effort and ability as well as on other factors such as tenure (60%). Enterprises in all other provinces and regions favoured a mode of promotion based solely on the efforts and abilities of employees.

Chart 1: Main factors for employee promotion within enterprises, by region, all surveyed industries, 2012

Problem resolution practices for the production of goods and the delivery of services

In 2012, 40% of all enterprises in Canada reported that they had a systematic process or procedure in place to resolve problems associated with the production of goods or the provision of services.

Chart 2: Enterprises with systematic problem resolution practices for the production of goods or delivery of services, selected sectors, all surveyed industries, 2012

The percentage of enterprises with a systematic process to resolve problems varied across sectors in 2012. Enterprises in administrative and support, waste management and remediation services (67.0%), manufacturing (61%) and utilities (60%) most often used this type of process in 2012.

The percentage of enterprises with a systematic process to resolve problems increased by size of enterprise, with 38% of small enterprises, 50% of medium-sized enterprises and 61.5% of large enterprises employing this type of management practice in 2012.

Competition and business strategies

The business strategy of an enterprise can be affected by several business environment factors, notably competition.

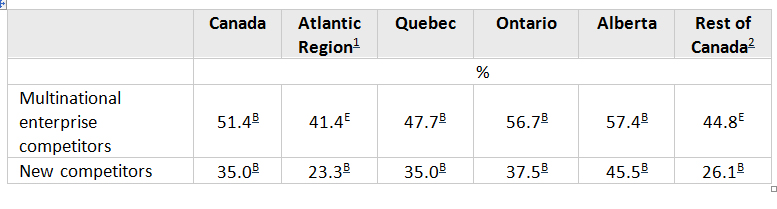

Competition from multinational enterprises: overall, 50% of enterprises in Canada were competing against a multinational enterprise in the main market for their highest selling good or service in 2012. Among all surveyed industries, this percentage increased with the size of the enterprise, with 49% of small enterprises, 58% of medium-sized enterprises and 79% of large enterprises indicating that they had such competition.

Competition from new competitors in the market: In 2012, 35% of enterprises in Canada reported that a new competitor had entered the main market for their highest selling good or service. In terms of regional distribution, new competitors were most prevalent in Alberta (46%). Ontario (38%) recorded the second highest proportion, followed by Quebec (35%), other provinces and territories (26%) and the Atlantic provinces (23%).

Chart 3: Enterprises that competed against multinational enterprise competitors, by size, selected sectors, all surveyed industries, 2012

Table 2: Enterprises’ Type of Competitors in Main Market for Their Highest Selling Good or Service 2012

B: reliable (standard error between 2.50% and 7.49%)

E: use with caution

1. The Atlantic region comprises Newfoundland and Labrador, PEI, Nova Scotia, and New Brunswick

2. The rest of Canada comprises Manitoba, Saskatchewan, BC, Yukon, NWT and Nunavut

3. New competitors may include multinational enterprises