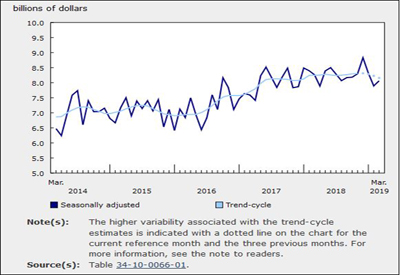

Real GDP Declined in December for Third Month

Mar 3, 2019

Real gross domestic product edged down 0.1% in December, the third decline in four months. The 0.7% decline in goods-producing industries more than offset the 0.2% gain in service-producing industries. Overall, 13 of 20 industrial sectors were up in December.

The goods-producing industries declined for the fifth consecutive month. All goods-producing sectors were down except for agriculture, forestry, fishing and hunting (+1.2%).

The manufacturing sector continues to decline as the majority of subsectors contract

The manufacturing sector contracted 0.7% in December, the fourth decline in five months, as the majority of subsectors were down.

Non-durable manufacturing (-1.1%) declined for the fourth month in a row, as five of nine subsectors contracted in December. Following a 3.1% decline in November, petroleum and coal products manufacturing fell 2.9% in December. Chemical products manufacturing was down 2.5% as there were notable declines in basic chemicals (-5.6%) and other chemical products (-6.5%).

Durable manufacturing was down 0.3%, with the largest declines in machinery (-2.2%), transportation equipment (-1.2%) and wood products (-3.6%) manufacturing. There were notable increases in fabricated metal product (+3.0%) and miscellaneous (+5.7%) manufacturing.

For the first time in almost three decades, the construction sector declines for the seventh consecutive month

For the first time in almost three decades, the construction sector declined for the seventh consecutive month, decreasing 0.9% in December. Residential construction (up 0.7% following six months of declines) and non-residential construction (up 0.2% following five consecutive monthly declines) did not offset the 3.6% decline in engineering and other construction. Repair construction grew 0.4%.

The growth in residential construction came as increased activity in home alterations and improvements and multi-unit dwellings more than offset the continued slowdown in the construction of single, semi-detached housing units and row-home units. Activity at the offices of real estate agents and brokers (-1.9%) declined for the third consecutive month, as housing resale activity decreased across most major urban markets.

Periods of mild weather in December lower demand for utilities

The utilities sector declined 2.0% in December, fully offsetting increases in the previous two months. Both electric power generation, transmission and distribution (-2.1%) and natural gas distribution (-2.9%) declined as periods of mild weather across many parts of the country reduced demand for electricity and natural gas for heating purposes.

Decline in support activities pulls mining, quarrying and oil and gas extraction down

The mining, quarrying and oil and gas extraction sector declined for the third time in four months, decreasing 0.3% in December. Support activities for mining and oil and gas extraction fell 16.8%, the largest monthly decline since March 2016. All types of support activities were down, affected by lower oil prices and a production cut, announced in early December, in the oil and gas extraction subsector in Alberta.

Oil and gas extraction rose 1.5% in December. Oil and gas extraction (except oil sands) was up 3.2%, with both crude oil and natural gas extraction activities increasing. Some crude oil production capacity was restored in Newfoundland and Labrador following a period of extreme weather and maintenance work at some floating platforms in November. Oil sands mining was down 0.2%, partly as a result of maintenance work at some facilities in December.

Mining and quarrying excluding oil and gas rose 5.5%, the largest growth rate since June 2014. Non-metallic mineral mining was up 6.6%, largely due to a 10.9% expansion in potash mining. Metal ore mining rose 5.4%, led by a 21.6% increase in iron ore mining. Coal mining was down 1.0%.

Wholesale and retail trade up

Wholesale trade was up 0.4% in December as six of nine subsectors grew, partly offsetting the decline in November. Miscellaneous wholesaling (+2.6%) led the growth, as activity increased in most of the industries. Building materials and supplies were up 1.9%, after declining the previous two months, with growth in lumber and millwork wholesaling contributing the most to the gain. There were notable declines in personal and household goods (-2.6%) and farm products wholesaling (-4.6%) as activity at oilseeds and grain dealers contracted.

Retail trade was up 0.2% as an increase in five subsectors more than offset declines in the remaining seven. Retail activity at building material and garden equipment and supplies increased 4.2%, ending a sequence of six consecutive declines. Motor vehicle and parts dealers (+1.0%) were up for the third time in four months, as increased activity at new and used car dealers led the growth. There were declines in most store types associated with December holiday shopping such as clothing and clothing accessories (-1.3%), electronics and appliance (-2.7%) and general merchandise (-0.2%) stores. Promotional events such as Black Friday and Cyber Monday in November shifted forward the start to the holiday shopping season, thereby affecting December values of industries generally associated with holiday shopping.

The cannabis sector grows

Effective with this release, monthly estimates of GDP by industry now include estimates of the licensed and unlicensed economic activities related to cannabis production, distribution and consumption for non-medical and medical use.

The cannabis sector expanded 0.2% in December, as an increase in licensed activity more than offset a decrease in unlicensed activity.

Agricultural production of cannabis grew 0.4%, as licensed agricultural production of cannabis was up 6.6% while unlicensed declined 1.3%. Cannabis retailing decreased 0.6% as licensed retailing of cannabis rose 15.4% while output of unlicensed cannabis retailing declined 1.2%.

Other industries

Professional services rose 0.4% in December with increases in most industries.

Transportation services and warehousing grew 0.4%, buoyed by an 11.5% increase in postal services as regular services resumed at Canada Post following the conclusion of rotating strikes in late November. Rail transportation was up 2.2% as rail movement of petroleum, chemicals, metals and minerals and grain and fertilizer products increased.

Finance and insurance increased 0.2% in December. Depository credit intermediation and monetary authorities along with insurance carriers and brokers were up, while financial investment services, funds and other financial vehicles were virtually unchanged.

The public sector edged up 0.1%, with all three components (education, health care and public administration) rising.

Accommodation and food services rose 1.0%, with both accommodation services and food services and drinking places increasing.

Fourth quarter of 2018

The value added of goods-producing industries was down for the second consecutive quarter, declining 1.5% in the fourth quarter of 2018. This was the largest decline since the second quarter of 2016. The output of services-producing industries rose 0.4%. There were gains in 12 of 20 sectors, with all of the increases (with the exception of utilities) occurring among service-producing industries.

The main contributor to the decline in goods-producing industries was construction (-2.8%). Residential (-3.5%), non-residential (-3.2%) and engineering and other (-3.5%) construction all declined, while repair construction edged up 0.2%. The mining, quarrying, and oil and gas extraction sector declined 0.7%, mainly as a result of a 7.9% decrease in support activities for mining and oil and gas extraction. Oil and gas extraction (+0.8%) and mining excluding oil and gas (+0.5%) were up.

Manufacturing declined 0.3% as non-durable manufacturing decreased 1.2% while durable manufacturing was up 0.6%. In non-durable manufacturing, most subsectors declined, with the largest decreases in paper products (-4.4%) and chemical (-1.5%) manufacturing. In durable manufacturing, most subsectors increased, led by fabricated metal products manufacturing (+1.8%).

Agriculture, forestry, fishing and hunting was down 0.1%, as most subsectors declined. Utilities (+1.4%) increased, with all components rising.

Among services-producing industries, the largest growth was in finance and insurance (+1.3%), helped in part by unseasonal activity in bond and equity markets in October, which contributed to increases in depository credit intermediation (+1.7%) and financial investment services, funds, and other financial vehicles (+3.3%). Professional services increased 1.1%, as most industry groups in the sector grew. The public sector was up 0.5%, with the strongest growth in health care and social assistance (+0.6%).

Activity at offices of real estate agents and brokers declined 3.1%, offsetting the rebound in the third quarter following large declines earlier in 2018. Wholesale trade was down 0.4%, the first decline since the second quarter of 2016. Retail trade (-0.2%) edged down for the second consecutive quarter. Transportation and warehousing edged down 0.1%, due in part to a 1.8% decline in postal services and couriers, as Canada Post rotating strikes took place in the fourth quarter.

Annual 2018

Growth was widespread in 2018 with 18 of 20 industrial sectors increasing. The value added of goods-producing industries increased 2.4%, the second annual increase after declines in 2015 and 2016, while services-producing industries rose 2.1%, a rate similar to the average annual growth rate for the previous five years.

The largest contributor to the increase in goods-producing industries was manufacturing (+2.2%). There were gains in both durable (+3.0%) and non-durable (+1.2%) manufacturing. Growth in durable manufacturing was led by fabricated metal products (+8.6%) and machinery (+6.1%) manufacturing, while among non-durable manufacturing subsectors, the largest increase was in chemical manufacturing (+3.5%). The mining, quarrying, and oil and gas extraction sector rose 4.6%, led by a 7.1% rise in oil and gas extraction, the largest increase since 2014. There were also increases in construction (+0.5%), utilities (+0.8%) and agriculture, forestry, fishing and hunting (+1.8%).

The value added of service-producing industries rose 2.1% in 2018. The public sector increased 2.8%, the strongest growth since 2009, with gains in all components (education, health and public administration). Professional services rose 3.2%, the sector’s largest growth since 2014. Real estate and rental and leasing services increased 1.5%, slowing down compared with previous years, reflecting in part a 15.1% decrease in activity at offices of real estate agents and brokers with the introduction of new mortgage regulations. Transportation and warehousing (+3.1%), wholesale trade (+2.7%) and retail trade (+1.0%) posted lower gains in 2018 than in 2017, while finance and insurance (+1.9%) posted its slowest growth since 2012.

Source: Statistics Canada