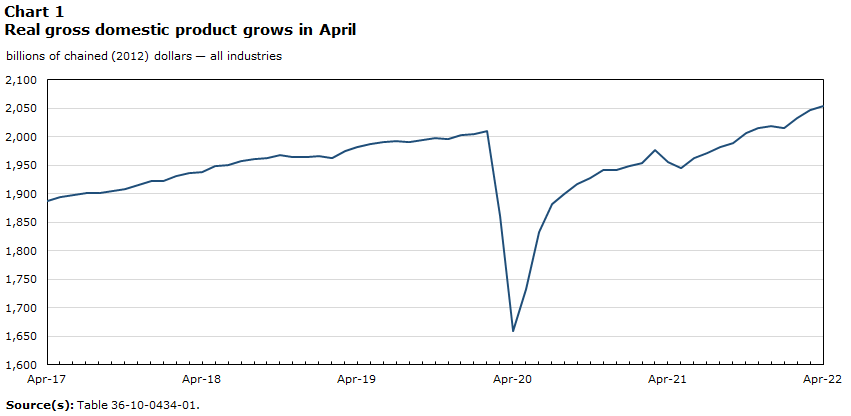

National Gross Domestic Product by Industry, April 2022

July 18, 2022

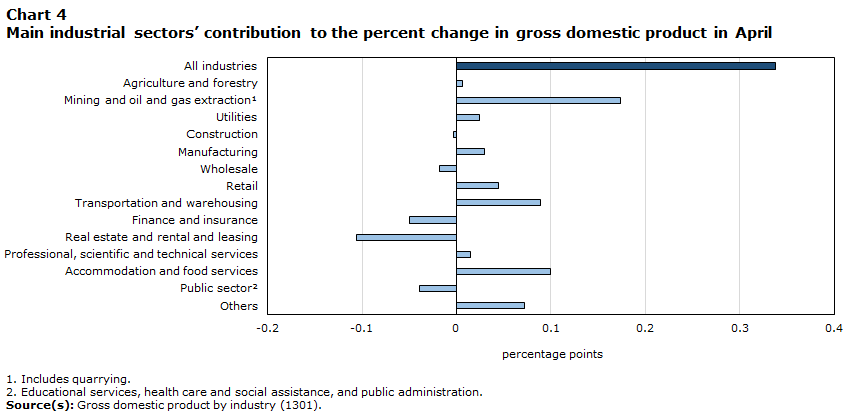

Real gross domestic product rose 0.3% in April, led by growth in goods-producing industries

Real gross domestic product (GDP) rose 0.3% in April, following a 0.7% expansion in March, led by the mining, quarrying and oil and gas extraction sector and client-facing industries.

Both goods-producing (+0.9%) and services-producing (+0.1%) industries were up, as 13 of 20 industrial sectors expanded in April.

Advance information indicates that real GDP decreased 0.2% in May. Output was down in the mining, quarrying and oil and gas extraction, manufacturing and construction sectors. An increase was recorded in the transportation and warehousing sector. Owing to its preliminary nature, this estimate will be updated on July 29 with the release of the official GDP data for May.

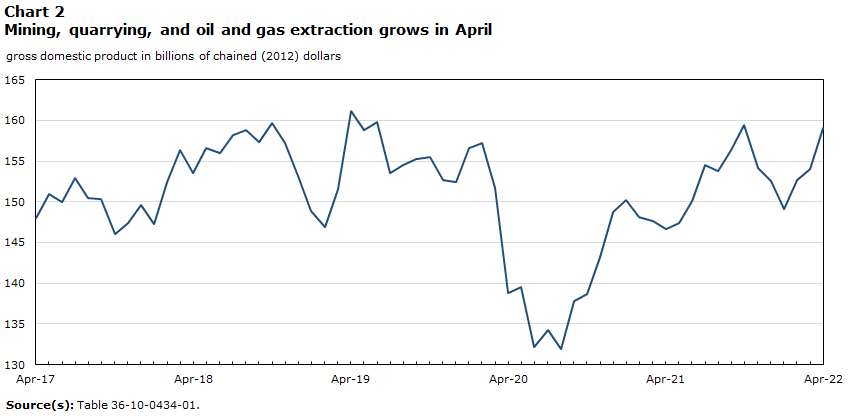

Mining, quarrying and oil and gas extraction contributing the most to growth

The mining, quarrying and oil and gas extraction sector expanded 3.3% in April, the largest monthly growth rate since December 2020, attributable to growth in all three subsectors.

Oil and gas extraction rose 3.9%, a third consecutive monthly increase and the largest since September 2020, buoyed by higher activity across the board.

Oil sands extraction increased 5.6% in April, the largest monthly increase since September 2020. High levels of synthetic oil production and crude bitumen extraction in Alberta contributed the most to the growth. Oil and gas extraction (except oil sands) grew 1.6%, as both crude petroleum and natural gas extraction were up. Support activities for mining, and oil and gas extraction were also up (+6.2%), as all types of services were up.

Mining and quarrying (except oil and gas) edged up 0.2% in April, as a result of increases in non-metallic mineral mining and quarrying, and in coal mining.

Non-metallic mineral mining and quarrying increased 3.6%, fully offsetting a 2.9% decline in March, as potash (+3.9%) mining led the growth.

Accommodation and food services keeps growing

The accommodation and food services sector expanded 4.6% in April, up for a third consecutive month, as both subsectors contributed to the growth.

Food services and drinking places expanded 3.5%, as activity grew in every province and territory. With a third consecutive monthly growth, the subsector surpassed the pre-COVID-19 pandemic level of activity in April.

Accommodation services grew 7.2% in April, driven by increased activity in traveller accommodation as travel restrictions continued to ease, lifting travel activity.

Arts, entertainment and recreation expands

The arts, entertainment and recreation sector increased 7.0% in April, a third consecutive increase, as all subsectors were up. Nevertheless, the sector is still 12% below its February 2020 levels.

Performing arts, sports and related industries and heritage institutions (+11.7%) contributed the most to the growth in April, led by spectator sports. The Toronto Raptors qualified for the NBA playoffs this year, playing late into April in their home arena in front of full crowds for the first time since winning a championship in 2019. Additionally, a number of minor hockey leagues extended their seasons into April to complete postponed games due to lockdown-related restrictions earlier in the year.

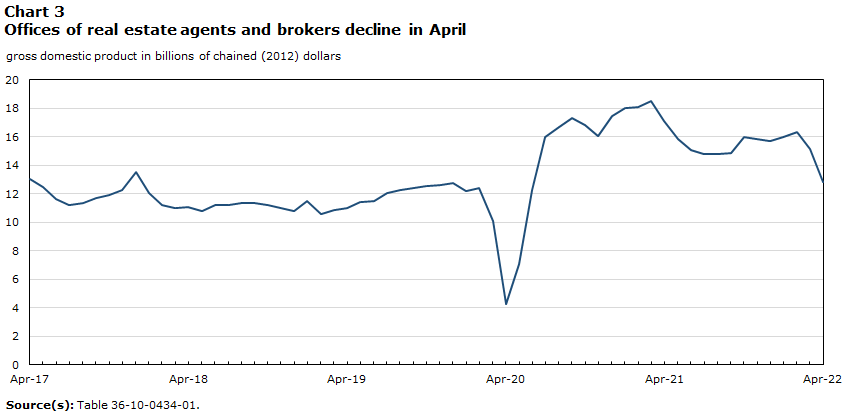

Real estate and rental and leasing contracts

Real estate contracted 0.8% in April, the largest monthly decline since April 2020, down for the second month in a row after a period of eight monthly increases.

Activity at the offices of real estate agents and brokers dropped 15.0% in April, the largest contraction since April 2020. The rising cost of borrowing contributed towards a continued cooling of the home resale market across the country, with Ontario, British Columbia and Alberta accounting for most of the decline.

Finance is down for the first time in eleven months

The finance and insurance sector contracted for the first time in ten months, down 0.7% in April. A pull-back in the sector followed an elevated level of activity in March spurred on by an unprecedented net inflow of funds in the Canadian economy. With the Canadian central bank ending quantitative easing and hiking the overnight lending rate in April, activity in the bond and other financial instruments markets cooled down. Activity in financial investment services, funds and other financial vehicles contracted 1.8% in April, while credit intermediation and monetary authority contracted 0.4% despite an increase in household mortgage debt as well as in deposits and other consumer debt.

Construction is essentially unchanged

The construction sector was essentially unchanged in April, following three months of growth as subsectors were evenly split between increases and decreases.

Residential building construction contracted 1.2% in April following three months of growth. Weaker activity in home alterations and improvements more than offset across the board expansions in all types of new residential building construction.

Repair construction was down for the first time in four months, decreasing 1.5% in April, as contractions in both the residential and non-residential repair activities contributed to the decline.

Engineering and other construction activities increased 1.5% in April and has expanded continuously since December 2020. Non-residential building construction also rose (+1.4%) in April, as all types of new non-residential building construction were up.

The transportation and warehousing sector expands

The transportation and warehousing sector rose 2.2% in April, up for a third month in a row, as 8 of 10 subsectors were up.

Air transportation expanded 20.0% in April as airlines continued carrying more goods and passengers, as demand for air travel grew for the third month in a row.

Transit, ground passenger, and scenic and sightseeing transportation expanded 6.6% in April, up for the third month in a row, benefitting from an increase in public transit ridership.

Rail transportation rose 3.6%, up for the third time in four months. Higher rail movement of petroleum, chemicals, metals and minerals products along with coal and intermodal freight contributed towards the growth in April.

Postal services contracted 1.8% in April, down for the second time in three months.

Retail trade rebounds

Retail trade rose 0.9% in April, more than offsetting the previous two months of decline, as 7 of 12 subsectors were up.

General merchandise (+4.5%) and miscellaneous retailing (+9.5%) led the growth, while activity at gasoline stations also rose (+5.3%) as domestic travel along with a gradual return to work in offices contributed towards the increased demand at the pumps. Clothing and clothing accessories stores rose 1.7%, pushed up by a higher demand at jewellery, luggage and leather goods stores, driven by travel accessory sales such as luggage.

Building material and supplies retailing declined 4.8% in April, its first decline in four months, but activity levels remain high. Motor vehicle and parts retailing contracted for the third month in a row, down 0.8% in April, as continued lack of inventory supressed the activity at new cars dealers and automotive parts and accessories stores.

Manufacturing keeps growing

The manufacturing sector increased 0.3% in April, a seventh consecutive monthly growth, as higher durable-goods manufacturing offset a decrease in non-durable-goods manufacturing.

Durable-goods manufacturing grew 0.8% in April, with 7 of 10 subsectors posting increases.

Non-durable-goods manufacturing edged down 0.2% in April, driven by a decrease in chemical manufacturing and a contraction in plastics and rubber products manufacturing. Higher petroleum and coal product manufacturing and beverage and tobacco manufacturing offset some of the declines.