Investment in Building Construction Declined 0.1% in November

Jan 13, 2021

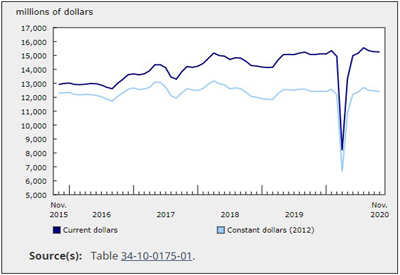

Total investment in building construction declined for a third consecutive month, edging down 0.1% to $15.3 billion in November. Slight decreases in both residential and non-residential construction led to minimal change overall. Gains in Ontario and Nova Scotia were offset in large part by declines in six provinces.

On a constant dollar basis (2012=100), investment in building construction decreased 0.3% to $12.4 billion in November.

Non-residential investment unchanged

Non-residential investment was mostly unchanged in November, remaining at $4.4 billion. Slight declines in six provinces were offset by small gains in Ontario (+0.4% to $1.8 billion) and British Columbia (+1.0% to $665 million).

As lockdowns and working from home continued across many parts of the country, reduced investment in office buildings, hotels and restaurants led to an overall reduction in commercial building investment (-0.5%). Commercial building investment was the lone component of non-residential construction to decline in November and remained below pre-COVID-19 levels (-13.5% compared with March 2020).

Investment in industrial building construction increased 0.6% in November, with the majority of the growth in Ontario (+1.7% to $339 million) and Quebec (+1.5% to $215 million). The increases reported in Ontario were attributable primarily to the construction of the $100 million Metrolinx Keelesdale transit station in the city of Toronto.

Institutional building investment advanced 0.4%—the first increase in this component following four months of declines. The majority of the growth was reported in Alberta (+2.6%) and British Columbia (+1.5%), stemming from new construction of educational buildings in both provinces and welfare homes in British Columbia.

Residential construction declines slightly

Investment in residential construction edged down 0.1% in November, declining for the first time in six months. Lower investment in multi-unit dwellings more than offset the growth reported for single-unit investment. Provincially, Manitoba reported the largest decline (-7.8% to $402 million), followed by Quebec (-1.1% to $2.3 billion). Meanwhile, Nova Scotia reached its second-highest value on record, up 15.2% to $271 million.

Despite the exceptional COVID-19-related decline in April 2020, year-over-year investment in single-unit buildings increased 9.4%. In November, single-unit investment was up 2.1% to $5.6 billion. The construction of new single family homes in Toronto led to an increase of 2.1% in Ontario—the largest increase of all the provinces.

Multi-unit construction investment declined for the second consecutive month in November, down 2.2% to $5.2 billion, and offsetting the growth observed in single-unit investment. Manitoba, Quebec, and Alberta reported the largest drops of the five provinces reporting declines in this component.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210112/dq210112a-eng.htm