Gross Domestic Product by Industry, July 2025

September 29, 2025

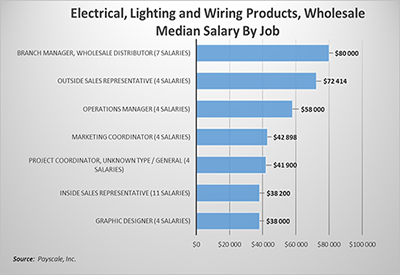

Real gross domestic product (GDP) grew 0.2% in July, after edging down (-0.1%) in June. The first increase in four months was predominantly driven by expansion in the goods-producing industries.

Goods-producing industries rebounded with a 0.6% increase in July, following three consecutive months of contraction, as all sectors in this grouping expanded. Services-producing industries edged up 0.1% in July, with increases in wholesale trade and real estate and rental and leasing tempered by a decline in retail trade. Overall, 11 of 20 industrial sectors expanded in July.

Chart 1

Real gross domestic product expands for the first time in four months in July

Mining, quarrying, and oil and gas extraction sector lead the growth in July

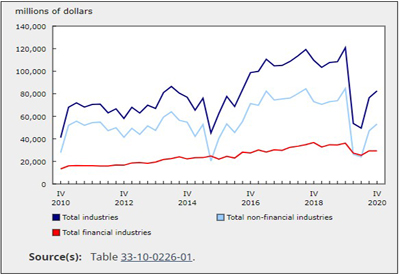

The mining, quarrying, and oil and gas extraction sector expanded 1.4% in July, driven by broad-based expansions across all subsectors.

Chart 2

Mining, quarrying, and oil and gas extraction sector expands in July

Mining and quarrying (except oil and gas) rose 2.6% in July, following back-to-back declines, with metal ore mining (+2.6%) leading the growth.

The oil and gas extraction subsector grew 0.9% in July, on continued strength in oil sands extraction. Oil sands extraction expanded 1.2%, as oil extraction facilities continued to ramp up production of synthetic crude oil and crude bitumen extraction, following the completion of retooling and maintenance activities that took place throughout April and May. Oil and gas extraction (except oil sands) rose 0.6%, reflecting increased extractions of natural gas and crude petroleum in July.

Transportation and warehousing expands

Transportation and warehousing rose 0.6% in July, following a 0.7% drop in June.

Pipeline transportation (+2.8%) drove the increase, marking its largest growth since September 2022. Expansions in crude oil and other pipeline transportation (+3.3%) as well as pipeline transportation of natural gas (+2.3%) drove the growth in July, coinciding with increased exports of crude oil, bitumen and natural gas.

Support activities for transportation rose 1.0% in July. This was the largest growth rate for the subsector since April 2024, reflecting in part the higher activity at the LNG Canada facility in Kitimat, which completed its first full month of operations in July. Rail transportation (+1.1%) further contributed to the increase in July, partially recouping the decline recorded in the preceding month.

Manufacturing sector up in July, led by increases in most subsectors

The manufacturing sector rose 0.7% in July, partially offsetting a 1.5% contraction in June, driven by increases in both durable and non-durable manufacturing industries.

Durable-goods manufacturing industries grew 1.0% in July. Transportation equipment manufacturing (+3.2%) led the growth, driven by expansions in motor vehicle parts (+10.5%) and motor vehicle (+9.1%) manufacturing, coinciding with higher exports of motor vehicles and parts. July typically sees planned temporary shutdowns at motor vehicle assembly plants in Ontario.

However, the impact of these seasonal closures was less pronounced this year due to the continued production slowdown, influenced by factors such as the new tariffs imposed by the United States. Primary metal manufacturing (-5.5%) tempered some of the growth; iron and steel mills and ferro-alloy manufacturing (-19.1%) recorded its steepest decline since April 2020, coinciding with lower exports of steel products, as the US tariffs on Canadian steel imports doubled to 50% at the beginning of June.

Non-durable goods manufacturing rose 0.4% in July. Chemical manufacturing (+4.8%) contributed the most to the increase, as pharmaceutical and medicine manufacturing expanded 12.6% in the month, offsetting most of the decline recorded in June.

Wholesale trade up in July

The wholesale trade sector increased by 0.6% in July, up for the third consecutive month. Motor vehicle and parts wholesalers (+5.4%) led the growth in July, in parallel with increased production and exports of motor vehicles and parts. Building material and supplies wholesalers grew 2.5%, in large part on the strengths of lumber and millwork, coinciding with higher exports and imports of lumber and other sawmills products in the month.

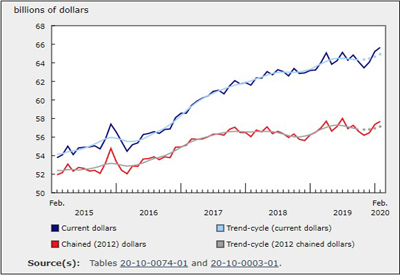

Real estate and rental and leasing posts a new record high for the second consecutive month

Real estate and rental and leasing (+0.3% in July) grew for the fourth consecutive month. Growth in July was driven in large part by higher activity at the offices of real estate agents and brokers and activities related to real estate (+3.6%). The fourth consecutive monthly increase in the industry group reflected rising home resales across the country, particularly in large markets in Ontario and British Columbia. Legal services, which derives much of its operations from real estate transactions, rose 0.5% in July.

Chart 3

Real estate and rental and leasing sector grows for the fourth month in a row in July

Retail trade down in July on widespread contractions

A decline in the retail trade sector (-1.0%) tempered the growth in the overall economy in July and partially offset the increase recorded in June.

After leading the growth in June, food and beverage stores (-2.0%) was one of the largest contributors to the decrease in July, driven in large part by weaker retailing activity in supermarkets and other grocery retailers. Clothing and clothing accessories stores (-3.4%), sporting goods, hobby, book and music stores (-8.2%) and building material and garden equipment and supplies dealers (-1.5%) further contributed to the decline in the sector, following increases in June. Meanwhile, an increase in non-store retailers (+2.4%) tempered the decline in the overall sector in July.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in July

Advance estimate for real gross domestic product by industry for August 2025

Advance information indicates that real GDP was essentially unchanged in August. Increases in wholesale trade and retail trade were offset by decreases in mining, quarrying, and oil and gas extraction, manufacturing, and transportation and warehousing. Owing to its preliminary nature, this estimate will be updated on October 31, 2025, with the release of the official GDP by industry data for August.