Gross Domestic Product by Industry, April 2024

July 2, 2024

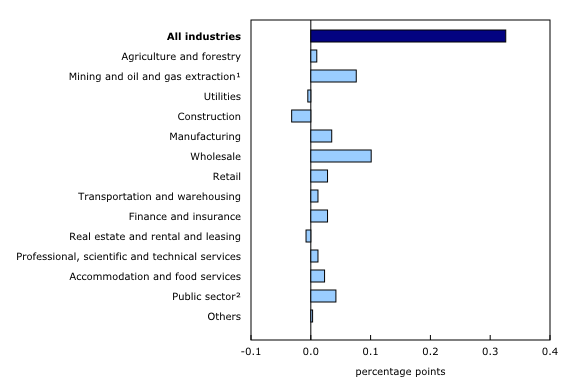

Real gross domestic product (GDP) grew 0.3% in April, after being essentially unchanged in March. Both goods-producing (+0.3%) and services-producing (+0.3%) industries contributed to the growth with 15 of 20 sectors increasing in the month.

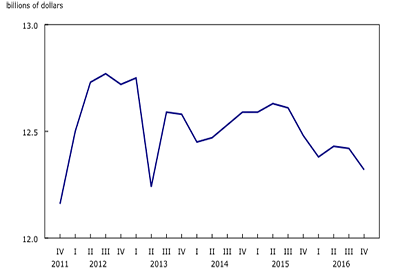

Chart 1

Real gross domestic product grows in April

Rebounds in several industries contribute to the gain

Wholesale trade, mining, quarrying, and oil and gas extraction and manufacturing were the largest contributors to growth in April after recording declines in the previous month. Following two consecutive monthly decreases, retail trade was also among the top drivers of growth in April, led by food and beverage retailers and gasoline stations which rebounded from declines recorded in previous months.

Wholesale trade expands on increases in most subsectors

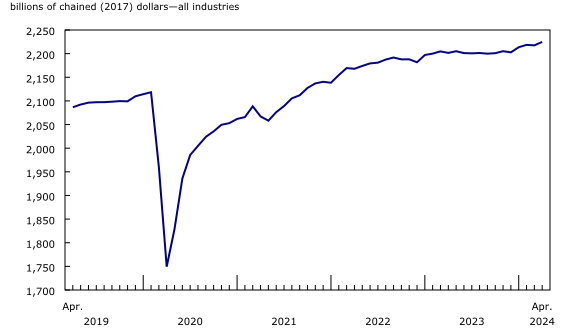

Chart 2

Wholesale trade expands on increases in most of its subsectors in April

Wholesale trade expanded 2.0% in April, which more than offset the decrease in March, with most subsectors posting increases in April. Motor vehicle and motor vehicle parts and accessories wholesaling (+8.0%) led the growth, with its largest monthly growth rate since October 2021. The motor vehicle industry group was the largest contributor to growth in the sector in April 2024, and increased activity coincided with an increase in motor vehicle manufacturing as well as an increase in imports of passenger cars and light trucks.

Personal and household goods rose 3.5% in April, further contributing to the sector’s growth, as higher personal goods, toiletries and cosmetics, and pharmaceutical wholesaling led the gain.

Mining, quarrying, and oil and gas extraction rises in April

Mining, quarrying, and oil and gas extraction rose 1.8% in April in large part due to increases in support activities for mining and oil and gas extraction (+6.9%). The rise was buoyed by broad-based expansion in all forms of supporting activities.

The oil and gas extraction subsector grew 1.2% in April, up for the sixth time in seven months, with the increase largely driven by oil sands extraction. The subsector expanded 2.1% in April, led by higher synthetic crude production and crude bitumen extraction in Alberta. Oil and gas extraction (except oil sands) also contributed to the gain, rising 0.4% in April, as higher oil extraction off Newfoundland and Labrador’s coast more than offset lower oil extraction in Western Canada.

Mining and quarrying (except oil and gas) increased 0.3% in April after contracting in March. Growth in metal ore mining (+1.6%) and coal mining (+2.4%) was partially offset by a decrease in non-metallic mineral mining and quarrying (-4.0%) as temporary shutdowns at potash and salt mines led to lower production in the month.

Manufacturing sector rises in April

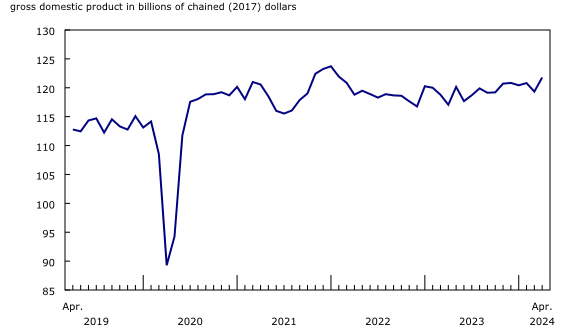

Chart 3

Manufacturing sector expands in April

After contracting for two consecutive months, the manufacturing sector expanded 0.4% in April. Coming off of four consecutive monthly declines, the durable goods manufacturing aggregate (+0.6%) contributed the most to growth, with transportation equipment manufacturing (+1.9%) driving the gain. Despite ongoing retooling activities, the motor vehicle and parts industry increased production in the month.

Non-durable goods manufacturing rose 0.2% in April following two consecutive monthly declines. Chemical manufacturing (+2.6%) contributed the most to growth, driven by a gain in pharmaceutical and medicine manufacturing which rebounded from a decline in the previous month. Petroleum and coal product manufacturing (-3.6%) tempered growth in the non-durable goods manufacturing aggregate, with petroleum refineries declining 4.9% in April. A larger-than-normal number of facilities undertook spring turnaround and maintenance in the month. This was the largest contraction for the subsector since April 2021.

Finance and insurance increases for the second time in three months

Finance and insurance increased 0.4% in April 2024, following a 0.3% decline in March. Financial investment services, funds and other financial vehicles increased 1.5% in April, reflecting volatility in financial markets that occurred in the month. Ongoing geopolitical tensions as well as uncertainty regarding interest rate announcements led to higher-than-normal activity in North American markets in April.

Arts, entertainment and recreation continue to grow, buoyed by spectator sports

The arts, entertainment and recreation sector (+0.9%) rose for the second consecutive month in April. Contributing the most to the growth in April was an increase in spectator sports as four Canadian hockey teams qualified for the National Hockey League playoffs that started in the second half of the month.

The accommodation and food services sector (+1.2%) also expanded in April, as both the accommodation services subsector (+2.1%) and the food services and drinking places subsector (+0.9%) rose.

Construction down in April as residential building construction contracts

The construction sector was down 0.4% in April, after recording in March its largest growth rate since October 2022. Residential building construction was the main source of the decline in the sector, contracting 2.3% in April 2024, which was its largest decline since May 2023. The decline in April 2024 reflected decreased activity in the construction of new single and multi-unit family homes and in home alterations and improvement. The subsector’s activity level in April was close to 24% below its peak observed in April 2021.

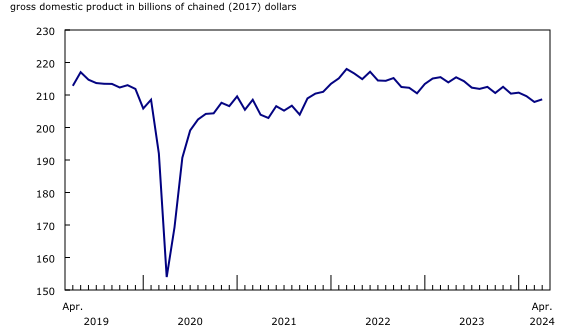

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in April

Advance estimate for real gross domestic product by industry for May 2024

Advance information indicates that real GDP rose 0.1% in May. Increases in manufacturing, real estate and rental and leasing and finance and insurance were partially offset by decreases in retail trade and wholesale trade. Owing to its preliminary nature, this estimate will be updated on July 31, 2024, with the release of the official GDP by industry data for May.