GDP Rose 0.3% in December

Feb 28, 2020

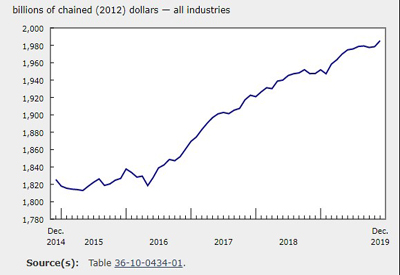

Real gross domestic product (GDP) increased 0.3% in December, after edging up 0.1% in November, as 15 of 20 industrial sectors grew.

Both goods-producing and services-producing industries grew, led by rebounds in transportation and warehousing and in the mining, quarrying, and oil and gas extraction sector.

Wholesale and retail trade grow

Wholesale trade rose 0.8% in December following two months of decline as five of nine subsectors increased. Miscellaneous wholesaling (+3.6%), building material and supplies (+2.0%) and food, beverage and tobacco wholesaling (+2.2%) contributed the most to the increase, while machinery, equipment and supplies (-0.4%) and personal and household goods wholesaling (-0.1%) offset some of the growth.

Retail edged up 0.2% in December as activity in 9 of 12 subsectors increased. Leading the growth were building material and garden equipment and supplies (+2.5%) with a second consecutive monthly increase. Activity in store types typically associated with the holiday season was up as clothing and clothing accessories stores (+1.1%), sporting goods, hobby, book and music stores (+1.7%), and electronics and appliance stores (+0.3%) increased. Motor vehicle and parts dealers were down 1.2%, partly offsetting a 2.2% increase in November, as gains at new car dealers were fully offset by declines in other industries. Gasoline stations were down 3.9%, the largest decline since October 2015.

Transportation and warehousing fully recoups the November decline

Transportation and warehousing rose 1.5% in December, the largest increase since March, as production resumed following events that reduced output in November. Rail transportation was up 9.5%, reversing a 4.6% decline in November as an eight-day strike by CN rail workers reduced Canada’s rail transportation capacity. Pipeline transportation increased 4.0% as pipeline transportation of natural gas, as well as crude oil and other pipeline transportation, both increased in December, following November’s closure of the Keystone pipeline. Postal service and couriers and messengers (+2.3%), air transportation (+0.9%) and truck transportation (+0.3%) were up, while support activities for transportation (-0.6%) declined.

Mining, quarrying and oil and gas extraction is up

The mining, quarrying, and oil and gas extraction sector was up 1.3% in December, partially offsetting November’s 1.6% contraction, as all subsectors grew.

Support activities for mining and oil and gas extraction rose 6.9% from higher drilling and rigging services. Oil and gas extraction increased 0.5%, up for a fourth consecutive month, as oil sands extraction grew 4.7% driven by higher crude bitumen and synthetic oil production in Alberta. Partly offsetting the growth was a 3.7% contraction in oil and gas extraction (except oil sands). Crude petroleum extraction at Canada’s North Atlantic facilities declined in December following a period of increased production.

Mining and quarrying (except oil and gas) was up 0.5% in December, continuing its sequence of increases alternating with decreases since April. Metal ore mining, up for the third time in four months, rose 1.7% in December as higher iron ore and other metal ore mining more than offset lower copper, nickel, lead and zinc ore, and gold and silver ore mining. Coal mining increased 3.9%, up for the third consecutive month. Non-metallic mineral mining (-3.5%) contracted for the fourth consecutive month. Potash mining (-6.3%) was down for a fourth month in a row as temporary shutdowns at a number of mines in Saskatchewan lowered output, reflecting soft international demand for the mineral.

Finance and insurance sector continues to grow

The finance and insurance sector increased 0.7% in December, the largest gain since March, on widespread growth across all subsectors. Atypical high trading activity in securities markets, such as the money market and the repo bond market, contributed to a 2.1% growth in financial investment services and a 0.6% gain in depository credit intermediation and monetary authorities. Insurance carriers and related activities were up for the third consecutive month, increasing 0.2% in December.

Manufacturing grows

Following three consecutive monthly declines, the manufacturing sector increased 0.4% in December as a growth in non-durable manufacturing more than offset a decline in durable manufacturing.

Non-durable manufacturing rose 1.4% in December, the largest increase since June 2018, as six of nine subsectors were up. Chemical manufacturing posted the largest increase (+6.1%), its highest rate of growth since February 2016, as the majority of industries recorded gains. Pharmaceutical and medicine (+11.5%), basic chemical (+9.7%) and resin, synthetic rubber and artificial and synthetic fibers and filaments (+4.8%) manufacturing contributed the most to the growth. Food (+1.6%), beverage and tobacco (+6.3%) and petroleum and coal products (+2.1%) manufacturing positively influenced the increase, while plastic and rubber products manufacturing (-7.1%), printing and related support activities (-8.2%) and paper manufacturing (-1.3%) declined.

Durable manufacturing was down 0.5% in December as the 10 subsectors were evenly split between increases and decreases. A 2.9% contraction in the transportation equipment manufacturing subsector contributed the most to the decline, as five of seven industries decreased. Lower production mostly attributable to longer seasonal plant shutdowns, and to a lesser extent, the closure of the General Motors Oshawa assembly plant contributed to declines in motor vehicle assembly (-5.0%) and motor vehicle parts manufacturing (-3.2%). Primary metal manufacturing rose 5.5% in December, partly offsetting the previous two months of decline. Non-metallic mineral products (+7.2%), miscellaneous (+6.7%) and wood products (+1.9%) manufacturing were up, offsetting some of the declines.

Wholesale and retail trade grow

Wholesale trade rose 0.8% in December following two months of decline as five of nine subsectors increased. Miscellaneous wholesaling (+3.6%), building material and supplies (+2.0%) and food, beverage and tobacco wholesaling (+2.2%) contributed the most to the increase, while machinery, equipment and supplies (-0.4%) and personal and household goods wholesaling (-0.1%) offset some of the growth.

Retail edged up 0.2% in December as activity in 9 of 12 subsectors increased. Leading the growth were building material and garden equipment and supplies (+2.5%) with a second consecutive monthly increase. Activity in store types typically associated with the holiday season was up as clothing and clothing accessories stores (+1.1%), sporting goods, hobby, book and music stores (+1.7%), and electronics and appliance stores (+0.3%) increased. Motor vehicle and parts dealers were down 1.2%, partly offsetting a 2.2% increase in November, as gains at new car dealers were fully offset by declines in other industries. Gasoline stations were down 3.9%, the largest decline since October 2015.

Construction grows

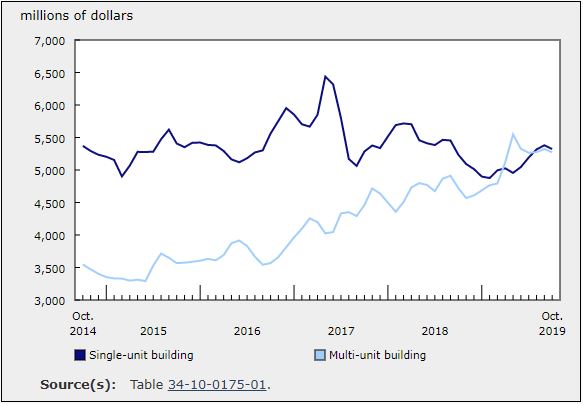

Construction edged up 0.2% with increases in a majority of subsectors. Residential construction expanded 0.9% as increases in multi-unit dwellings and home alternations and improvements fully offset lower single-unit dwellings construction. Non-residential construction increased 0.6%, up for a fourth consecutive month, as all types of non-residential construction rose. Repair construction was up 0.6%, while engineering and other construction contracted 0.9%.

Other industries

The professional, scientific and technical services sector was up 0.3%, continuing its uninterrupted growth since November 2017, led by increases in computer systems design and related services (+0.8%) and legal services (+0.9%).

For the tenth consecutive month activity at the offices of real estate agents and brokers grew, up 0.5% in December, mainly as a result of higher housing resale activity in the Lower Mainland of British Columbia, Calgary and Montréal.

The performing arts, spectator sports and heritage institutions industry rose 2.3% in December. Contributing to the growth was a higher number of NHL and NBAgames in the month, including the NBA’s Toronto Raptors hosting their first ever prime-time Christmas Day game.

Utilities declined 0.5% in December, following a 1.4% growth in November.

Fourth quarter of 2019

The value added of goods-producing industries was down for the fourth time in five quarters, declining 0.6% in the fourth quarter. Services-producing industries were up 0.4%, the lowest growth since the first quarter of 2019. Overall, there were gains in 13 of 20 industrial sectors.

Manufacturing (-0.9%) contributed the most to the decline for goods-producing industries, falling for the third quarter in a row. Durable manufacturing declined 1.3%, as 7 of 10 subsectors contracted with notable decreases in machinery (-5.0%) and transportation equipment (-1.3%). Declines in the latter were a result of decreases in motor vehicles and parts manufacturing (-3.2%), as Canadian motor vehicle and part producers scaled back production due to the United Auto Workers strike in October. Non-durable manufacturing (-0.5%) was down for the fifth quarter in a row with declines in 5 of 9 subsectors, led by plastics and rubber (-2.6%) and beverage and tobacco (-3.1%) manufacturing.

Mining, quarrying and oil and gas extraction was down 0.5%, falling for the fourth time in five quarters. Mining and quarrying (excluding oil and gas) decreased 4.1% due in large part to declines in non-metallic mineral mining (-15.0%) as a result of multiple potash mine closures in November. Oil and gas extraction increased 1.0% as North Atlantic offshore production facilities resumed production following shutdowns and maintenance last quarter. Support activities for mining and oil and gas extraction were up 0.6%.

Construction declined 0.4% after posting gains in the previous three quarters, with contractions in both residential (-0.6%) and engineering and other construction activities (-0.9%). Agriculture, forestry, fishing and hunting was down 1.2%, while utilities increased 0.2%.

Real estate and rental and leasing (+0.6%) increased for the seventh quarter in a row as housing resale activity continued to increase across the country. Widespread growth among subsectors led to increases in professional, scientific and technical services (+1.1%) and in finance and insurance (+0.9%). Transportation and warehousing edged up 0.2% as declines in rail transportation (-3.7%), coinciding with a week-long rail strike in November, were offset by increases in air transportation (+3.4%) and transit, ground passenger and scenic and sightseeing transportation (+1.2%).

Wholesale trade (-1.2%) had its first decline in four quarters due to decreases in motor vehicle and parts (-3.8%) and personal and household goods (-2.2%). Retail trade declined 0.6% as a result of decreases at health and personal care stores (-1.8%) and non-store retailers (-2.6%).

Annual 2019

Growth was widespread in 2019 with 16 of 20 sectors increasing. The value-added of services-producing industries grew 2.5%, while goods-producing industries were down 0.9% following increases in 2017 and 2018.

The largest contributor to the declines in goods-producing industries was mining, quarrying and oil and gas extraction (-5.1%), offsetting the increase in 2018. Support activities for mining, oil and gas extraction were down 30% following increases in 2017 and 2018, as production cuts in Alberta contributed to the decline. Mining and quarrying (except oil and gas) (-2.3%) was driven by declines in diamond and potash mining, as multiple potash mines were closed in November. Oil and gas extraction (+1.2%) was up for the seventh year in a row. Oil and gas extraction (except oil sands) increased 2.4%, as crude petroleum production at offshore North Atlantic facilities increased in the fourth quarter. Construction declined 0.4%, its first decrease since 2016, with declines in residential (-2.0%) and non-residential (-0.6%) construction. Manufacturing was essentially unchanged in 2019 as an increase in durable manufacturing was offset by a decline in non-durable manufacturing.

The value-added of services-producing industries was up in all but one of its sectors, led by real estate and rental and leasing (+2.6%), reflecting the partial recovery at offices of real estate agents and brokers (+5.6%) after the 2018 mortgage stress test was implemented. The public sector (education, health care and public administration) was up 2.6% in 2019, with all three components increasing. Professional, scientific and technical services (+4.5%) posted its largest growth since 2014, up every month in 2019. The transportation and warehousing sector recorded a 1.1% gain, the weakest growth since 2009, reflecting in part events that disrupted transportation throughout the year such as a week-long rail strike, adverse weather and a train derailment. Both wholesale (+2.8%) and finance and insurance (+2.9%) posted stronger gains than in 2018.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200228/dq200228b-eng.htm