Fewer Businesses Closed in June and More Opened

Sept 28, 2020

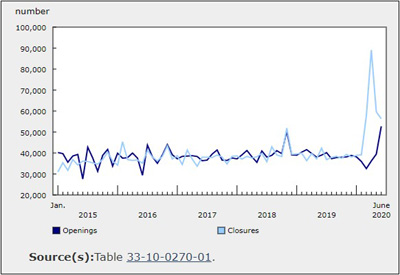

The June estimates of business openings and closures show that, with the continued easing of COVID-19 restrictions, there was a slight decrease in business closures and a large increase in business openings from May to June.

In June, 56,296 business closures were observed in the Canadian business sector, 5.6% less than was observed in May, but still 44.0% higher than the pre-COVID-19 level observed in February. By comparison, the number of business openings increased by 33.7% from May.

The June estimates for the experimental series on monthly openings and closings are now available. The series include monthly estimates of the number of business openings and closures, continuing businesses, and active businesses from January 2015 to June 2020.

With the exception of Quebec, which recorded a slight increase in business closures of 2.0% since May, every province and territory continued to record fewer business closures. The largest decreases since the previous month occurred in Nova Scotia (-29.3%; -403), Newfoundland and Labrador (-21.5%; -199), and Alberta (-19.5%; -1,688). For Quebec, the increase in business closures is largely due to an increase in other services, in transportation and warehousing, and in wholesale trade.

In all provinces and territories, with the exception of Prince Edward Island and the Yukon, the number of business closures remains higher than the pre-COVID level of February. For instance, in Ontario, the level of business closures in June was 47.0% greater than the February level.

The number of business closures continued to decrease in Toronto and Vancouver from May to June, by 1,578 (-10.8%) and 445 (-8.2%), respectively. Meanwhile, the number of businesses that closed in Montréal increased by 279 (+3.9%).

At the industry level, there were fewer business closures in June than in May in most industries. Declines continued to be observed in the most impacted industries in terms of business closures in April: there were 2,205 (-28.6%) fewer business closures observed in accommodation and food services, 2,229 (-31.7%) fewer in other services, which include personal services, and 888 (-14.6%) fewer in retail trade. In accommodation and food services, the number of business closures remains more than double the pre-pandemic level, while these are less than double in all other industries.

Business openings largely increased in June. There were 52,723 business openings in June, an increase of 33.7% compared with May. At the provincial level, the largest increases in business openings were observed in Nova Scotia (+79.9%; +599), Ontario (+40.5%; +5,912) and Saskatchewan (+30.9%; +362).

Nearly one in five businesses that closed in March and April re-opened by June

With the gradual re-opening of the economy following the onset of the pandemic, it was anticipated that some businesses that closed temporarily in March and April would re-open in May and June. This can be examined using the new series on monthly business openings and closures.

In February, there were nearly 800,000 active businesses in the business sector. In March, 8.3% of these businesses closed and a further 9.2% closed in April, leading to a total share of 17.4% of businesses that closed. Since then, 4.1% of these businesses re-opened in April (i.e., those that closed in March), 7.4% re-opened in May and 7.6% re-opened in June. As a result, 14.1% of businesses that were active in February remain closed as of June. In other words, of the 17.4% of businesses that closed in March and April, roughly one in five have re-opened.

There is variability not only in the share of businesses that closed at the industry level, but also in terms of the share of businesses that re-opened. Among businesses that were active in February, the largest share of business closures occurred in accommodation and food services (22.8%), transportation and warehousing (20.6%) and other services (19.5%). In contrast, the proportion of these active businesses that closed in March and April was lowest in utilities (8.2%), wholesale trade (11.0%) and manufacturing (11.7%).

Businesses re-opened across all industries, with the greatest proportion occurring in utilities, forestry, fishing and hunting, and construction, which represented more than one-quarter of businesses that closed in March and in April in those industries. In accommodation and food services, transportation and warehousing, and other services, fewer than one in five businesses re-opened.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200928/dq200928b-eng.htm