Canadian Gross Domestic Product, Income and Expenditure, First Quarter 2021

June 1, 2021

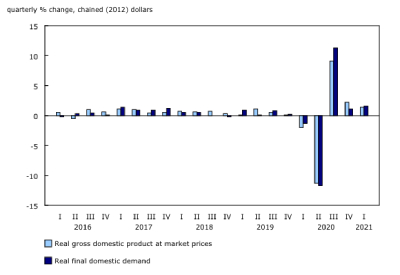

Real gross domestic product (GDP) grew 1.4% in the first quarter of 2021, following increases of 9.1% in the third quarter and 2.2% in the fourth quarter of 2020. These gains more than offset the sharp drop (-11.3%) in the second quarter of 2020. Real GDP was up 0.3% compared with the first quarter of 2020.

Real gross national income rose 2.7%, largely fuelled by higher prices of exported products, including crude oil, crude bitumen and refined petroleum. Final domestic demand rose 1.6%, primarily because of higher housing investment and consumer spending.

The increase in GDP in the first quarter of 2021 reflected the continued strength of the economy, influenced by favourable mortgage rates, continued government transfers to households and businesses, and an improved labour market. These factors boosted the demand for housing investment, while rising input costs heightened construction costs.

Record gains in prices and nominal gross domestic product

The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 2.9% in the first quarter, driven by higher prices for construction materials and for energy used in Canada and exported. The sharp increase in prices boosted nominal GDP (+4.3%). Compensation of employees rose 2.1%, led by construction and information and cultural industries, and surpassed the pre-pandemic level recorded at the end of 2019.

Strength in oil and gas extraction, manufacturing of petroleum products, and construction industries led to a higher gross operating surplus for non-financial corporations (+11.5%). Higher earnings from commissions and fees bolstered the operating surplus of financial corporations (+3.9%), coinciding with the sizeable increases in the value and volume of stocks traded on the Toronto Stock Exchange (TSX).

Strong growth in housing for the third consecutive quarter

On a real basis, housing investment rose 9.4%, after increasing 29.6% in the third quarter and rising 4.0% in the fourth quarter of 2020. Compared with the first quarter of 2020, housing investment was up 26.5% and led the recovery. Growth in housing was attributable to an improved job market, higher compensation of employees, and low mortgage rates. After adding $63.6 billion of residential mortgage debt in the last half of 2020, households added $29.6 billion more in the first quarter of 2021.

Growth in housing investment was broad-based. New construction rose 8.7%, largely driven by detached units in Ontario and Quebec. Ownership transfer costs increased 13.1%, with the rise in resale activities. Working from home and extra savings from reduced travel heightened the demand for, and scope of, home renovations, which grew 7.0% in the first quarter.

Household spending rises

On a real basis, household spending increased 0.7% in the first quarter. Spending was down 1.9% compared with the first quarter of 2020.

Outlays for durable goods rose 1.4%, led by increases in purchases of new trucks, vans and sport utility vehicles (+2.8%), information processing equipment (+18.7%) and major tools and equipment (+13.8%). Spending on durable goods was up 22.3% compared with the first quarter of 2020.

Outlays for semi-durable goods rose 0.9%, following a 3.4% drop in the previous quarter. A decline in clothing and footwear (-6.1%) was offset by increases in games, toys and hobbies (+25.0%), and equipment for sports, camping and open-air recreation (+9.8%). These opposing movements reflect pandemic-induced shifts in spending patterns. Spending on semi-durable goods was up 9.0% compared with the first quarter of 2020.

Outlays for non-durable goods rose 1.0%, after increasing 1.4% in the fourth quarter of 2020. As consumers spent more time at home, spending on food (+2.5%) and alcoholic beverages (+4.2%) rose. Overall, spending on non-durable goods was up 3.0% compared with the first quarter of 2020.

Outlays on services edged up 0.2% in the first quarter, following a 0.3% gain in the previous quarter. Increases in outpatient services (+4.3%) and insurance and financial services (+1.7%) were largely offset by lower spending on games of chance (-20.5%) and transport services (-8.9%). Overall, spending on services was down 10.2% compared with the first quarter of 2020.

Business investment in machinery and equipment falls

On a real basis, business investment in machinery and equipment fell 2.7% in the first quarter, because of a sharp decline in investment in aircraft (-98.7%), as a large number of used aircraft were disposed of through international exports. All other categories of machinery and equipment, such as industrial machinery and equipment, computers, and medium and heavy trucks and buses, rose.

Business investment in non-residential structures increased 0.6%, following three consecutive quarterly declines. Investment in intellectual property products rose 3.3%, with a substantial gain in investment in research and development.

Businesses drew down $8.7 billion of inventories. Larger drawdowns of inventories in manufacturing and retail industries were slightly offset by an accumulation of inventories in the wholesale of durable and non-durable goods. Consequently, the economy-wide stock-to-sales ratio fell from 0.831 in the fourth quarter of 2020 to 0.813 in the first quarter of 2021.

Exports and imports rise

Export volumes rose 1.5% in the first quarter, but were down 3.0% compared with the first quarter of 2020. Increased exports of aircraft (+33.9%), other transportation equipment including ships and boats (+124.6%), and crude oil and crude bitumen (+5.2%) were partly offset by declines in exports of passenger cars and light trucks (-9.9%).

Import volumes increased 1.1% in the first quarter, but were down 2.8% compared with the first quarter of 2020. Intermediate metal products (+9.3%) posted a notable gain, driven by computers and computer peripherals (+9.1%), and commercial services (+3.3%).

Terms of trade improve

The ratio of the price of exports to the price of imports—the terms of trade—rose 6.1% in the first quarter, primarily because of a 25.5% increase in the price of exported crude oil and crude bitumen, which spurred strong growth in the operating surplus of oil and gas extraction industries. The price of imported products edged down 0.6% in the first quarter, coinciding with the appreciation of the Canadian dollar. The terms of trade was up 12.4% compared with the first quarter of 2020.

Double-digit household savings rate

Household disposable income rose 2.3% in the first quarter of 2021, following two consecutive quarterly declines. Government transfers to households were up 1.8%, mainly from expanded Employment Insurance and other benefits as Canadians grappled with a third wave of COVID-19 infections, regional stay-at-home orders, and the potential for future economic disruption. This modest increase in government transfers contrasts with the considerable expansion and subsequent reductions in benefits over the course of 2020. However, in the first quarter of 2021, government transfers were 36.2% higher than their pre-pandemic levels. This continued support, coupled with a third consecutive quarter of rising employee compensation, pushed disposable income $32.3 billion higher.

Nominal household consumption was up 1.1%, but was outpaced by growth in disposable income, leaving households with more net savings compared with the previous quarter. The savings rate rose from 11.9% in the fourth quarter of 2020 to 13.1% in the first quarter of 2021, more than double the rate of 5.1% in the first quarter of 2020. This was the fourth consecutive quarter during which the savings rate has been in double-digit territory. The household savings rate is aggregated across all income brackets; in general, savings rates are higher for higher income brackets.

Go HERE for more information