Canadian GDP by industry for September 2020

Dec 1, 2020

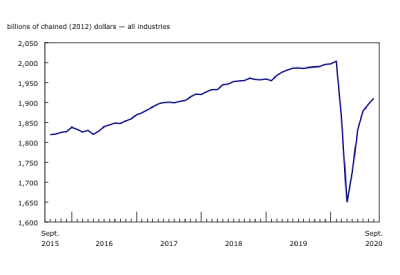

Real gross domestic product (GDP) grew 0.8% in September, on the heels of a 0.9% increase in August. This fifth consecutive monthly increase continued to offset the steepest drops on record in Canadian economic activity observed in March and April. Total economic activity was about 5% below February’s pre-pandemic level.

Both goods-producing (+0.7%) and services-producing (+0.8%) industries were up as 16 of 20 industrial sectors posted increases in September.

Preliminary information indicates an approximate 0.2% increase in real GDP for October. The 20 industrial sectors were nearly evenly split between gains and losses. Owing to its preliminary nature, the estimate will be revised on December 23 with the release of the official GDP data for October.

Mining, quarrying and oil and gas extraction grows

Mining, quarrying and oil and gas extraction was up 4.1% in September, continuing its sequence of increases alternating with decreases since April.

Oil and gas extraction grew 4.9%, following two months of declines, led by an 8.8% increase in oil sands extraction driven by higher synthetic oil production in Alberta. Oil and gas extraction (except oil sands) increased 1.1%, as both crude petroleum and natural gas production increased. Support activities for mining and oil and gas extraction were up for the third consecutive month, increasing 19.0% from higher drilling and rigging services. Output in this subsector is slightly less than half (47%) of what it was in February and is still at levels comparable to the first half of 1999.

Mining and quarrying (except oil and gas) was down 1.3% in September, decreasing for the third time in four months. Non-metallic minerals mining was down 12.7% in September, as a 33.5% decline in potash mining contributed the most to the decrease. Metal ore mining was up 2.0%, led by an increase in copper, nickel, lead and zinc mining, while coal mining grew 4.0%.

Manufacturing continues to grow

The manufacturing sector rose 1.0% in September as both durable and non-durable manufacturing were up. Durable manufacturing rose 1.1%, led by fabricated metal products (+3.3%), furniture and related products (+8.4%) and electrical equipment manufacturing (+6.2%). Offsetting some of the growth were miscellaneous, primary metal and computer and electronic products manufacturing.

Non-durable manufacturing was up 0.9% in September as five of nine subsectors were up. Petroleum and coal products (+6.8%), plastic and rubber products (+2.7%) and paper manufacturing (+1.7%) led the growth, while printing and related support activities (-3.1%), textile, clothing and leather (-4.0%) and food manufacturing (-0.5%) offset some of the growth.

The public sector continues to increase

The public sector (educational services, health care and social assistance, and public administration) grew 0.8% in September, as all three components were up. Educational services rose 1.1%, led by a 1.8% increase in elementary and secondary schools. Throughout the month, many elementary and secondary school teachers, support staff and administrators opened classrooms (physical and virtual) to students for a new school year under a new set of operating procedures brought on by COVID-19. Health care and social assistance rose 0.7% as all subsectors, except for hospitals (-0.2%), were up, while public administration grew 0.7%.

Professional services continue to grow

Professional services expanded 1.3% in September as all industries were up. Contributing the most to the gains were management, scientific and technical consulting services (+2.9%) and computer systems design and related services (+1.1%). Legal services, which derive much of their activity from real estate transactions, were up 1.0% in September as continued strong home resale activity across the country pushed the activity at offices of real estate agents and brokers (+2.2%) to continued record-high levels.

Retail keeps growing

The retail trade sector grew 1.0% in September on broad-based growth as 11 of 12 subsectors were up, with the sole decrease in sporting goods, hobby, book and music stores (-2.7%). Motor vehicle and parts dealers (+1.5%), general merchandise stores (+1.7%) and food and beverage stores (+0.8%) contributed the most to the growth.

Construction declines

Following a 0.6% growth in August, the construction sector declined 1.2% in September, largely as a result of lower non-residential construction. During the month, activity in non-residential construction declined 9.5% as all three types of non-residential construction (commercial, industrial and public) decreased. Engineering and other construction decreased 1.5%, while repair construction was up 1.8%. Residential construction grew 1.4% in September as single-unit and multi-unit dwelling construction, along with home alterations and improvements, all contributed to the fifth consecutive monthly growth.

Other industries

Transportation and warehousing grew 1.4% in September, as 7 of 10 subsectors were up, led by rail (+4.4%), transit, ground passenger and scenic and sightseeing (+4.6%) and support activities for transportation (+1.3%).

Agriculture, forestry and fishing grew 1.9% in September, as higher crop production and forestry and logging contributed the most to the growth.

Finance and insurance grew 0.4% as credit intermediation and monetary authorities (+0.4%), financial investment services, funds and other financial vehicles (+0.5%) and insurance carriers and related activities (+0.1%) grew.

Utilities decreased 1.9% in September as growth in natural gas distribution (+5.4%) was more than offset by lower electric power generation, transmission and distribution (-3.1%).

Third quarter of 2020

Following the steepest declines in Canadian economic activity in March and April due to the COVID-19 pandemic and the gradual reopening of the Canadian economy in May and June, economic activity rebounded in the third quarter as 19 of the 20 industrial sectors rose. Economic activity in the quarter was about 5% below the pre-pandemic level in the fourth quarter of 2019. After four consecutive quarterly declines, goods-producing industries were up 8.8%. Activities in services-producing industries grew 9.3%, after contracting in the first and second quarters of 2020.

As weak demand for manufacturing products led many factories to reduce production even before the onset of the COVID-19 pandemic, the manufacturing sector bounced back (+18.7%) during the third quarter. Both durable and non-durable manufacturing were up, as the majority of subsectors began recovery following the national lockdown imposed by the government last March. The most notable increase was in durable manufacturing. This growth was led by transportation equipment (+59.5%) and wood product manufacturing (+24.5%), with the latter having reversed declines over the last four quarters to reach a level not seen since the beginning of 2019.

Retail trade rose 19.7% as all subsectors grew in the third quarter, excluding food and beverage stores (-0.1%). Growth was led by notable increases in motor vehicle and parts dealers (+54.8%) and clothing and clothing accessories stores (+97.0%). Furniture and home furnishing stores (+55.4%) and gasoline stations (+21.8%) were also up significantly. After providing the strongest counterbalance to steep declines in overall retail activity in the second quarter, non-store retail continued to increase (+3.6%) in the third quarter.

Wholesale trade grew 16.7% in the third quarter as all subsectors posted gains. Machinery, equipment and supplies (+14.4%) and motor vehicle, parts and accessories (+63.2%) contributed the most to the growth, while personal and household goods (+20.0%) and building material and supplies (+18.5%) also rebounded strongly as many restrictive measures associated with COVID-19 were relaxed and construction activity was ramping up.

The public sector (educational services, health care and social assistance, and public administration) increased 7.3% following two quarters of declines, as all three components increased in the quarter. Contributing the most to the growth was the health care and social assistance sector (+11.1%). Ambulatory health care services increased 27.4% as COVID-19 restrictions on health care providers’ offices became less stringent. Educational services grew 8.7% as all subsectors increased, while public administration was up 2.8%.

Real estate and rental and leasing was up 5.0%, as output at the offices of real estate agents and brokers and activities related to real estate more than doubled (+108.2%) in the third quarter, driven by strong home resale activity in the majority of urban centres across the country.

The construction sector grew 8.4% in the third quarter as most of the components were up. Residential construction (+12.9%) and repair (+20.1%) contributed the most to the increase. Non-residential construction increased 9.2%, while engineering and other construction tempered the growth with a 2.4% decline.

Mining, quarrying, and oil and gas extraction decreased 1.6% as an increase in mining and quarrying (except oil and gas) (+12.2%) was more than offset by declines in oil and gas extraction (-4.4%) and support activities for mining, and oil and gas extraction (-19.3%).

The transportation and warehousing sector was up 12.5%, led by truck transportation (+15.2%). Output in the sector is low as air, urban transit, taxi and other ground and scenic transportation activities continue to face restrictions and low demand.

Go HERE for more information