Investment in Building Construction, September 2023

November 20, 2023

Investment in building construction increased 5.3% to $18.9 billion in September. The residential sector rose 7.3% to $12.9 billion, and the non-residential sector was up 1.2% to $6.0 billion.

On a constant dollar basis (2012=100), investment in building construction increased 4.9% to $10.8 billion.

Chart 1

Investment in building construction, seasonally adjusted

Strong gains in residential investment

Investment in residential building construction went up 7.3% to $12.9 billion for the month of September. Growth in residential investment was driven by Ontario (+6.7%; +$325.1 million), Quebec (+9.1%; +$191.6 million), Alberta (+10.6%; +$164.6 million) and Manitoba (+33.6%; +$102.2 million).

Single family home investment increased 6.4% to $6.3 billion in September. After seven consecutive monthly declines, Manitoba (+58.5%; +$78.2 million) posted its largest-ever recorded monthly increase in single family investment in September.

Multi-unit construction rose 8.2% to $6.6 billion in September, with all provinces reporting gains. Ontario (+7.3%; +$180.2 million) led the way, while Alberta (+21.6%; +$141.0 million) contributed its largest monthly increase since April 2018.

Infographic 1

Investment in residential building construction, September 2023

Chart 2

Investment in residential building construction, seasonally adjusted

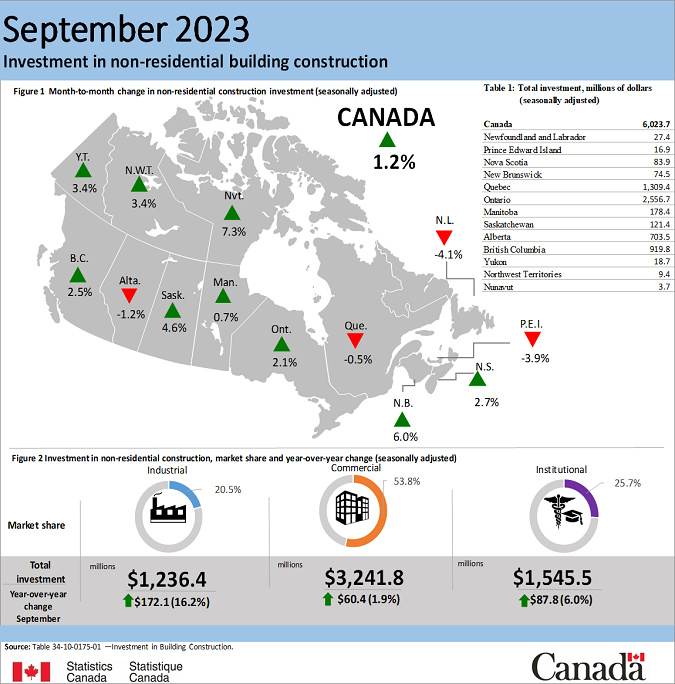

Institutional investment drives non-residential sector

Investment in non-residential construction was up 1.2% to $6.0 billion in September 2023. The increase was driven mainly by Ontario, which accounted for 72.8% of the sector gains.

Industrial construction investment increased 1.2% to $1.2 billion for the month of September. Despite stabilizing in recent months, industrial investment was still up 16.2% from September 2022.

Institutional construction investment rose 4.3% to $1.5 billion in September 2023. Ontario (+11.4%; +$58.7 million) led the way, with a large hospital renovation in Toronto and the construction of a correctional facility in Thunder Bay contributing to growth in the province.

Commercial construction investment edged down 0.2% to $3.2 billion in September.

Infographic 2

Investment in non-residential building construction, September 2023

Third quarter declines due to residential sector

Across Canada, investment in building construction fell 2.8% to $54.7 billion in the third quarter, the fourth consecutive quarterly decrease. The residential sector was down 4.4% to $36.7 billion in the third quarter, while the non-residential sector rose 0.5% to $17.9 billion.

Investment in residential building construction was down by 4.4% from the second quarter to $36.7 billion in the third quarter, driven by declines in single family home investment. Multi-unit construction edged up 0.1% to $18.7 billion in the third quarter, with Alberta (+19.1%; +$328.6 million) posting its largest quarterly increase in this component since the second quarter of 2018. This partially offset declines in Ontario (-3.1%; -$238.7 million) and British Columbia (-4.0%; -$170.7 million) in the third quarter of 2023.

Investment in non-residential construction was up 0.5% to $17.9 billion in the third quarter, the 11th consecutive quarterly increase. Investment in institutional construction accounted for much of the increase, up 2.4% to $4.5 billion. Industrial construction investment edged up 0.2% to $3.7 billion, while commercial investment decreased 0.3% to $9.8 billion.