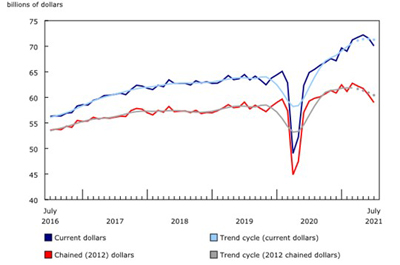

Wholesale sales continue to decline

Sept 30, 2021

Wholesale sales fell 2.1% in July, the second consecutive decline and the largest since April 2020. Excluding the sharp decline created by the first wave of COVID-19, July’s fall was the largest since February 2016, when sales decreased 2.1%. The decline was entirely the result of a 12.4% drop in sales of building materials and supplies, fuelled by lower prices for lumber. Excluding the building material and supplies subsector, wholesale sales rose 0.1%.

Chart 1: Wholesale sales decline in July

Building material and supplies sales fall

In July building material and supplies sales fell 12.4%, the largest decline since April 2020 and the second largest decline in the past 12 years. The drop came as a result of sharply falling prices for softwood lumber, sales of which make up more than half of the subsector. In July 2021, the price of lumber and other wood products decreased 23.0%, according to the Industrial Product Price Index. In particular, exports of forestry products and building and packaging materials fell 12.7%. Notwithstanding the lower sales for the month, activity in the building material and supplies subsector remained robust due to the cumulative strength throughout the pandemic. Sales in July 2021 were 22.4% higher than in July 2020 and represented the seventh highest monthly sales level of all time.

Also contributing to the decline were lower sales in the personal and household goods, and in the food, beverage and tobacco subsectors. Sales of personal and household goods fell 1.6% in July, the second decline in the past three months. Similar to building material and supplies, recent declines are not a sign of subsector weakness, as the subsector’s second highest sales on record were posted in July 2021, with the highest coming the previous month. Sales in July 2021 were 4.5% higher than the same month last year.

Food, beverage and tobacco sales fell for the second consecutive month, down 0.8% to $12.7 billion. Sales in the subsector have been relatively stable since the start of the pandemic, coming in at between $12 billion and $13 billion monthly from May 2020 to July 2021.

The largest gains in the month came from the motor vehicle and motor vehicle parts and accessories subsector, which rose 1.8% to $10.8 billion, driven by a 6.4% increase in exports of motor vehicles and parts. Some motor vehicle companies were able to access more computer chips in order to move vehicles to the wholesale market, but supplies of this key component are still inconsistent across the sector.

Quebec leads sales declines in July

Wholesale sales decreased in seven provinces and one territory in July, accounting for 43% of total national sales. Lower sales in Quebec generated over three-quarters of the drop in national wholesale sales.

Following a record high month in June, sales in Quebec were down 8.8% to $13.4 billion in July. Excluding the decline in April 2020 due to the COVID-19 pandemic, this was the largest month-over-month decrease in the past 10 years. Sales fell in all seven subsectors, with the largest decrease coming from the building material and supplies subsector, down 19.4% to $2.1 billion. The motor vehicle and motor vehicle parts and accessories subsector followed closely behind, dropping 21.4% to $1.6 billion, after posting record high sales in June.

Sales in British Columbia fell for the second consecutive month, down 3.7% to $7.4 billion in July. This decrease was again largely due to lower sales in the building material and supplies subsector, which fell 17.6% to $2.3 billion. While this was the largest month-over-month decrease on record, total sales for July were higher than they had been prior to the recent increase in lumber prices. Excluding the building material and supplies subsector, wholesale sales in British Columbia increased 4.3% on the strength of an 18.1% jump in sales of personal and household goods and a 13.4% increase in the miscellaneous goods subsector.

In Ontario, wholesale sales rose 0.4% to $35.5 billion in July. While sales in the building material and supplies subsector dropped 9.0% to $4.6 billion, sales in the motor and motor vehicle parts and accessories subsector were up 10.7% to $7.3 billion, largely contributing to Ontario’s overall increased sales in July. Demand for vehicles continues to be strong, despite the ongoing disruptions in motor vehicle plant operations and supplies, and lower inventories.

While seven provinces had lower sales in July than in June, all seven were higher than July 2020.

Inventories rise in July

The value of wholesale inventories rose 0.6% in July to a new all-time high of $95.7 billion. Inventories in five of seven subsectors increased, representing 77% of total inventories. The increase comes as wholesalers dependent on international markets are contending with sharp increases in the cost of shipping containers as well as shortages of wooden pallets and related shipping materials, driving up the cost of inputs required by a broad range of wholesalers. These developments may affect the levels or timing of inventories wholesalers can, or choose to, carry.

Building material and supplies merchant wholesalers’ inventories grew 3.6% to $17.4 billion. All the component industries increased, but 69% of the increase was in the inventories of metal service centres, which grew 10.7% to $4.3 billion. The value of inventories of lumber, millwork, hardware and other building supplies increased 0.5% to $8.4 billion.

Machinery, equipment and supplies merchant wholesalers’ inventories were up 1.3%, to $26.8 billion. Mounting inventories in construction, forestry, mining, and industrial machinery, equipment and supplies merchant wholesalers more than offset mixed results in the subsector’s other industries; they added 3.5% for a total of $12.2 billion.

Inventories of motor vehicles and motor vehicle parts and accessories fell 4.2% to $11.4 billion. Decreases of 4.0% in motor vehicles and 4.6% in new motor vehicle parts and accessories inventories account for virtually all of the change.

The inventory-to-sales ratio increased to 1.37 in July. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.

decreased 23.0%, according to the Industrial Product Price Index. In particular, exports of forestry products and building and packaging materials fell 12.7%. Notwithstanding the lower sales for the month, activity in the building material and supplies subsector remained robust due to the cumulative strength throughout the pandemic. Sales in July 2021 were 22.4% higher than in July 2020 and represented the seventh highest monthly sales level of all time.

Source : https://www150.statcan.gc.ca/n1/daily-quotidien/210916/dq210916a-eng.htm