Supply Chain Might Be the Big Lighting Story of 2021

May 27, 2021

Over the last decade, the global lighting industry has seen a paradigm shift. Conventional lighting sources such as incandescent, fluorescent, and high-intensity discharge are being replaced by solid-state light-emitting diode (LED) technology, enabling energy savings with increased adoption. Due to improvements in scientific understanding and its underlying technology, LED lighting now outperforms many baseline technologies in energy efficiency, lifetime, versatility, and colour quality. Furthermore, manufacturing advancements, increased demand, and the development of a global supply chain network have made LED lighting products cost-competitive to conventional technologies in most lighting applications.

Components shortages, price increases, freight delays continue to disrupt the lighting industry

The impact of COVID was clearly the most prevalent theme that affected lighting industry businesses last year. The same may be true in 2021, but the related impact of supply chain on the lighting industry continues to make headlines.

Citing increased costs associated with components and shipping, multiple large, prominent lighting manufacturers announced a price increase in the first quarter of 2021. Some manufacturers even announced a second price increase this year.

In March, Acuity Brands CEO Neil Ashe stated that the global electrical components shortage “will create challenges for the entire industry.”

Last month Signify CEO Eric Rondolat estimated that 3% of Q2 sales were pushed to the next quarter due to supply chain issues. He went on to explain that component shortages are not solely electronic semiconductors. Other components such as plastics, resins and metals are creating supply chain challenges. There is even a shortage of shipping containers in China.

Twelve months ago, a pound of copper was US$2.33. Recently it has been US$4.74, an increase of 103%. Copper thieves in Tulsa, Oklahoma are risking electric shock to steal cooper from streetlights on Interstate 44. A gas pipeline hack has recently choked supply in the Southeast U.S. and increased fuel costs even more. Shipping containers continue to be delayed in Long Beach and Savannah. Weeks ago, a freight ship anomaly clogged the Suez Canal for six days and disrupted supply chain (more so in Europe) for a couple of weeks.

The DLC recently extended a delisting deadline by 6 months: “After conversations with multiple manufacturers, we understand that manufacturers are experiencing component shortages of integrated circuit (IC) chips needed for electronics, including LED drivers, and that shipping delays have created higher costs and longer lead times for products. Due to the continuing disruption to operations for our stakeholders, the DLC is extending the delisting date for products qualified under SSL V5.0 by six months.”

Other than that, everything seems to be running smoothly.

The recent report, 2020 LED Manufacturing Supply Chain, published by the U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy offers more insights into how supply chain affects the industry. Below are some of the takeaways from the report:

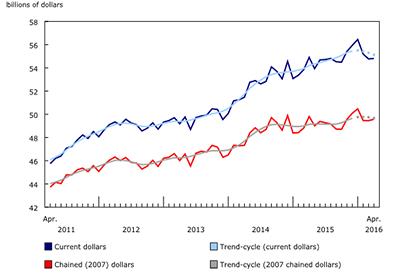

Cost breakdown for LED troffers

The cost of the LED light engine (15%) can be further broken down to the cost of LED packages (5%) and the PCB (10%).

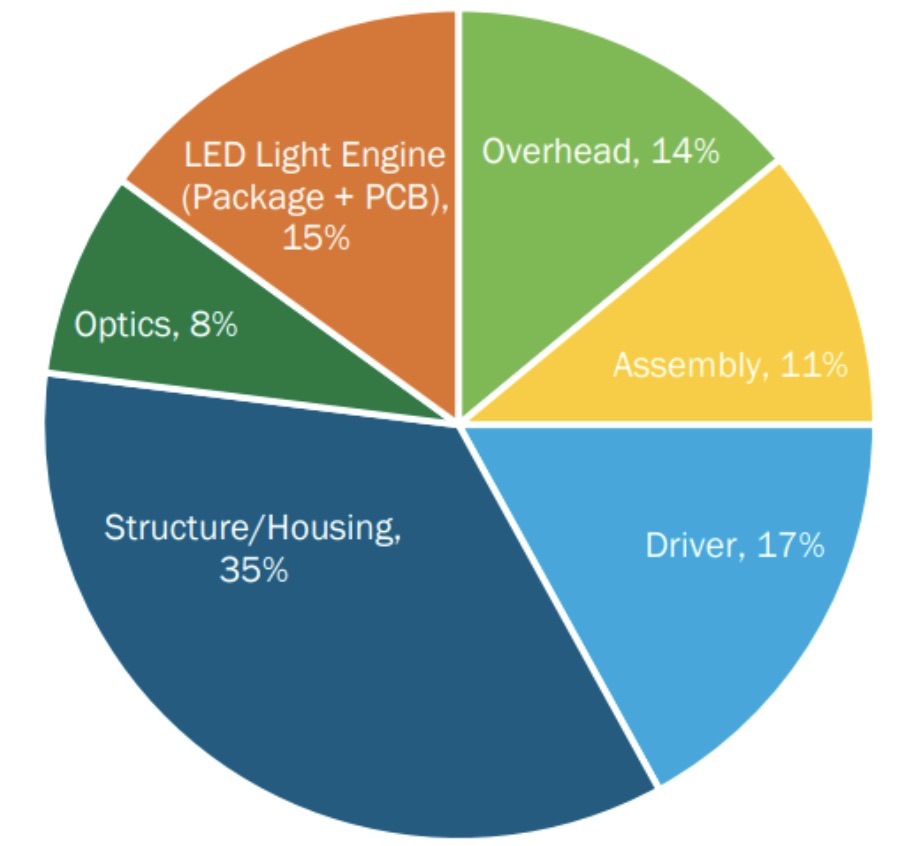

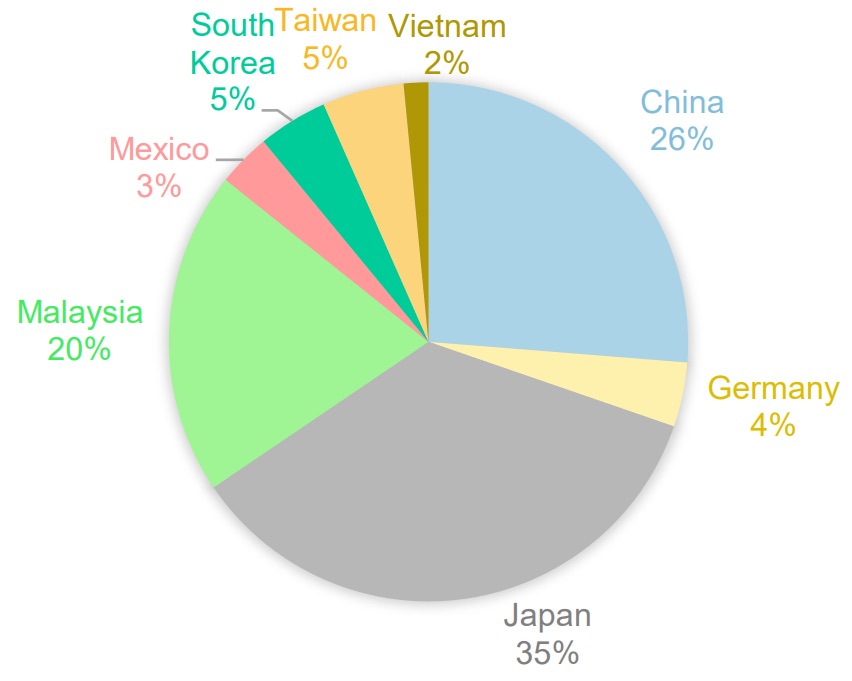

U.S. imports of LED packages and die

In 2019, the United States imported a total of US$340 million from the eight other countries of interest listed (these countries account for the vast majority of LED die and package production globally). The United States predominantly imports LED die and packages from Japan, China and Malaysia.

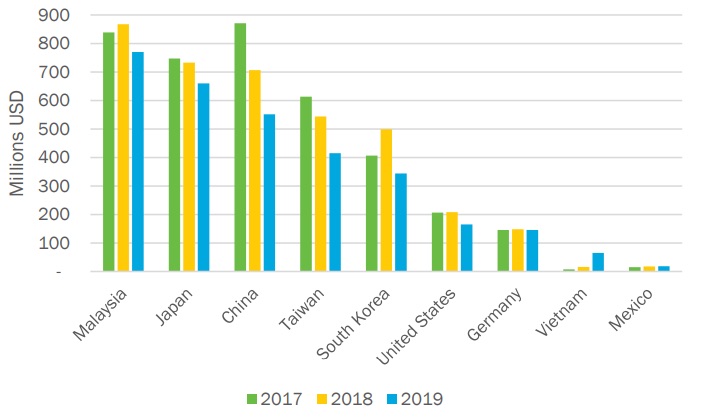

This figure shows the top Asian exporters — China, Japan, Malaysia, South Korea, and Taiwan — all exporting between US$300 million and US$900 million per year from 2017 to 2019.

The decrease in global LED package and die exports from 2018 to 2019 is the result of an oversupply of LED packages in 2018 due to increased production capacity in China and also a slowdown in the global LED lighting market that occurred in 2019. The steep drop in exports from China led to Malaysia becoming the top exporter in 2018 and 2019. Multiple manufacturers indicated they had ramped up production in Malaysia for several reasons, including the increasing cost of labour in China. They also stated the Section 301-China tariffs accelerated this product shift from China to Malaysia.

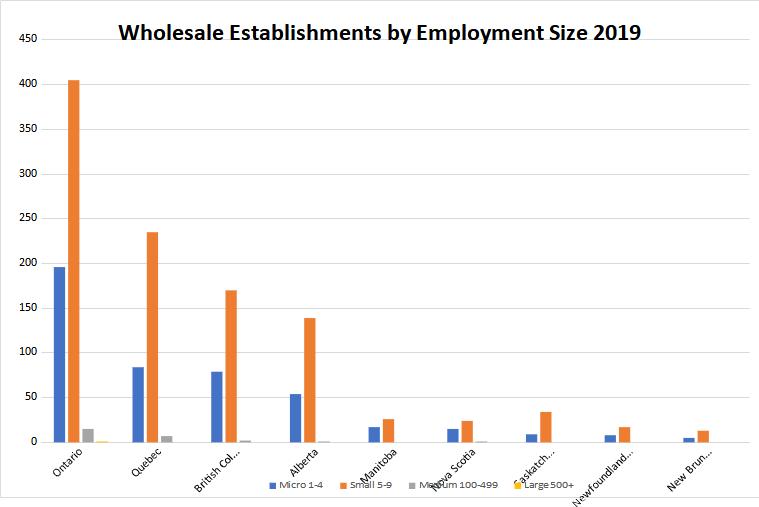

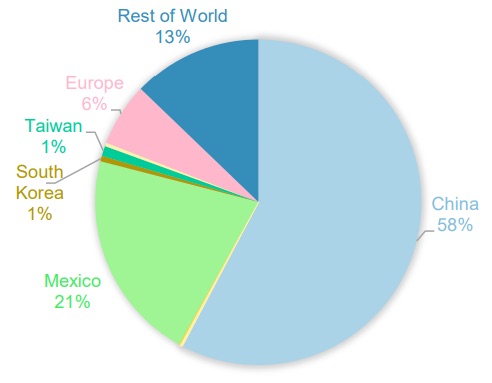

U.S. imports of LED luminaires, 2019

In 2019, the United States imported a total of $4.77 billion of LED luminaires. Of this $4.77 billion of LED luminaire imports, US$3.4 billion (58%) came from China and US$1.25 billion (21%) came from Mexico.

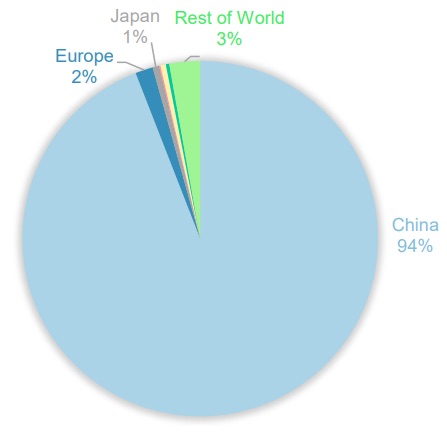

Global trade flow of LED lamps, 2019

No surprises here except, possibly, that the China number is so low.

Read the full report here.

Source https://inside.lighting/news/21q2/supply-chain-may-be-big-lighting-story-2021

Source of all charts and corresponding text: U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy

Photo source: McKinsey at www.rawpixel.com