Manufacturing Sales Fell in February After January Increase

Apr 27, 2021

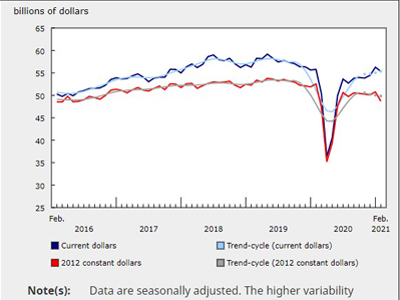

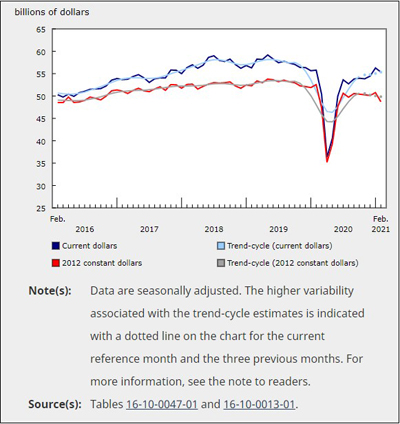

Following the largest increase observed in seven months in January (+3.4%), manufacturing sales fell 1.6% to $55.4 billion in February on lower sales of transportation equipment. The declines were partially offset by higher sales in the petroleum and coal product, chemical, and wood product industries.

Following the largest increase observed in seven months in January (+3.4%), manufacturing sales fell 1.6% to $55.4 billion in February on lower sales of transportation equipment. The declines were partially offset by higher sales in the petroleum and coal product, chemical, and wood product industries.

Since January, motor vehicle and motor vehicle parts manufacturers have faced a semiconductor shortage, which has led to production slowdowns or shutdowns at several auto assembly plants. The tight supply of semiconductors also impacted plastics and rubber products manufacturing in February as a result of lower demand for plastic products from the auto industry. These declines brought total manufacturing sales down 0.8% year over year in February.

In constant dollars, manufacturing sales decreased 4.0%, indicating that higher prices mitigated a significantly lower volume of goods sold in February. The gains in the Industrial Product Price Index in February were widespread, rising 9.8% for energy and petroleum products, 5.2% for lumber and other wood products, and 3.9% for chemicals and chemical products.

Semiconductor shortage continues to stall auto production

Following a 9.1% decrease in January, motor vehicle sales fell 14.5% to $3.3 billion in February, their lowest level since May 2020, because of the global shortage of microchips. Some assembly plants ramped down production or extended shutdowns in February as a result. Year over year, sales of motor vehicles were down by almost one-third (-31.2%). Exports of motor vehicles and parts decreased 10.2% in February.

The semiconductor supply issue also stalled production of motor vehicle parts, leading to a 10.9% decline in sales to $2.2 billion in February, their lowest level since May 2020.

Sales of plastics and rubber products decreased 8.7% to $2.7 billion in February, driven by lower plastic product sales. Lower demand from motor vehicle and motor vehicle parts manufacturers partially contributed to the sales decline in February.

The non-metallic mineral products (-15.8%) and aerospace product and parts (-15.8%) industries also contributed to lower sales in February.

Sales in the petroleum and coal product industry rose 6.5% to $4.7 billion in February, their fifth consecutive gain and their highest level since February 2020. Higher prices were entirely responsible for the gain as sales volumes were down 3.3% in February. Petroleum production declined in the United States because of an extreme cold snap in mid-February. This, along with increased global demand, contributed to higher prices. Exports of refined petroleum energy products rose 27.2% in February.

Chemical sales rose 3.8% to $4.7 billion in February on higher sales of basic chemicals, followed by soap, cleaning compound and toilet preparation products. Sales of chemicals in February were at their highest level since November 2018. During the COVID-19 pandemic, sales in the chemical industry decreased 8.0% in April 2020 and then rose slowly on higher sales of basic chemicals, followed by resin and synthetic rubber products, as well as pesticides and other agricultural chemicals.

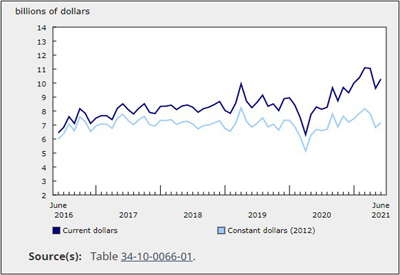

Wood product sales rose for the third consecutive month, up 4.0% to $4.3 billion in February on higher prices and volumes. Prices for lumber and other wood products increased 5.2% in February, while the volume of goods sold edged up 0.2%. The total value of building permits issued rose 2.1% in February and passed $10 billion for the first time on the continued strength of the housing market.

Sales decline in Regina and Winnipeg, rise in Toronto

Manufacturing sales on an unadjusted basis were down in 7 of the 12 census metropolitan areas (CMAs) covered by the survey in February, led by Regina and Winnipeg. Toronto posted the largest increase.

Following a 119.2% gain in January, sales in Regina decreased 17.2% in February on lower sales of pesticide, fertilizer and other agricultural chemicals. This industry was the main contributor to the large gain in January.

Sales in Winnipeg fell 11.7% to $764.0 million in February, their lowest level since April 2020, on lower sales in the transportation equipment industry. Manufacturing sector sales were down 7.6% on a year-over-year basis.

Manufacturing sales in Toronto rose 4.3% in February, mitigating some of the 13.4% decrease in January. While sales of motor vehicles declined in Ontario in February, sales rose (+81.4%) for two assembly plants in the Toronto CMA after significant production disruptions in January because of the semiconductor chip shortage. These gains were partially offset by lower sales of food (-5.0%), aerospace products and parts (-15.1%), and fabricated metal products (-3.8%). Year over year, manufacturing sector sales in Toronto decreased 10.9%.

Inventory levels rise

Total inventories rose 0.8% to $88.7 billion in February, their highest level since May 2019, on higher inventories of beverages and tobacco products (+14.4%), primary metals (+3.2%), and petroleum and coal products (+4.8%). Inventories fell in the aerospace product and parts (-6.1%), furniture and related product (-9.9%), and plastics and rubber products (-1.8%) industries.

The inventory-to-sales ratio increased from 1.56 in January to 1.60 in February. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

Unfilled orders decline

Following two consecutive monthly gains, unfilled orders decreased 1.1% to $86.6 billion in February, on lower unfilled orders of transportation equipment (-1.9%) and chemicals (-6.8%). Unfilled orders were up in the primary metal (+9.6%), miscellaneous manufacturing (+8.4%) and wood product (+11.3%) industries.

The total value of new orders fell 6.6% to $54.4 billion in February, driven by lower unfilled orders of transportation equipment (-33.0%). The declines were partially offset by higher new orders in the wood product, petroleum and coal product, and primary metal industries.

Capacity utilization rate declines

The capacity utilization rate (not seasonally adjusted) for the total manufacturing sector fell from 76.5% in January to 75.7% in February, attributable to lower production.

Capacity utilization rates decreased in the transportation equipment (-1.3 percentage points), plastics and rubber products (-1.8 percentage points), and non-metallic mineral product (-4.0 percentage points) industries. The capacity utilization rate rose in the wood product (+1.4 percentage points) and primary metal (+0.6 percentage points) industries.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210415/dq210415a-eng.htm?CMP=mstatcan