Canada’s International Investment Position, Fourth Quarter 2020

March 16, 2021

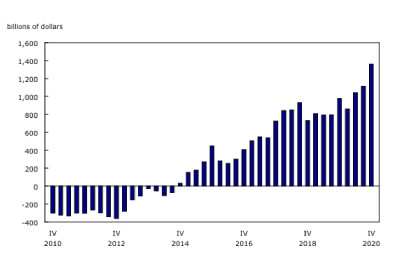

Despite ongoing current account deficits and the corresponding need for foreign borrowing, Canada’s net foreign asset position continued its upward trend in the fourth quarter to reach an unprecedented level of $1,360.6 billion. For a third consecutive quarter, the increase (+$248.1 billion) was attributable to higher foreign equity prices and was moderated by the revaluation effect resulting from fluctuations in exchange rates.

Over the quarter, changes in market prices led to a $345.3 billion increase in Canada’s net foreign asset position. Major foreign stock markets outperformed the Canadian stock market in the fourth quarter. While the Canadian stock market increased by 8.1% over the quarter, the US stock market grew by 11.7%, the European stock market rose by 11.2%, and the Japanese stock market gained 18.4%. A much higher proportion of Canada’s international assets (70.8%) are held in the form of equities than liabilities (39.7%). As a result, changing stock market conditions also tend to affect Canada’s international assets more severely than its liabilities.

The revaluation effect resulting from fluctuations in exchange rates (-$92.9 billion) moderated the overall increase in Canada’s net foreign asset position. Over the quarter, the Canadian dollar gained 4.8% against the US dollar, 0.1% against the euro and 2.3% against the Japanese yen, but lost 1.0% against the UK pound sterling. At the end of the fourth quarter, 96.4% of Canada’s international assets were denominated in foreign currencies, compared with 40.3% of its international liabilities.

Net borrowing from abroad was negligible and therefore had a limited impact on the change in Canada’s net foreign asset position in the fourth quarter. Nonetheless, both Canadian acquisitions of foreign assets and borrowing from abroad were strong and contributed to the increase in the value of Canada’s international assets and liabilities.

Canada’s international assets and liabilities increase significantly

Canada’s international assets were up by $497.3 billion to a record high of $6,582.0 billion at the end of the fourth quarter. The upward revaluation attributable to market price changes (+$467.9 billion) and substantial investments (+$204.6 billion), mainly in the form of shares and currency and deposits, led the increase. However, the downward revaluation (-$168.4 billion) resulting from fluctuations in exchange rates moderated the overall growth.

On the other side of the ledger, Canada’s international liabilities were up $249.3 billion to $5,221.5 billion, also on higher market prices (+$122.7 billion) and larger foreign borrowing activity (+$205.2 billion), mainly in the form of currency and deposits. The downward revaluation (-$75.5 billion) coming from the fluctuations of the Canadian dollar against foreign currencies moderated the overall increase.

Year 2020

Despite the volatility observed on global stock markets at the beginning of the year as a result of the uncertainty caused by the COVID-19 pandemic, Canada’s net foreign asset position increased by $381.8 billion in 2020, the largest yearly increase since 2015. While the change in Canada’s net foreign asset position in 2020 resulted mainly from revaluations attributable to market price fluctuations (+$456.7 billion), the change in 2015 resulted from revaluations attributable to fluctuations in exchange rates. While the European and the UK stock markets closed the year at a lower level than in 2019, the Canadian stock market gained 2.2% and the US stock market grew by 16.3% in 2020. At the end of 2020, 38.5% of Canada’s international assets were held in the form of US equities.

Canada’s gross external debt was up $246.0 billion to reach $3,147.4 billion at the end of 2020. It represented 136.4% of Canada’s gross domestic product; this proportion was at 123.8% at the end of 2019.

About half of the increase in Canada’s gross external debt stemmed from the government sector, whose gross external debt was up $119.1 billion to reach the unprecedented level of $589.2 billion at the end of 2020. To support enterprises and households affected by the COVID-19 pandemic, the federal government substantially expanded its overall borrowing activity in 2020, resulting in a record amount of debt securities being acquired by foreign investors.

Go HERE for more information